Today, for us, the Wealth of Nations has a new spin.

Instead of every imaginable topic covered by Adam Smith, the IMF looks at the wealth of nations through a balance sheet lens. Their focus is what we own and owe:

The Health (and Wealth) of Nations

In a new paper, the IMF demonstrates the value of a balance sheet. Whereas the fiscal picture shows what the country spends, borrows, and taxes, and GDP focuses on production, a balance sheet can display even more. It tells us net worth by subtracting liabilities from assets. (More technically we would say that Assets = Liabilities + Owners’ Equity.)

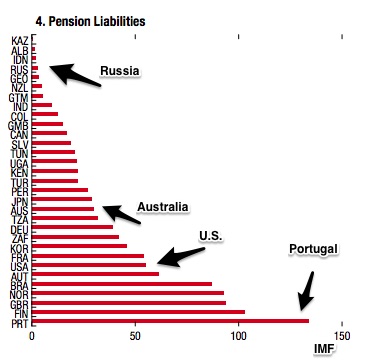

For the U.S., a balance sheet of assets and liabilities would include our public corporations such as Amtrak, the pensions that are owed to public employees, natural resources like the U.S. strategic oil reserve, and even our roads and bridges. As you know, the value of public corporations, infrastructure, and natural resources are plusses while the pensions are minuses.

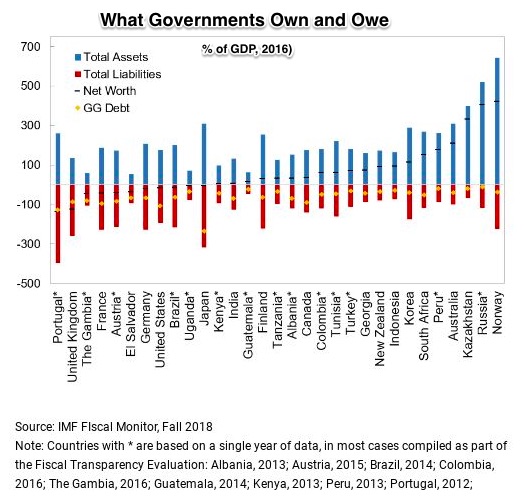

Below, along a balance sheet scale, the IMF places Norway at the top and Portugal at the other extreme:

What Countries Own and Owe

So now, what you own and owe can come to mind when you think of national wealth. And that can take you to a country’s financial and non-financial assets, to its public corporations, and to its pension liabilities. It also might make you think a bit more about Norway, Russia, Japan, and Portugal.

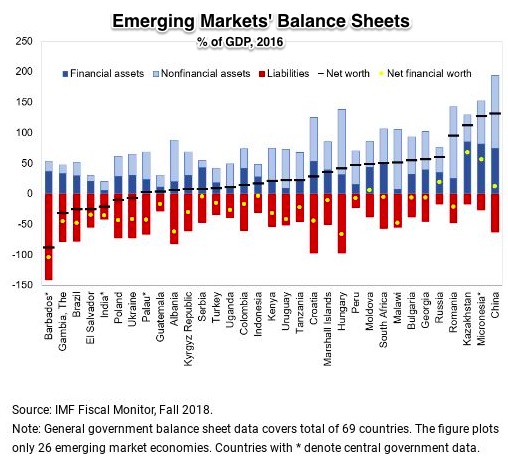

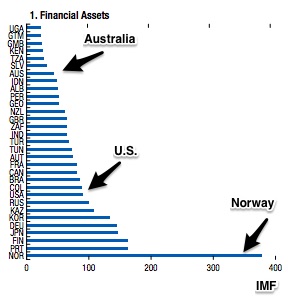

Below, you can see how the 31 countries in the IMF report line up for each variable.

Financial Assets:

Natural Resources and Other Non-Financial Resources:

Natural Resources and Other Non-Financial Resources:

Public Corporations:

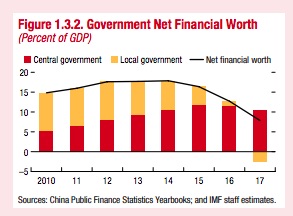

Because of its SOEs (state-owned enterprises), its off- and on-budget expenses, and its layers of market and non-market production and finance, the IMF dealt separately with China’s balance sheet:

You can see though that China is first among emerging markets:

Our Bottom Line: Balance Sheets

Businesses and countries need to know their net worth. For both entities, knowing what you own and owe facilitates planning in good times and bad. It can tell you more about your financial condition than a fiscal or a GDP focus.

My sources and more: Thanks to the always excellent FT Free Lunch column (free subscription) for alerting me to the new IMF report. However, if you just want a brief summary, the IMF blog was good.