You probably recall that when Goldilocks tasted the Three Little Bear’s porridge, she said that Papa Bear’s cereal was too hot and Mama Bear’s, too cold. But Baby Bear’s was just right.

Referring to that just right sweet spot, in 1995, Secretary of Labor Robert Reich said that GDP growth, unemployment and inflation were also neither too hot nor too cold. After a 1990-1991 recession, they were enjoying a Goldilocks recovery.

Are we?

A Goldilocks Recovery? Yes and No

After a “Great Recession” that lasted from December 2007 to June 2009, how are we doing?

Yes

Looking at a GDP that grew pretty consistently, unemployment that fell, and low inflation, we can say we have had a Goldilocks recovery.

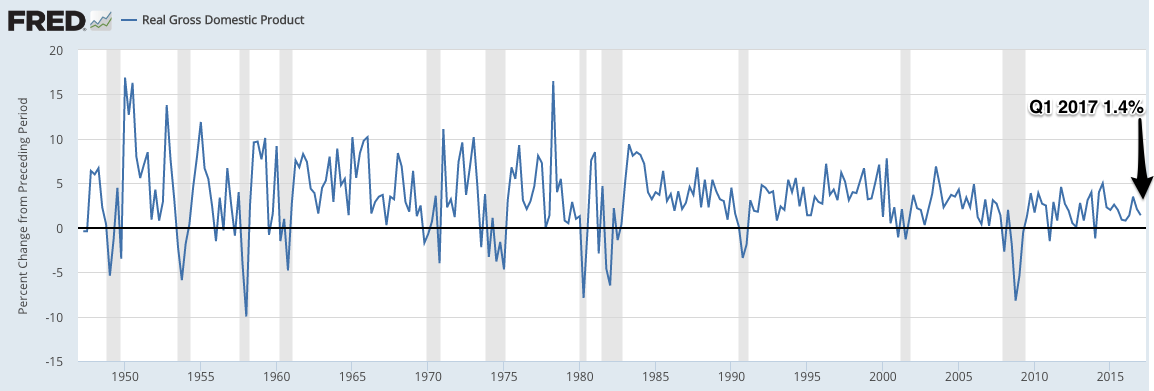

GDP Growth Rate

The GDP has grown pretty consistently.

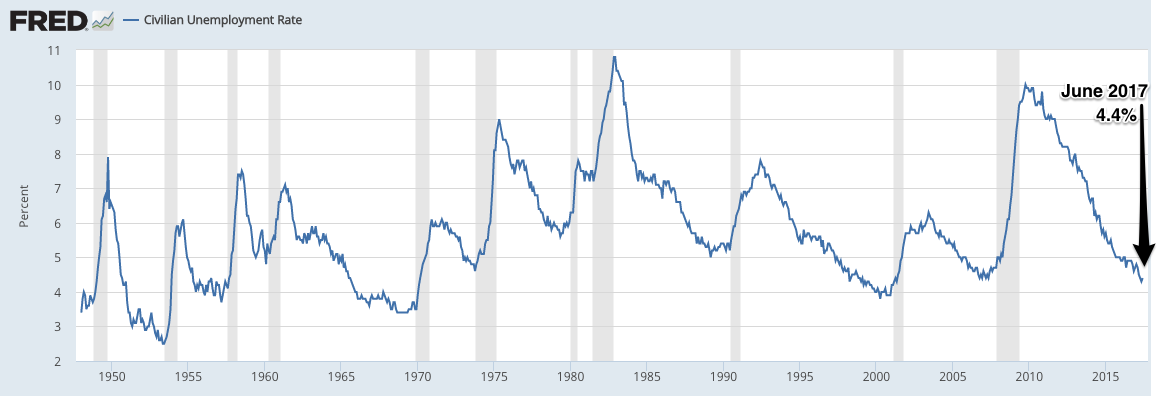

The unemployment rate has plunged from an October 2009 10% high.

Inflation has been close to the Fed’s 2% target rate:

No

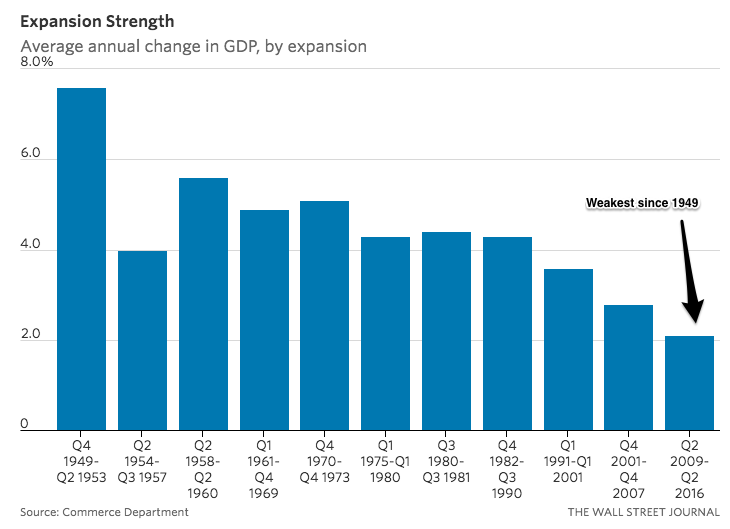

On the other hand, GDP expansion has massively lagged previous recovery rates:

Labor Force Participation Rate

At 66.0% when the Great Recession began, the labor force participation rate is now down to 62.8% for people who could be in the labor force:

Wage Growth

Especially for less educated workers, wage growth has been meagre:

Equal only to a brief time during 1980, current labor productivity is at an all time low:

Our Bottom Line: Productivity

The productivity decline could be our most worrisome statistic. As the source of a rising standard of living during the past century, output per unit of input needs to soar. Without it, our economic recovery is…

Not quite goldilocks.

My sources and more: Used economically, Goldilocks appeared for the first time in a 1988 NY Times column. Then, for more about a less than vibrant recovery you might look at this BLS productivity analysis and this WSJ blog.