Like Mark Twain saying, “The reports of my death have been greatly exaggerated,” non-cash payments have not eliminated currency.

The Fed’s Inflation Mystery

Usually Federal Reserve interest rate hikes should control inflation but now it is mysteriously missing, even with low unemployment.

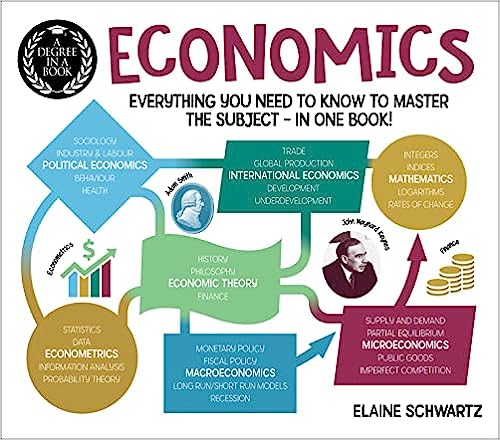

Weekly Roundup: From Affluent Mates to Successful Names

Our everyday economics includes tradeoffs, deposit insurance, supply chain, bias, human capital, income inequality, marriage markets and Federal Reserve.

The Data Leaks That Move Markets

In financial markets, data security relates to the timing of data releases because premature releases or leaks unfairly favor one group of investors.

Pondering the Bunker Hill Theory of Inflation

As the source of monetary policy, the Federal Reserve has to decide if interest rates should rise when inflation is low but a jobs recovery has begun.

The Mystery of the Missing Marijuana Money

Federal Reserve monetary policy is not taking account of money from marijuana retailers because banks in Colorado have refused to give them accounts.

One Song, Two Graphs and the Fed’s Dual Mandate

Because the Congress established a dual mandate of high employment and price stability for the Federal Reserve’s monetary policy, they created a dilemma.

How the Fed Solves the Old Money Problem

Part of keeping the money supply at the right level involves the Fed monitoring the paper money that enters circulation and recycling cash that leaves it.

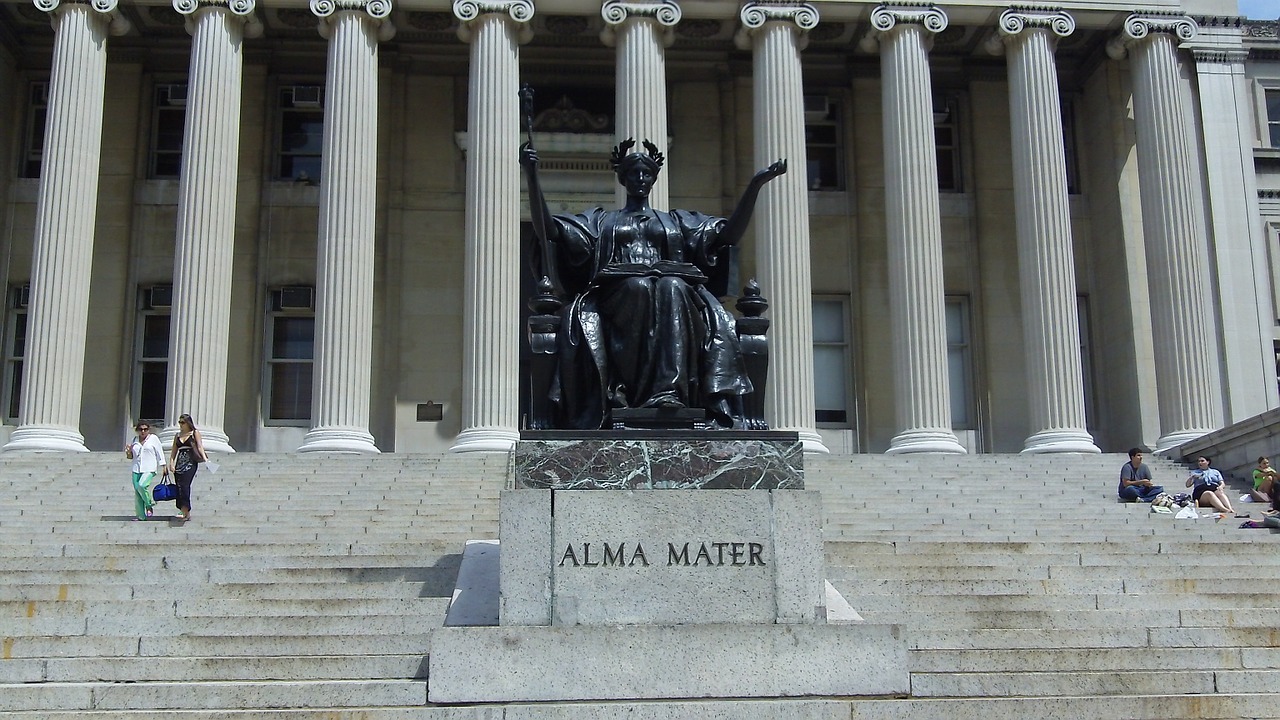

Who, How and When We Use Cash

Although coin and currency are costly to transport and secure, still, cash is a key component of the money supply that people use for low value payments.

My Two Cents About Pennies

Expensive for the U.S. mint and worthless to consumers, the penny still remains a part of the U.S. money supply although phase-out laws have been proposed.