The most recent GDP report from May 28th shows a 5 percent decline in our production of goods and services for the first three months of 2020:

Soon though, the GDP decline will exceed the Great Recession’s 8.4 percent drop. According to the Atlanta Fed’s June 17 GDPNow forecast, annualized real GDP will drop by 45.4 percent for the second quarter (seasonally adjusted). The Atlanta Fed calls its GDPNow number a “running estimate” because their calculations use current stats, not what they expect.

From so precipitous a plunge, we can ask what about the recovery?

A Recovery Alphabet

A “V” recovery from a recession is typical. With a “V,” the robust production of goods and services is our beginning. Then, the economy produces less and less, businesses lay off workers, and consumer spending declines. Happily, once we reach the bottom of the left side of the “V,” it all reverses. Production accelerates, unemployment declines, and the economy roars ahead.

Very few of us expect a V-shaped recovery.

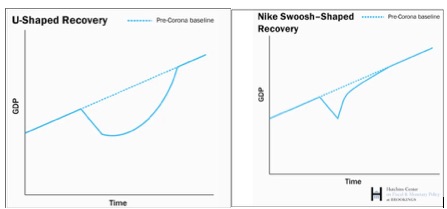

Among the alphabet recoveries, the “U” and the Swoosh are most likely. Below, the dotted lines indicate the pre-coronavirus baseline:

However, this recovery could be unusual because of the services that are depressing it. Past recessions have been characterized by slowdowns in manufacturing and construction. You can see that services don’t have the same recessionary dips as goods production:

Now though, services have led the decline. So yes, industry and construction could have a V-shaped recovery. But it is tougher to imagine a rapid return for concerts, sports, retailers, and restaurants. The GDP could also be constrained by more work from home and fewer business trips that would pull the airlines, restaurants, convention centers, and hotels down as well.

Our Bottom Line: Alphabet Explanations

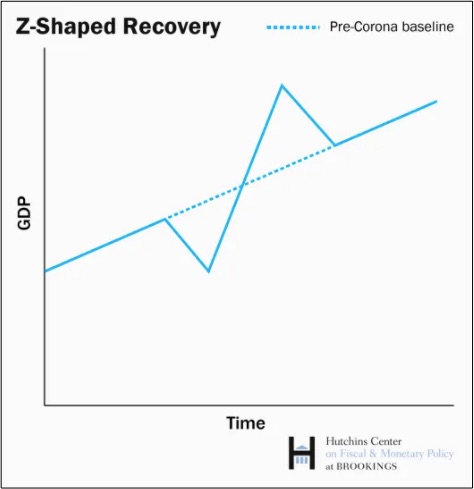

The rosiest scenario is the “Z.” After the dip, the economy has a huge bounce, beyond where it would have been. As pent-up demand explodes, we make up for many of our delayed purchases:

The realists among us suggest that a “U” or a Nike Swoosh are more likely. With a “U,” social distancing limits business activity until we can function normally. The Swoosh sees a “V” like dip and rise but then takes awhile to return to the baseline:

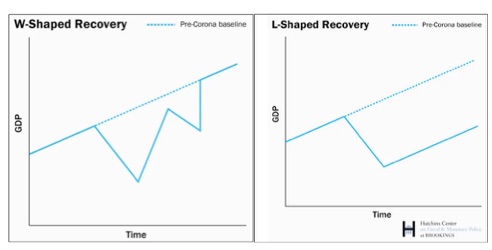

More pessimistic, the “W” and “L” people see a prolonged drop. The two scenarios are different though because the “W” illustrates a rise that soon reverses after a second coronavirus wave. The “L” remains down if global supply chains are permanently upset and many smaller businesses permanently disappear:

There is one symbol that we can all agree illustrates where we are going:

My sources and more: As I mentioned in Friday’s e-links, Dr. Ed’s Blog always provides insight. His analysis of each letter’s recovery pattern then took me to Brookings, the Atlanta Fed, and the BEA press release. Please note that the first quarter GDP decline was for real GDP (it accounted for inflation) and was an annualized number (that assumed the first quarter five percent decline continued throughout the year.)