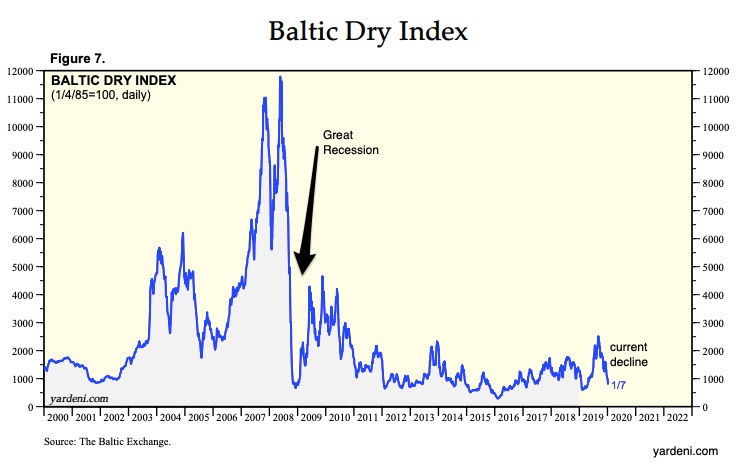

What I would call the Rent-a-Ship Register is really the Baltic Dry Index. This week it hit an eight-month low…and that matters.

Measuring World Trade Activity

Our story starts in London during the 18th century. If you wanted to trade some equities, the place to go was Jonathan’s coffeehouse. For insurance, yes, the coffeehouse was called Lloyd’s. And, for shipowners and cargo brokers, you went to the Virginia and Baltick (because of Virginia’s tobacco and the Baltic’s furs and tallow).

At first the Virginia and Baltick attracted pirates, merchants, and an assortment of maritime businesspeople. But by the 1800s, in a more respectable location, it became a hub for learning cargo ship rates and making freighter transactions. As a composite listing of what it cost to ship raw materials, in 1985 it became the Baltic Dry Index. Created “to lubricate shipping,” the BDI was the go-to source for maritime transport.

It took an economist to see the Index somewhat differently.

About supply and demand, the index reflected trade volume. When prices went up, so too was global trade; if they went down, the opposite was happening. In 2008, foreshadowing the Great Recession, a 25 percent plunge in the Index reflected much less demand for the commodities that manufacturers and builders needed.

Although recently, a surge in Chinese shipbuilding distorted the impact of the supply side on prices, still the BDI remains a valuable barometer. If you want to know how much it will cost to book an ocean trip for coal, iron ore, or some other dry commodity the BDI is your destination.

You can see that the BDI has been sinking:

Our Bottom Line: Economic Indicators

Economic indicators can be categorized as leading, coincident, or lagging. We call stock markets leading indicators because they reflect investors’ future expectations. As a statistic showing the current state of the economy, the GDP is coincident. And, since the unemployment rate takes time to respond, it is a lagging indicator.

As for the Baltic Dry Index, it signals what looms ahead. Conveying current world trade activity for the commodities that will be used in manufacturing and construction, it is a leading indicator.

My sources and more: The more I looked for the BDI, the more I found and the more interesting it became. You might want to start (as did I) with this 2016 New Yorker article and then go to a Learning Markets tutorial. Meanwhile, I checked Bloomberg for the most recent Index reading and London Images had the old coffeehouses.