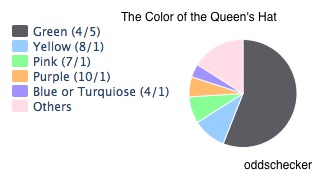

Vanity Fair called it neon green while Harper’s Bazaar (more kindly) said, lime:

But the key is that Queen Elizabeth wore a green hat to Meghan and Harry’s wedding–precisely what the betting markets expected. Sadly though, based on the 4/5 odds, the green hat group could have lost money:

Now betting markets have some opinions about vaccines.

Let’s take a closer look.

Vaccine Prediction Markets

Polymarket is a platform that lets users bet on current events issues. They say that trading activity can give us “actionable insight” if. for example, we know whether it is likely that Andrew Cuomo will be New York’s governor on June 1 or how high President Biden’s approval rating will go. The numbers below are based on 11 PM last night:

Other possibilities include the minimum wage and where inflation will go:

For vaccines, the wager activity is based on a contract that says, “Will 100 million people have received a dose of an approved COVID-19 vaccine in the US by April 1, 2021?” As the lower payoff displays, the answer has increasingly become yes:

The predictions could be based on these CDC numbers. On April 1, if the “At Least One Dose,” column says 100 million or above at 12 PM EST, then the market will have resolved Yes:

![]()

Moving beyond the number of vaccinations, we can say that they are really talking about the economy. They are telling us what the conventional wisdom believes about our return to normalcy. Because the betting opinion is untainted by political bias, it could be an accurate prediction. Or, as Polymarket explains, through the free market, they demystify events.

Our Bottom Line: The Wisdom of Crowds

Adam Smith would have said that markets composed of many individuals are much better at determining price and quantity than one person.

Similarly, in The Wisdom of Crowds, former New Yorker columnist James Surowiecki explains that crowds accurately price sodas and tennis lessons. He cites studies that show why together we can estimate the number of jelly beans in those huge glass jugs. And we know that financial markets give us commodity prices.

So, whether it’s vaccinations or stocks and bonds, we just need to have supply and demand come from a large number of individuals to wind up with their aggregate wisdom.

My sources and more: I found out about vaccine prediction markets in WSJ. But because we had looked at prediction markets for the royal wedding, I checked the results at Harper’s Bazaar and Vanity Fair. After that, it made sense to look at Polymarket and that is where the fun began. Do go there to see what the wagers say. And finally, if you just want more on the wisdom of crowds, James Surowiecki’s book is excellent. (Please note that a section of “Our Bottom Line” was in a previous econlife post.)