Why McDonald’s Cares About a Speedy Drive-Thru

September 23, 2021

September 2021 Friday’s e-links: The Ego That Makes a Presidential Library

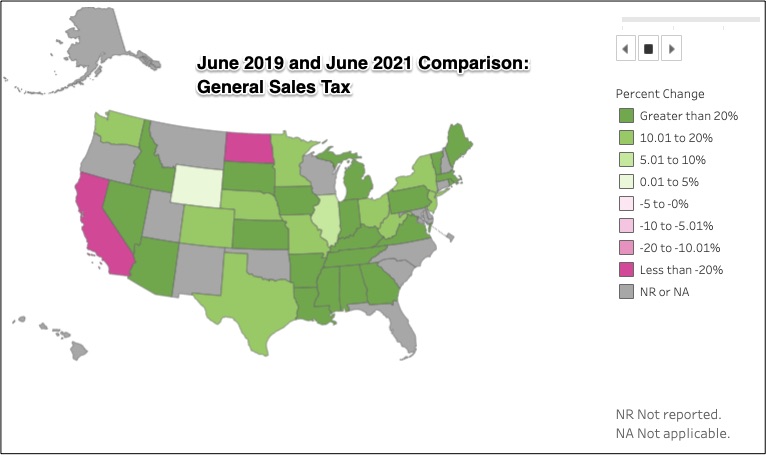

September 24, 2021The Covid-19 state tax revenue story is one of decline and rebound. According to the GAO (U.S. Government Accountability Office), state and local revenue dipped during the second quarter of 2020 when compared to the same months in 2019. But then it recovered in subsequent quarters.

Let’s take a look at how state tax revenue changed between a pre-Covid 2019 and June 2021.

State Tax Revenue Changes

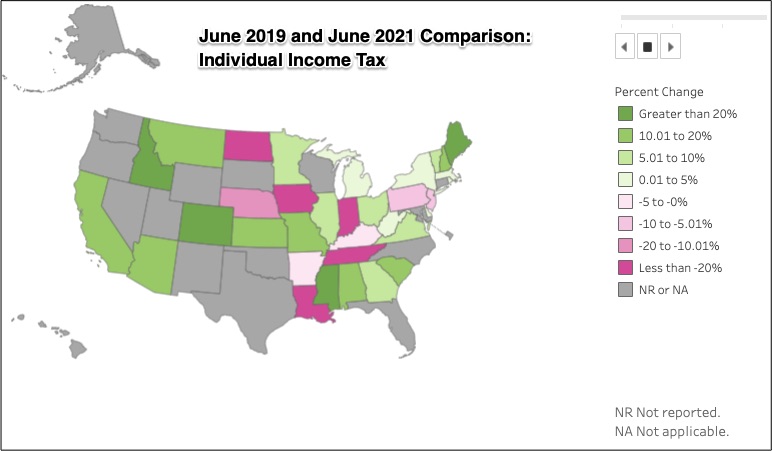

Individual Income Tax

https://www.census.gov/library/visualizations/interactive/monthly-comparisons-for-state-sales-tax-collections.html

https://www.census.gov/library/visualizations/interactive/monthly-comparisons-for-state-sales-tax-collections.html

Corporate Income Tax

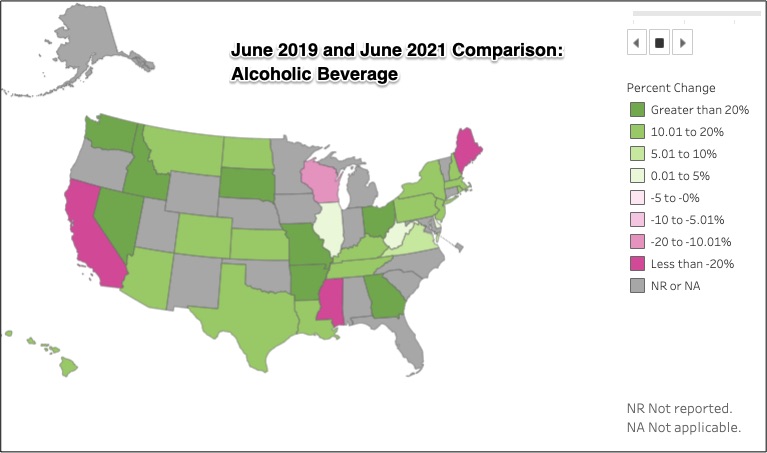

Alcoholic Beverage Tax

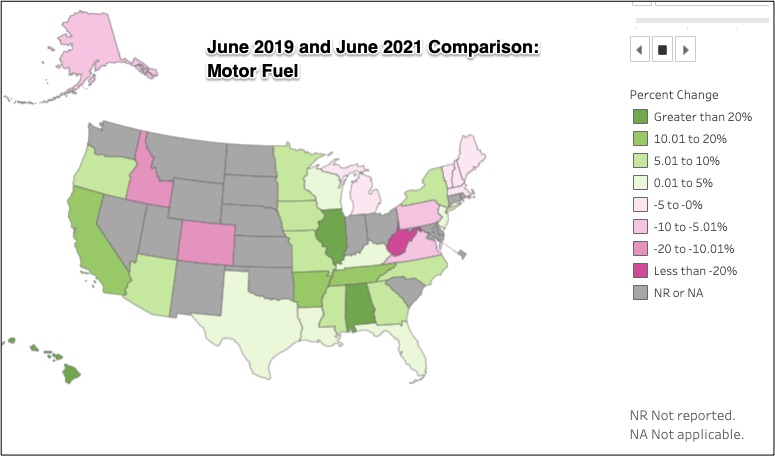

Motor Fuel

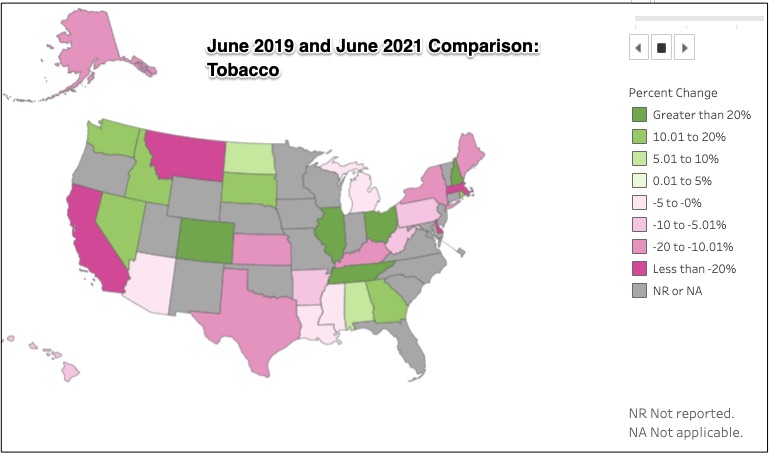

Tobacco

Our Bottom Line: Kinds of Taxes

You income level can determine the impact of state tax policy. A progressive tax, like most income taxes, targets the more affluent because rates rise with marginal income. Quite the opposite, a sales tax is regressive because it takes a larger proportion of what those of us with less earn. The reason? When all of us pay the same amount for the same purchase, then the percent ascends as our income drops. (According to the Tax Foundation, depending on sales tax revenue, Nevada and Louisiana are most regressive.) Meanwhile, a proportional tax takes the same percent from everyone.

My sources and more: Census infographics are a handy source of the big facts. However, if you want every detail imaginable for state tax revenue and fiscal health, do go to the Urban Institute. In addition, the GAO had published a July 2021 study that focused on 8 states. But, if you just check one extra source, this econlife post is the ideal complement.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)