The FTX multi-billion dollar crypto bankruptcy filing is rippling far past the company’s customers and investors.

The story though is not a new one.

Financial History

J.P. Morgan

Long before 1907, J. P. Morgan had established his reputation as a financial superman. From funding and restructuring railroads to creating the massive corporations that appeared at the turn of the century, J. P. Morgan had shaped the United States financial landscape for close to half a century:.Then, during the beginning of the 20th century, he saved the U.S. from a monetary disaster. Including President Theodore Roosevelt, no politician could provide a solution. Neither could any other business person or member of the clergy.

Only J.P Morgan had the power and prestige:

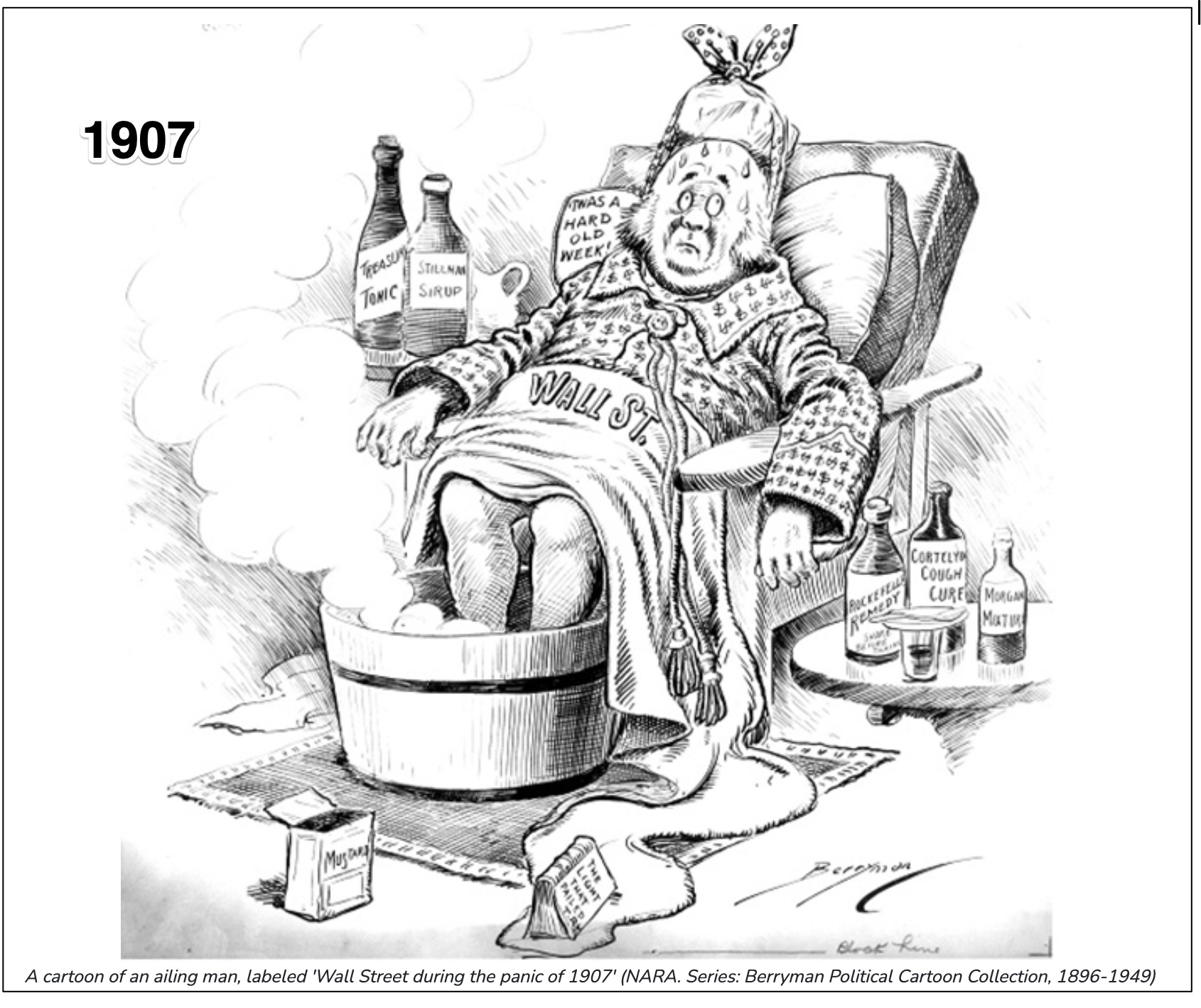

The Panic of 1907

Our story starts when, in 1907, institutions such as the Knickerbocker Trust Company had no direct pipeline to the banking system. Yes, like a bank, it had depositors. But, because they didn’t require collateral, trust companies were also the ideal source of the money that New York Stock Exchange brokers borrowed for the business day. Then, using the loans to buy securities, the brokers had the collateral for new loans from banks that let them pay back what they had borrowed that morning. It was rather like a Jenga stack of blocks that could easily topple.

And it did.

The crisis began when a failed attempt to corner the shares of United Copper spread to Knickerbocker through massive loan defaults. Comprehending the potential magnitude of the problem, J.P. Morgan knew that the tidal wave of withdrawals at Knickerbocker and beyond could not continue. Making a long story very short, we can just say that from his library, J.P. Morgan, suffering from a terrible cold, reestablished the liquidity of the banking system, (Sucking lozenges, he had doctors spraying his throat, Whenever he dozed, no one dared awaken him. They merely tried to remove his lit cigar from his fingers and then continued their negotiations.)

Resulrs

Because of a regulatory void, a 1907 panic had a private rescuer. We also had financial institutions with conflicts of interest between depositors’ funds and risky investments. However, out of the 1907 panic, we evenually got the Federal Reerve system while during the 1930s, the Congress gace us Glass-Steagall and the SEC. Combined, we had the foundation of today’s financial regultion.

Our Bottom Line: Déjà Vu

FTX’s former CEO Sam Blankman-Fried certainly was no J.P. Morgan. However, in his unregulated area of the market, he tried to become a private rescuer this summer when smaller crypto firms needed a bailout. In addition, like Knickerbocker after the copper corner, FTX appears to have had massive conflicts of interest between risky loans and ciustomer money. And finally, we are seeing how, like 1907 banking, there is no saftety net in the cryptocurrency world.

So, we can ask what regulation will soon follow.

My sources and more: My own book, Econ 101 1/2 was the source of my 1907 facts as was this Federal Reserve paper. However, I thank Roger Lowenstein’s NY Times article for inspiring today’s topic.

Parts of today’s text came from a previous econlife post.

The financial intermediation industry, despite becoming unnecessarily bloated over the past fourty years, provides a necessary service to society – facilitating efficient allocation of capital. It therefore needs regulation and safety nets, even though regulators have difficulty keeping up with inventive efforts to evade regulation and swindle the public by concealing risk.

The crypto industry, by contrast, serves no purpose useful to society. It is merely a venue for gambling, and deserves no regulation or safety net.