At 58 percent, the share of households that own stock is at a new high:

But like the British and Norwegian coastlines, the closer we look, the more we see.

Six Facts: Stock Ownership

Through shares of stock, you and I can own a small or large piece of a corporation. It usually all begins when a company decides to switch from private to public ownership. They can make the switch with an IPO (Initial Public Offering). Then, doing the IPO, a financial firm can decide the number and price of the shares they create and sell to the public. At this point, once the new owners exist, share price is determined by what sellers charge and what buyers are willing and able to pay.

1. At 158 million, as individual consumers, 61 percent of us own stock.

The numbers are high because many of us do not directly own the stock:

2. Sometimes, as with Apple, the shares most of us own are a very small proportion of the outstanding shares of a company.

As the owner of one share of Apple, because there are 15.78 billion shares, you would own much less than a billionth of the company.

And, Apple is not alone as a multi-billion share corporation:

3. How we own stock varies.

While our ownership can be direct, it is more likely through other financial vehicles that include mutual funds and retirement accounts:

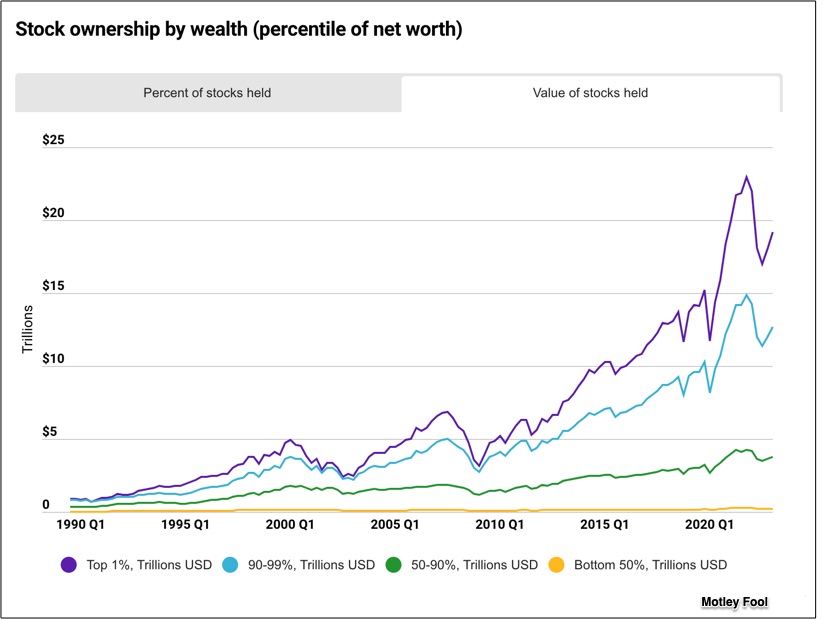

4. Stock ownership also varies with income.

The top one percent owns the vast proportion of stocks:

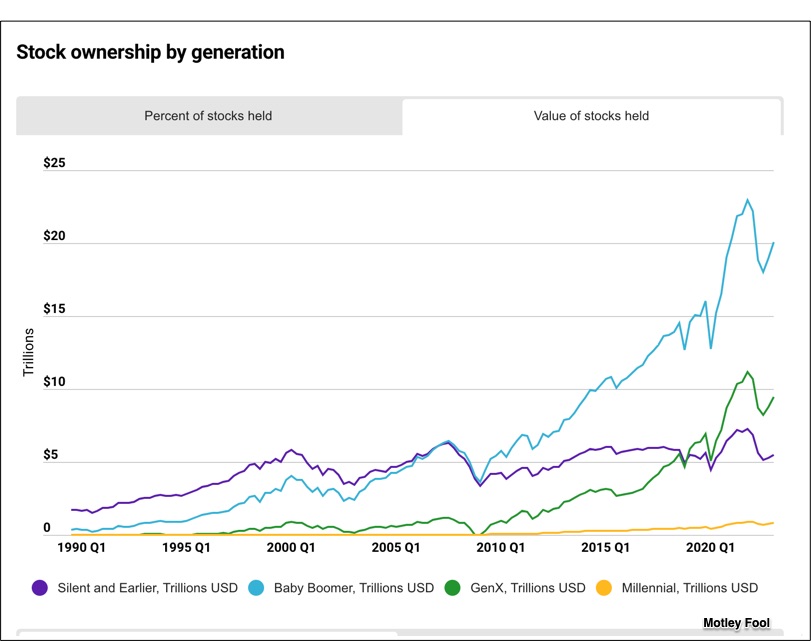

5. Correspondingly, it also depends on your generation.

Compared to other age cohorts, the value of baby boomers’ stock is worth the most:

6. And finally, we can ask how much we are talking about.

Between $20,000 and $40,000, the median value of stock held directly and indirectly is dipping:

Our Bottom Line: Financial Intermedaries

An economist would say that stock markets are financial intermediaries. As financial intermediaries, they pair those who have money with the individuals and groups that need it. Somewhat similarly, because it has savings and makes loans, a bank is a financial intermediary as are bond markets and even insurance companies. In addition, looking at the crypto world, we can find cryptocurrency exchanges, electronic wallet providers, and bank-like entities. Meanwhile, as we have seen at econlife, our list of financial intermediaries includes the central banks that offer digital currencies.

My sources and more: Thanks to my Axios email newsletter for inspiring today’s post. From there it was helpful to see more detail at Gallup and Motley Fool. Then, adding to the story, CNBC told about Apple’s share buybacks.

Please note that several sentences from today’s “Bottom Line” were in a past econlife post.