We have cases around the world of coronavirus proliferating. Businesses that range from Macau’s casinos to Apple’s iPhones makers are calculating a response. And, after soaring a whopping 28.9 percent in 2019, the S&P has plunged in record time.

Yes, we all said that astronomic market highs could not continue, But no one thought a virus that might be a pandemic would be the reason. We did not expect the Black Swan Event.

But we never do.

Black Swan Events

Nassim Taleb was working on Wall Street when he wrote a book about Black Swan Events. As he explained, philosophers had always told us that black swans were exceptions. But Taleb’s definition took the next step. For him, the exceptional event was “oversize.”

It has three characteristics:

- The event is unpredictable. Negative or positive, it still is an outlier.

- Its impact is massive.

- People believe they can explain the black swan. They want to give the event retrospective predictability…but they cannot.

Global Stock Market Response

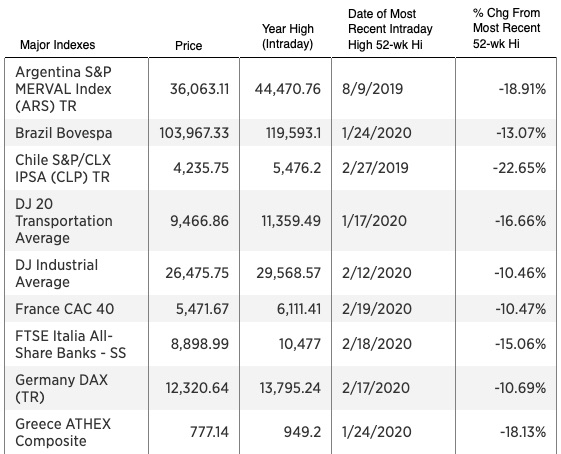

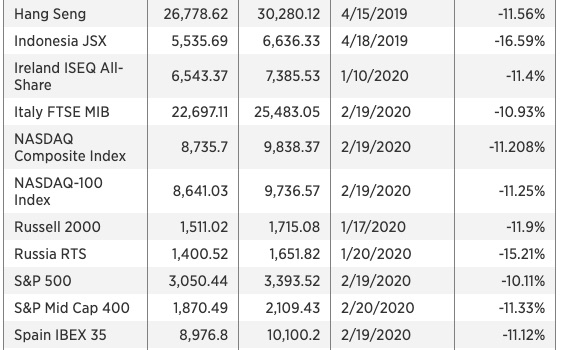

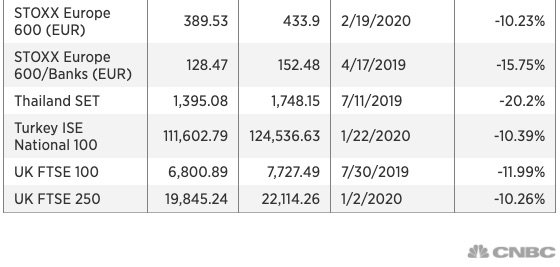

With coronavirus, so far, we’ve seen Taleb’s first two black swan requisites. It was way out of the realm of predictability. And now, looking through a financial lens, we’ve begun to see one example of its massive impact. You can see below that global stock markets have plunged (data from CNBC, yesterday on February 27 at 2:15):

Our Bottom Line: Confirmation Bias

While a Black Swan Event connects to so many issues, let’s conclude with how it starts.

A behavioral economist could suggest that many (maybe all) of us engage in confirmation bias. To validate what we believe, we pick the facts that prove it and we associate with the people who agree with us. As a result, the unpredictable event becomes even more of a surprise. Before the 1987 stock market crash, investors wanted to believe that portfolio insurance would protect them. We like to believe that the market’s incentives propel innovation but Taleb says instead, we just need the room for luck.

So, where does all of this leave us? Perhaps by knowing the coronavirus is a Black Swan Event and others might follow, we can better understand how to respond.

My sources and more: It was ideal to get black swan information from the Nassim Nicholas Taleb book.and his econtalk interview. Then, I could leap to today’s Black Swan Event articles in The New Yorker and from CNBC. And finally, Taleb comes the closest to suggesting how to cope with Black Swan Events in his “Ten Principles for a Black Swan-proof World.”