Coke competes by taking its zombies off the shelves.

Including more than half of its 500 brands, Coke says that its zombies are products with stagnant sales. That means we will no longer see Diet Coke Feisty Cherry nor Zico Coconut waters. It’s why Odwalla has disappeared. And, it takes us to an iconic Coke brand that has been here since 1963.

Tab is a zombie.

How Coke Competes

Tab

In 1963, Tab was Coca-Cola’s answer to Royal Crown’s Diet Rite soda. Targeting women, the diet soda market was new and potentially massive. So Coke developed a saccharine-sweetened drink with a metallic bite that some loved and others hated.

To see its “flavor” firsthand, do take a look at this Tab ad:

After peaking in 1980 or so, Tab receded as Diet Coke took over. Sweetened with aspartame, Diet Coke soon captured a 17 percent market share. But, aware of Tab loyalists (called Taboholics), Coke retained the brand, even as it sunk to 1 percent of all sales in 2001. Now though, at a low of .1 percent of Coke’s $22 billion in global sales–compared to Diet Coke’s 35 percent and Coke Zero Sugar’s 22 percent–the end is here.

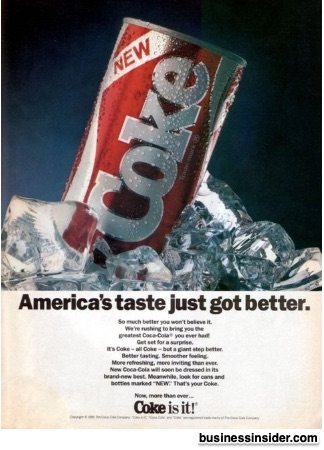

New Coke

The story of a more famous Coke zombie takes us back to 1985.

During the early 1980s, Pepsi was catching up to Coke. Whereas in 1955 Coca-Cola sales were double Pepsi’s, by 1984 the gap was only 4.9 percent. Furthermore, combined, Diet Pepsi and Pepsi Light were ahead of Coca-Cola’s Tab.

In 1984, Coca-Cola responded with Project Kansas. A top secret, the plan for Project Kansas involved 200,000 consumers blind taste testing a sweeter cola flavor. Because participants preferred the new taste over Coke as did some Pepsi lovers, it became a done deal. Coke changed the formula.

The world was told the decision during a razzle-dazzle media extravaganza at Lincoln Center. In front of an audience of seven hundred, Coca-Cola CEO Roberto Goizueta exclaimed, “The best soft drink, Coca-Cola, is now going to be even better.”

This was the ad:

It turned out that tradition (and the bond with Coke) mattered more than taste. During the two months after the announcement, 1,500 telephone calls poured in daily to the company’s consumer hotline. At a Houston Astrodome sports event, people booed the commercials for new Coke. Coke fans created a Society for the Preservation of the Real Thing.

Within weeks, Coca-Cola knew it had to clean up a catastrophe. Minimizing the damage, they decided new Coke would become a “sister” to the traditional recipe which henceforth would be known as Coke Classic. As a zombie brand, new Coke was discontinued in 2002.

Our Bottom Line: Competition

As oligopolies, large companies like Coca-Cola have market power. They and a few other large firms dominate sales. They have some pricing power and compete through product differentiation. Their size and the expense make it tough for new firms to compete with them.

Below, moving to the right on a market structure continuum, firms grow larger and more powerful:

As an oligopoly. Coca-Cola decided that less is more. Especially in a COVID-19 world, they recognized the advantages of fewer products. Their goal was to make their supply chains simpler and their sales force more focused. Meanwhile, less on the shelf lets them kill the zombies and keep the “rock stars.”

So you can see why Tab had to go.

My sources and more: A Journal podcast on Tab made yesterday’s walk more pleasant (I did 7 miles!). From there, Beverage Daily, here and here, had the facts as did WSJ. Finally, Coca-Cola tells the best story of the new Coke fiasco.

Our featured image is from Pixabay.