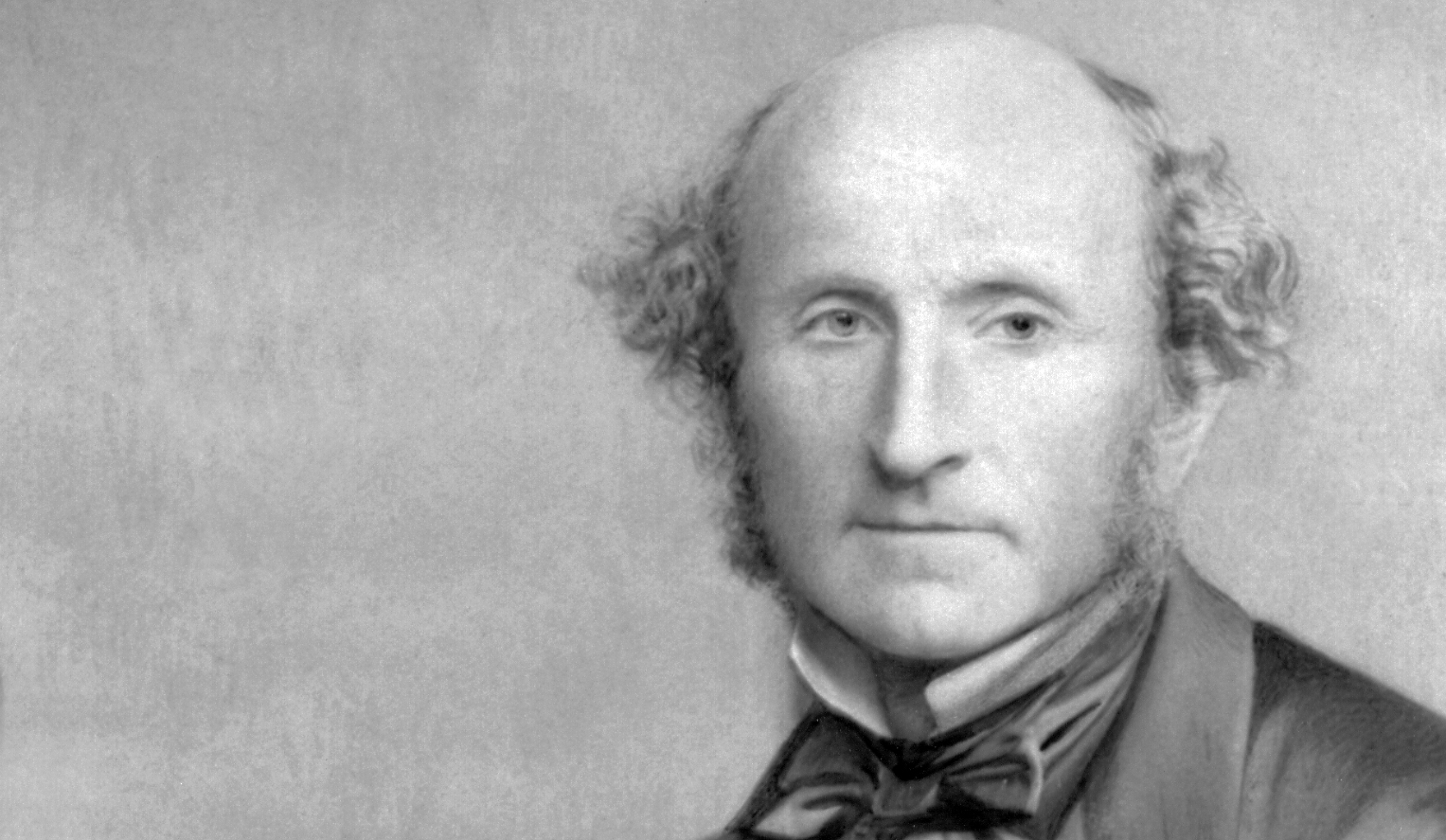

A child prodigy, 19th century economist John Stuart Mill said in his Autobiography that, “I have no remembrance of the time when I began Greek; I have been told that it was when I was three years old. My earliest recollection on the subject…being lists of common Greek words…and I faintly remember going through Aesop’s Fables, the first Greek book which I read. I learnt no Latin until my eighth year…I also read, in 1813,…the first six dialogues…of Plato.” Mill tells readers that he did not understand Plato’s Sixth Dialogue, “But my father, in all his teaching, demanded of me not only the utmost that I could do, but much that I could by no possibility have done.”

Mill became an economist who was torn between the merits of the market system and the precepts of utilitarianism. He believed demand, supply and unfettered markets generated efficiency. Also though, he sought a society in which happiness for every individual was maximized.

And that takes us to Mill’s (probable) ideas about taxation and the Affordable Care Act.

John Stuart Mill was the first economist to separate production and distribution. A society’s production, he believed, was subject to certain immutable laws which we could not change and the market would manage. Distribution, though, was a different story. Hearkening back to his utilitarian predilections, he said that you and I could decide who got what by redistributing incomes through taxes. All society needs to do is collect taxes from those who have more and then let those with less benefit from someone else’s earnings through a government provided good or service.

Hearing that the Affordable Care Act was a step toward making health care accessible to everyone, Mill no doubt would have been comfortable with the new taxes it created. On January 1, 2013, a new 3.8% Net Investment Income Tax went into effect. Applying primarily to the more affluent, the tax targeted investment income over a certain threshold. At the same time, an additional Medicare tax of .9% again impacted those with higher incomes because of its minimum income level of $250,000 for married couples who file jointly and slightly lower threshold for others.

Our bottom line: Taxation is redistribution. Its basic dilemma is deciding when the size of redistribution starts to adversely affect production incentives.

John Stuart Mill on Affordable Health Care

Elaine Schwartz

Elaine Schwartz has spent her career sharing the interesting side of economics. At the Kent Place School in Summit New Jersey, she was honored with an Endowed Chair in Economics. Just published, her newest book, Degree in a Book: Economics (Arcturus 2023), gives readers a lighthearted look at what definitely is not “the dismal science.” She has also written and updated Econ 101 ½ (Avon Books/Harper Collins 1995) and Economics: Our American Economy (Addison Wesley 1994). In addition, Elaine has articles in the Encyclopedia of New Jersey (Rutgers University Press) and was a featured teacher in the Annenberg/CPB video project “The Economics Classroom.” Beyond the classroom, she has presented Econ 101 ½ talks and led workshops for the Foundation for Teaching Economics, the National Council on Economic Education and for the Concord Coalition. Online for more than a decade. econlife has had one million+ visits.