Legend has it that Casper’s founders were spending a lot of time in a Manhattan start-up incubator. Sleeping on bean bags, they said there had to be something better. They knew that Warby Parker had figured out an online eyewear model that sidestepped traditional competition. A mattress maker could copy the same model.

Casper’s Origins

The result was the mattress-in-a-box. Instead of a $200 delivery charge and a mattress that had to be wedged up a staircase, in an elevator, or through a doorway, a foam mattress could be folded into a 41″ x 21″ x 20″ cardboard enclosure. You just had to open the box and out it popped.

If you have not done it yourself, do take a look:

Inflated Mattress Markets

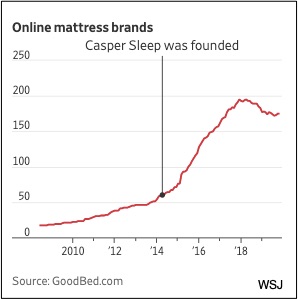

We could say that Casper started a revolution. And that became their problem.

As The Journal podcast explains, the type of foam factory that Casper contracted to make its mattresses could be hired by everyone. And everyone did. The copycat firms included Purple, Tuft & Needle, Layla, Avocado, Bear, Saatva, Leesa, Nectar, HelixSleep, Sleep Number, GhostBed and also Amazon and Walmart. Meanwhile, with Seeley and Serta still dominant, the Wall Street Journal called Casper a “high-profile, high-loss start-up” as its disappointing IPO (public stock sale) unfolded.

You can see the rapid entry of new firms in just four years:

Our Bottom Line: Mattress Competition

To make a mattress in-a-box, you just need a website, some customer service, an ad budget, a manufacturer, and a shipper. As low as $250 apiece (reputedly), most mattresses are pretty cheap to make so mark-ups can easily equal 100%.

As a result, we can insert the mattress-in-a-box group at the monopolistic competition point in our market structure continuum. Because firms can easily enter and exit the market, demand and supply shape their pricing power while competition limits their profits. And yet, each firm has some power because of a unique characteristic. Purple has purple, Casper now has retail. Many have something they patented. But all are basically the same:

All changes though when we look at the entire industry. Then, with Serta Simmons and Tempur Sealy the two leaders, the top four firms in the industry represented a 68.4 percent market share in 2019. At the same time, more than 300 mattress manufacturers, including Casper, share the remaining 32.6 percent.

My sources and more: Thanks to WSJ’s Journal podcast for reminding me it was time to return to mattress markets. From there this Rubber and Plastic News article is a possibility as well as a Freakonomics podcast. Curbed and SFChronicle. But if you read just one mattress story, do look at this one. It describes the customer who perpetually avoids buying a mattress through sequential 100-day trial returns.

Please note that several of today’s sentences were in past econlife post.