How We Respond to Restaurant Psychology

April 7, 2024

March Madness College Applications Bump

April 9, 2024During 2021, a tax on rum generated more than $700 million.

Where the money wound up is the surprise.

The Rum Tax

During 1917, the US Congress decided to give Puerto Rico some financial support. Called a cover-over, we would import the rum they made, tax every sale, and send back the tax revenue. Then, extending the program, in 1954, the Virgin Islands received the same perk for its distilleries. The sweet part was they even shared the tax dollars for any rum not made on their islands.

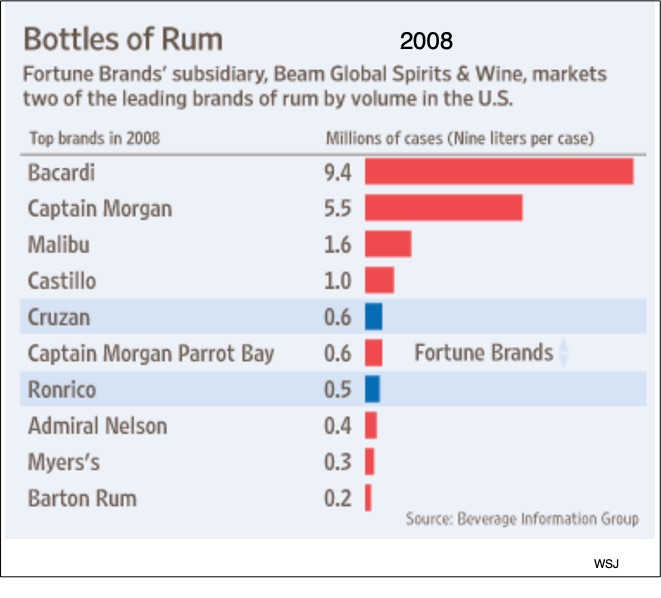

Leaping to 2008, we would see some rather clever (or devious) Virgin Island legislators eyeing Puerto Rico’s deal with Captain Morgan (a Diageo rum maker). With the contract expiring, they thought they could offer a better deal. And, they did. They told Captain Morgan that if it switched islands to St. Croix, it would pay for molasses, the factory, and give them 40% of the cover-over. Too good to refuse, the factory is now on St. Croix after what has been called “the rum war.”

When Captain Morgan moved to the Virgin Islands, it was the #2 rum maker. Bacardi was Puetro Rico’s biggest distillery:

Our Bottom Line: Alcohol Taxes

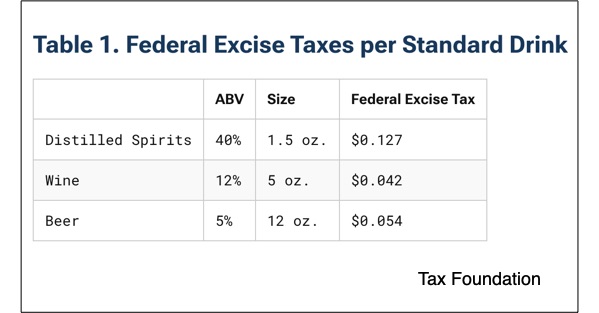

Called a sin tax, taxes on alcohol are supposed to have a dual benefit. When people engage in an unhealthy activity, the government gets revenue while if the tax stops them, then it does something good. Varying hugely, federal alcohol taxes range from 48% on spirits to 5% on beer:

We can certainly wonder if the U.S. Congress expected a hefty slice of its tax revenue would go to Diageo. It did know though that taxes can create perverse incentives.

My sources and more: Thanks to NPR for alerting me to the rum taxes. From there, the Tax Foundation, here and here, and WSJ had more of the story. And finally, firsthand, (CRS) some Congressional Research gave the history.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)