It could be canoe paddles, clothespins, or live eels.

When we think of a tariff, the item with the tax comes to mind. Entering the U.S. those three items and many more have been hit with a tax that consumers will wind up paying.

But there is much more that we do not see…rather like the butterfly effect.

The Retaliatory Tariff Impact

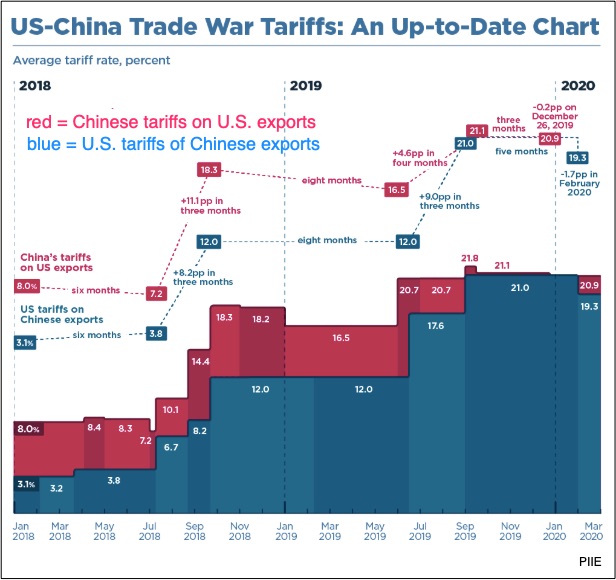

We could look at the U.S. China trade war through the tariff buildup:

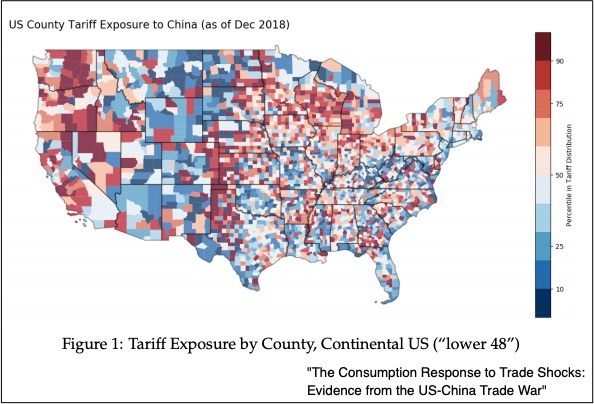

From the September “round” alone, more than $300 billion of tariffed goods will increase what most consumers spend. In certain U.S. counties though, China’s retaliatory tariffs will create more concentrated hardship:

On spending

In a new paper, an NYU economist concluded that China’s retaliatory tariffs shrink consumer spending on items like autos. Ostensibly, the cars have nothing to do with the tariffs. However, their sales suffer because China’s tariffs diminished worker income (on exports to China) and increased prices. With less to spend and costlier goods, consumers have to make choices. One result is lower new car sales in U.S. counties hit by Chinese retaliatory tariffs.

On jobs

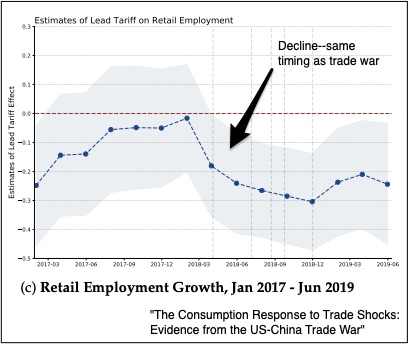

Where retaliatory tariffs are highest, a worker’s aggregate consumption drops by somewhere between $630 and $1600. Consequently, communities also feel the impact of a tariff on retail employment. The job losses though are not caused directly by the items that China or the U.S. have taxed. Like diminished auto sales, they are the result of consumers having less to spend on items like food and clothing:

Our Bottom Line: Spillover

We could say that the impact of the retaliatory tariff is spilling over into consumer welfare. Defined as the impact of a distant event or transaction on an uninvolved third party, a spillover is rather like the butterfly effect. After all, a butterfly can flap a wing in Brazil and cause a hurricane in Texas? Not really but the basic idea from chaos theory–called the butterfly effect–is that a small event can wind up having a large far off impact.

So yes, we can have soybeans that never make it into China. The spillover? General Motors’s sales shrink and its stock price sinks.

Or, as James Gleick said in Chaos,

My sources and more: As an NBER Digest subscriber, I learned about the tariff study. Always my go-to website for trade information, the Peterson Institute had the tariff graph. From there, I went to a long list of the September 1, 2019 tariffs for the three I note above. However, if you want the academic analysis of the tariff impact, this paper and this article are ideal.