During the 1870s, when the NYSE (New York Stock Exchange) started signaling a beginning and end of the trading day, they chose a Chinese gong. In 1903, they switched to a brass bell.

Not like the bell we hear today, a Chinese gong sounds like this:

Stock Market Trading Hours

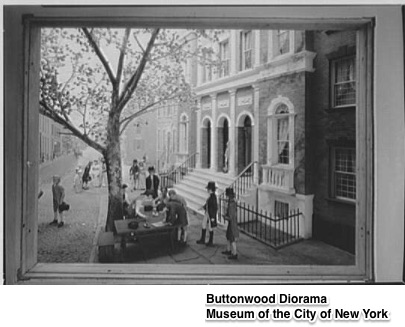

Our story starts in 1792 when the 24 men that had been trading government bonds and bank stocks under a Wall Street buttonwood tree made a deal. Hoping for more order, integrity, and better records, they created the New York Stock and Exchange Board through the Buttonwood Agreement. At the time, those hoping to sell stock through the exchange were asked to notify auctioneers so they could advertise beforehand. Once the auction began, the exchange president recited the listed stocks as brokers called out their bids and offers. Still, in 1865, having traded indoors for many years, they made the “calls” of stock twice a day.

The buttonwood tree (below) was toppled by a storm on June 14, 1865:

It wasn’t until the 1870s and the advent of continuous trading that they needed to signal an open and close. With continuous trading, you could buy and sell Monday through Saturday. At the time, the market opened at 10 a.m. and closed between 2 and 4 in the afternoon. Then, from 1887 to 1952, you could trade weekdays from 10 to 3, and Saturdays, 10 to noon. Next, after a series of changes that eliminated Saturdays, we wound up with today’s 9:30-4:00 trading day.

And now it all might change.

According to the Financial Times, a NYSE analytics team polled market participants about 24-hour weekday trading. They wondered if they should join the round-the-clock trading that includes cryptocurrencies, US Treasuries, and major currencies. One worry is the swing between sparse trading at certain times and the increasing volume at 9:30 a.m. or 4 p.m.

Our Bottom Line: Markets

When we talk about stock markets, we really mean a process rather than a place. Determining the prices of securities and quantities that are traded, stock markets help businesses raise money when they sell shares to the public. They create liquidity for investors who want to trade stocks and bonds, and help governments fund their debt.

And, it all began under a buttonwood tree.

My sources and more: Thanks to my Axios Markets newsletter for alerting me to the 24-hour trading debate and to this FT article. From there I returned to my own Econ 101 1/2 for some NYSE history and then to a trading hours history, here and here. And from there, I even found a history of the NYSE bell.

Please note that today’s post quotes sentences from Econ 101 1/2.