With another debt ceiling conflict emerging this week, we.should look back and ahead at how, what, and why the U.S. borrows.

January 2021 Friday’s e-links: From Flamin’ Hot Cheetos to a Rapper’s Janet Yellen

Last updated 1/29/21 Every once in a while, (and sometimes each day) I listen to a great podcast, enjoy an article, or see a good video that I want to share with you. I like to think of them as…

What You Need to Decide About the Future of the Federal Budget

While the CBO’s (Congressional Budget Office) 2018-2028 report presents federal budget projections, the numbers also reflect the tradeoffs and some tough decisions.

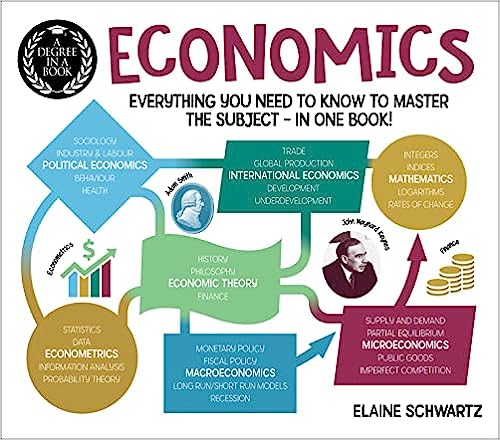

The Impact of a Legendary Economics Curve

Showing the connection between inflation and unemployment, the Phillips Curve has been re-interpreted, re-affirmed and condemned as a monetary policy tool.

Connecting the (Interest Rate) Dots

With the timing of the first Fed rate hike still a mystery, we can use the FOMC (Federal Open Market Committee) dot plots to predict when rates will rise.

Deciding if the Labor Market is Okay

Including the unemployment, quits and participation rates, Janet Yellen’s labor market indicators will help her decide whether to raise interest rates.

Where to Spend 100 Trillion (Zimbabwe) Dollars

Coping with hyperinflation, Zimbabwe finally had to replace their currency with the US. dollar. A low inflation rate should be their monetary policy goal.

Some Federal Reserve (Gallows) Humor

In the 2009 transcripts, Federal Reserve humor brings smiles and memories of the dire condition of finance, housing and the GDP.

Pondering the Bunker Hill Theory of Inflation

As the source of monetary policy, the Federal Reserve has to decide if interest rates should rise when inflation is low but a jobs recovery has begun.

One Song, Two Graphs and the Fed’s Dual Mandate

Because the Congress established a dual mandate of high employment and price stability for the Federal Reserve’s monetary policy, they created a dilemma.