Long ago, during 2011, we wrote about a unique method for collecting taxes. Having mobilized a group of drummers, Bangalore officials reputedly boosted tax revenue. Their goal? To embarrass tax scofflaws by drumming outside their windows.

The BBC documented the strategy:

After identifying the best tax codes, we will see that global tax rates could require the drummers.

After identifying the best tax codes, we will see that global tax rates could require the drummers.

The Best Tax Codes

According to the Tax Foundation’s Center for Global Tax Policy, a productive tax code attracts investment, promotes economic growth, and needs to be competitive and neutral. On the competitive side, marginal tax rates have to be low. Otherwise, domestically and globally, investors, looking for lower rates, leave. As for being neutral, the goal is maximum revenue and minimal distortion. The distortions refer to the tax loopholes and tax categories that incentivize tax avoidance.

The top ranked countries have simple codes with relatively low rates. Thinking of Estonia, for example, we can remember the number 20. At 20 percent, its corporate tax and individual rate are low. At the same time, it limits the corporate tax to domestic activity and the property tax solely to the land’s value.

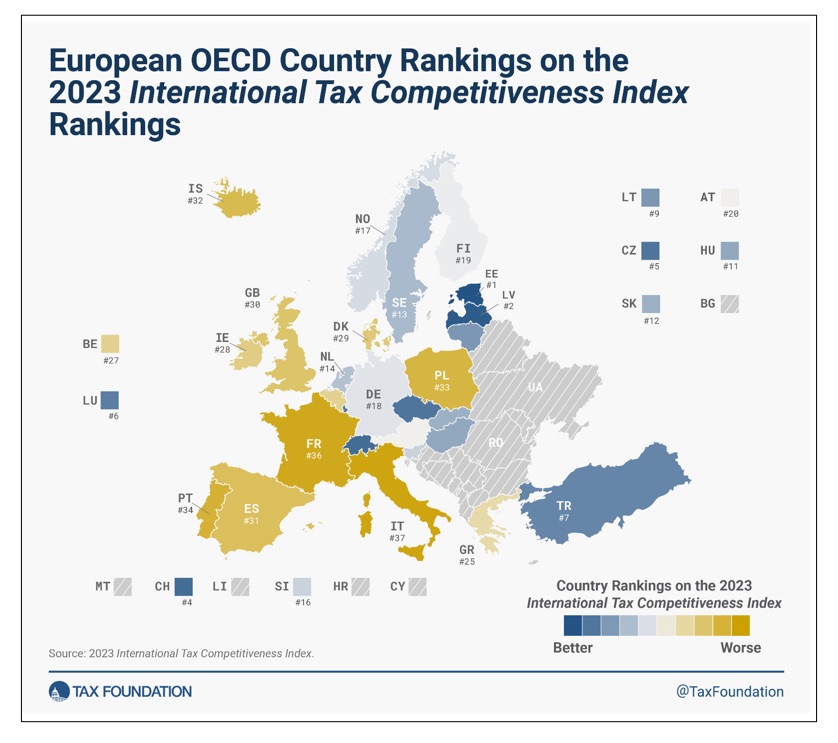

While our featured image shows the OECD 38 ranked countries, these are the top 10:

Ranked rather low, the U.S. is #21 and the UK, #30. At the bottom, we have Italy and then Colombia.

Our Bottom Line: Global Tax Rates

Hoping to eliminate tax competition among high and low tax countries, in 2021, more than 130 “member jurisdictions” agreed to adopt the rates they would charge multinational corporations. As we might expect, multinationals try to minimize their taxes by locating their headquarters in low tax countries. The new agreement is supposed to eliminate the incentive. It also avoids double taxation.

The basic plan changed where companies pay taxes and established a 15 percent global minimum tax. It said that physical location no longer matters. If you do business in a country, you owe taxes.

As of last June, delayed approvals pushed back the implementation timeline. Now, it looks like the speediest progress will take us through 2024. The problem is that countries need to adopt new rules, negotiate new treaties, and repeal existing laws.

Because it will affect the domestic tax codes that are tough to change, returning to where we began, we might need the drummers.

My sources and more: All of today’s facts are from The Tax Foundation’s International Tax Competitiveness Index 2023. From there, the tax foundation, here and here, had global tax details. Then, the Peter G. Peterson Foundation described U.S. corporate tax history and the BBC told .about the drummers. We should note also that because today’s facts were from the Tax Foundation, they have a right of center bias.