The internet might soon be taxed. It all depends on what happens today in the Supreme Court.

The case is South Dakota v. Wayfair Inc.

The Many Sides of an Internet Tax

South Dakota purposely passed an unconstitutional law. In 2016 it said that online sales that exceeded $100,000 or 200 transactions had to be taxed. The problem was a 1992 Supreme Court case confirming an earlier decision that said only sellers with a physical presence in the state had to pay a sales tax. So, when South Dakota asked online firms to pay their taxes, several of those retailers took them to court.

Although it is rarely mentioned, the physical presence rule has…well…a big presence. Businesses are aware of it when they decide where to locate warehouses and sales reps. Local merchants complain that it lets online sellers avoid sales taxes. Consumers rarely report the taxes they were supposed to pay. And states like South Dakota without an income tax especially need the extra revenue.

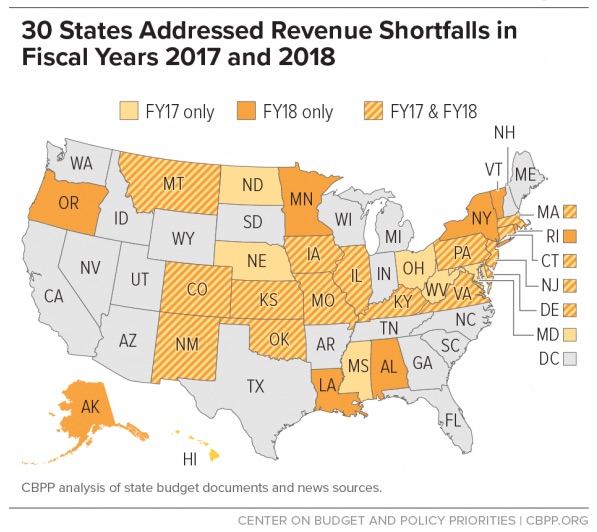

So too do these states:

Responding, the Wayfair side says the change is too unsettling. With 12,000 different taxing jurisdictions, small online firms would have a daunting task. And furthermore, they all would have to absorb the cost of buying and implementing new software for countless products in multiple municipalities with different tax rates. States without a sales tax– Montana, New Hampshire, Oregon, and Delaware–would have to decide what to do. And we have courts that hesitate to change a 50 year old precedent. (Amazon already collects sales taxes in the 45 states that have them.)

Our Bottom Line: Fiscal Policy

When we slice away all of the complexities, it comes down to fiscal policy tradeoffs. States and local governments can spend less or borrow and tax more. The Supreme Court will soon help them decide which it will be.

My sources and more: Having taken a peek at SCOTUSblog for the internet sales tax case, I was intrigued. Fascinating, the issues affected firms like Wayfair, state revenue, and the Court. Then, for even more, Bloomberg and WSJ had the best summary.