Because a commodity is money if it serves as a unit of value, a store of value, and a medium of exchange, it is more than a rectangular note. Consequently, the forms of money we spend can become extinct.

Money Transactions

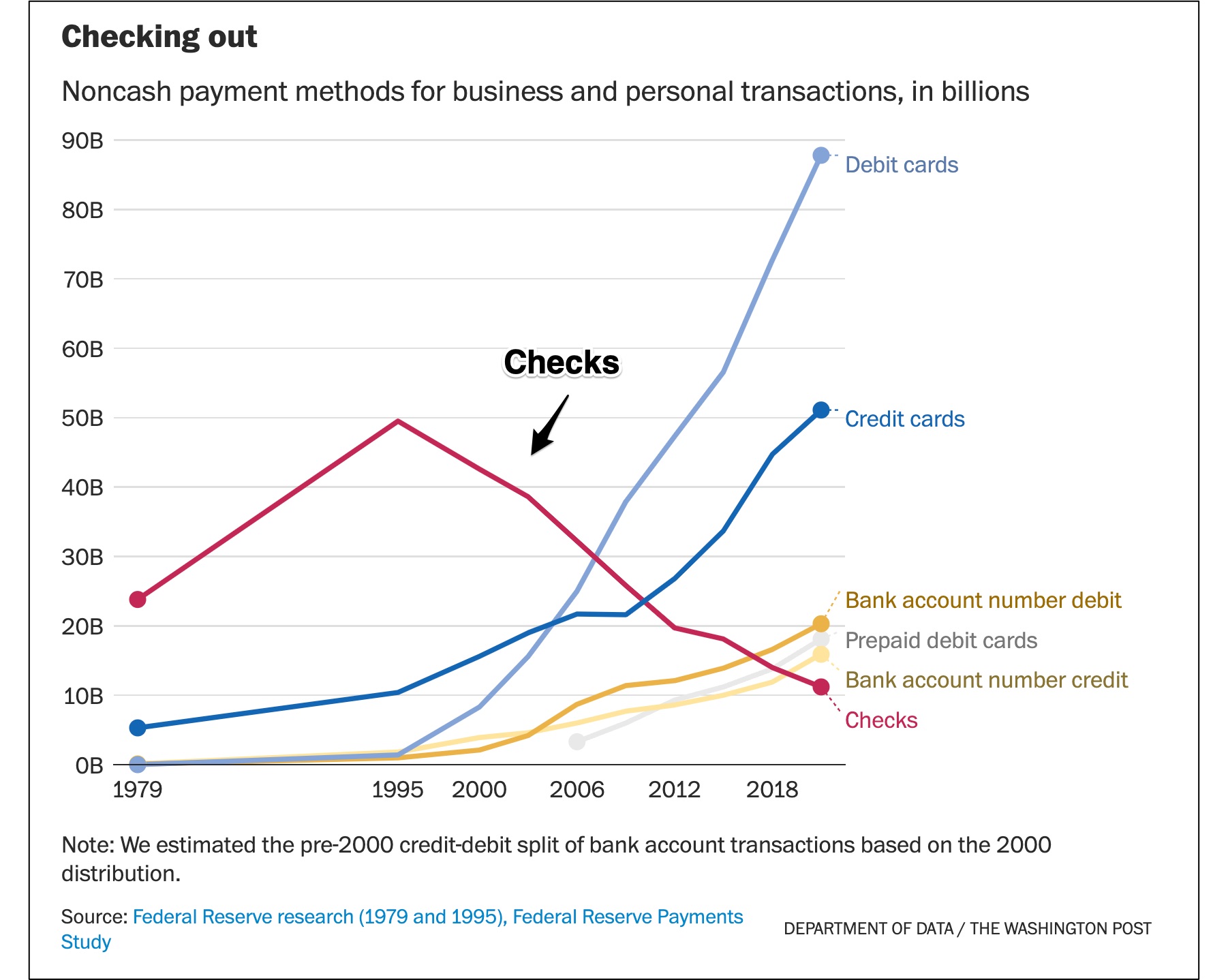

Approximately 25 years ago, a preferred form of money was the demand deposits that we call checks. Then, many of us used checks for 60 percent of all noncash purchases, paid bills, and gifts. Now, for the same money transactions, check use has plunged to five percent:

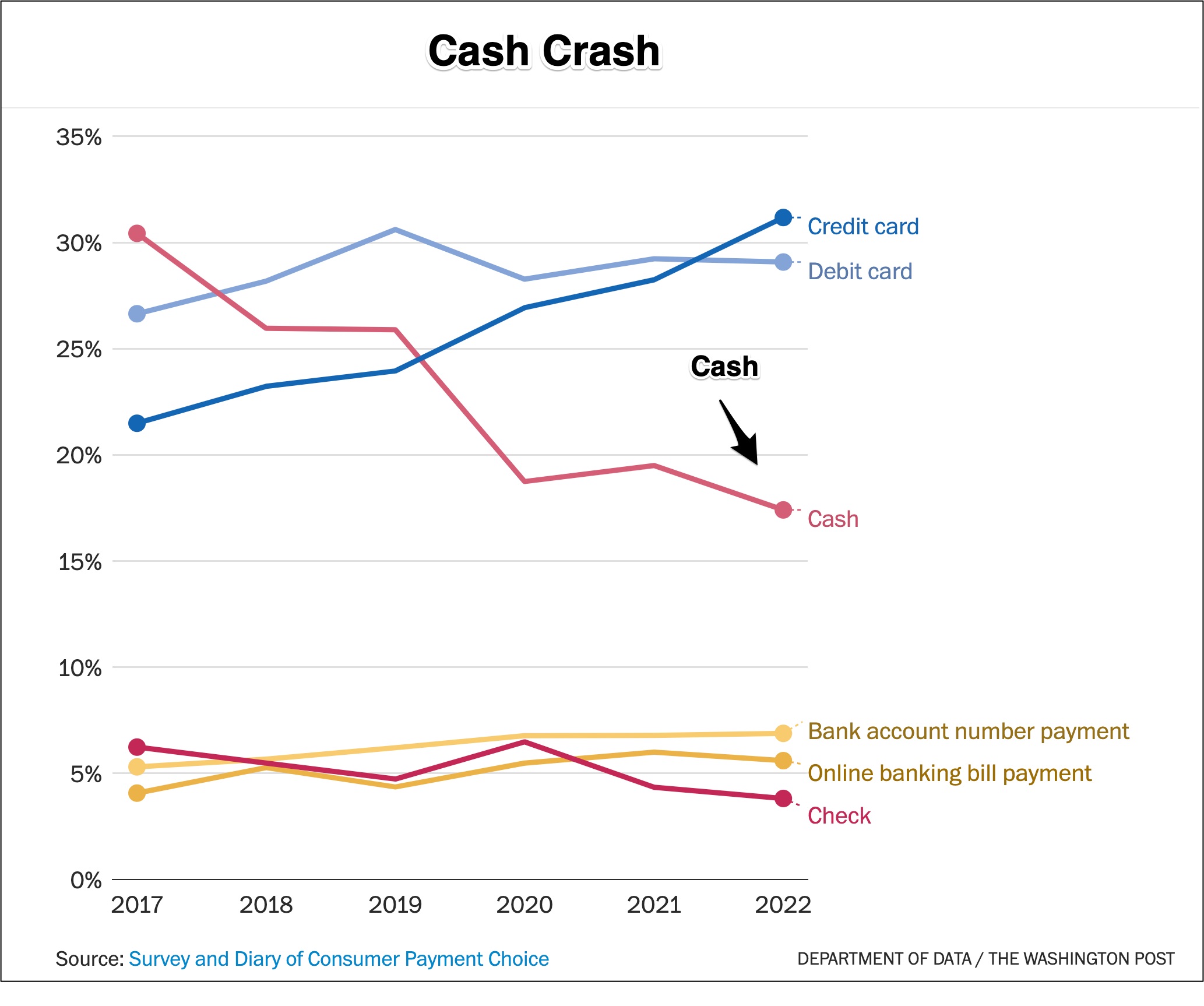

Correspondingly, we are spending less cash:

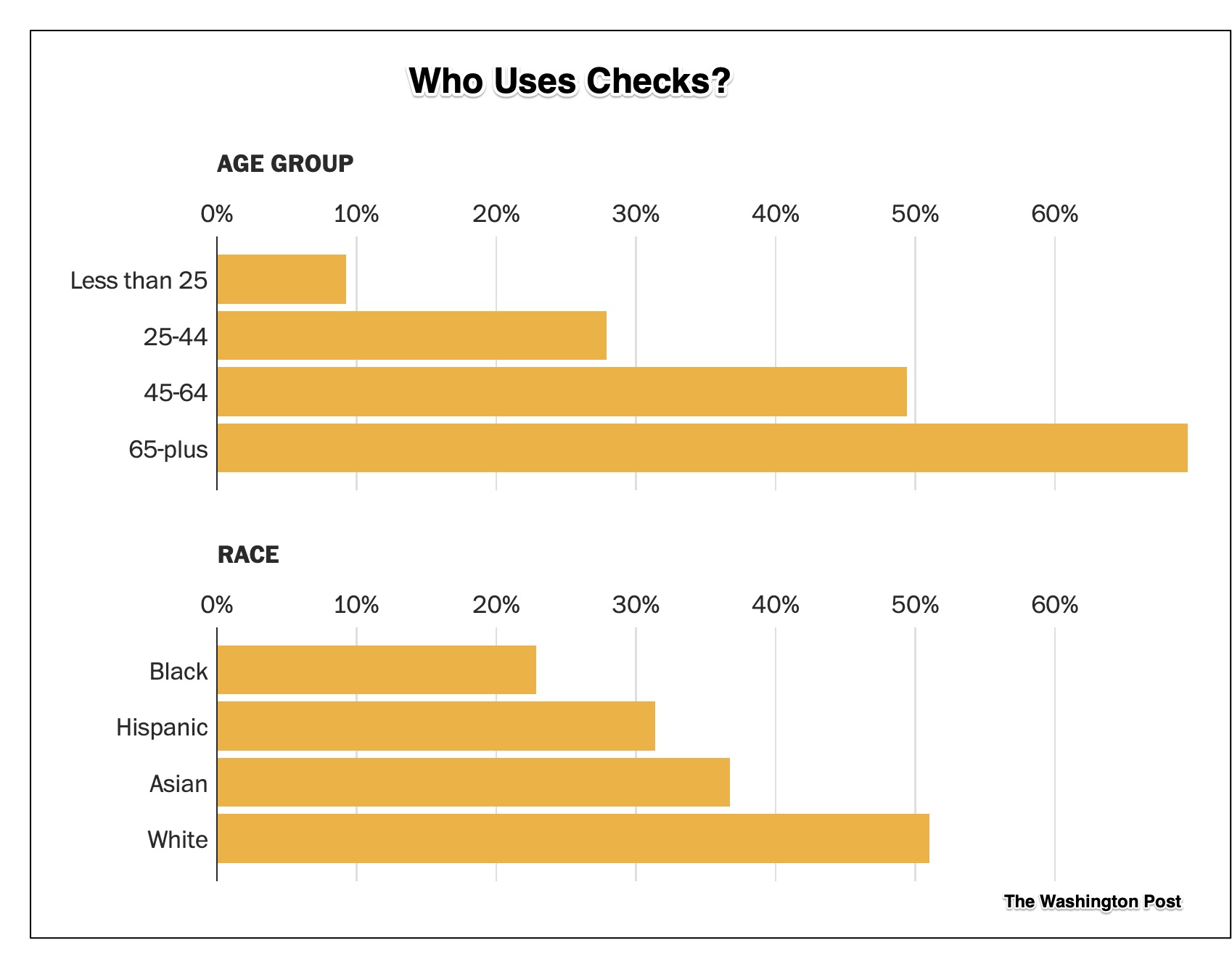

Meanwhile though, as The Washington Post points out, who we are determines the form of money that we use. During the past 30 days, shown below, older white people were the check users. Also, they tended to have advanced degrees and higher incomes:

Still, the kind of money we use depends on what we are buying. Here, we should point out that traditionally, a credit card is not defined as money because we use money to pay for credit card bills. But, comparing cash, checks, credit and debit cards, we would see our money preferences. Shown in a long list comparing the four alternatives, we tend to give checks to building contractors, plumbers and the people that help us at home. However, it is more likely that we will use our debit cards for groceries and other retail transactions. And, for accommodations and air fares, we use credit cards.

Our Bottom Line: Incentives

More than its technical definition, money has an emotional side. As a present to a child, an image on a bill, or a digital transaction, it provides clues about a culture, mutual obligations, our individual identity, and how we connect to the billions of people on our planet.

It also relates to our neurology.

Researchers have observed that the pain receptors in our brain can be activated when we spend cash. A behavioral economist would say the reason is loss aversion.

Because spent money is invisible when we use plastic or our smart phones, our loss aversion diminishes. Perhaps then, as cash and checks become extinct, we will have the incentive to spend more?

My sources and more: Thanks to Cary for inspiring today’s post with this Washington Post article. (Do take a look at that The Washington Post article for the very important facts that I excluded about our unbanked cohort.) Then, complementing today ideally, in a past econlife, we looked at the psychology of spending. Related also, we described Sweden’s cash extinction and Time told us that more money in our checking account made us happier..