Strolling around 110th street in New York’s Harlem, you see new restaurants and small cafes that sell gourmet coffee.

It could be called the Starbucks effect.

The Starbucks Effect

Zillow

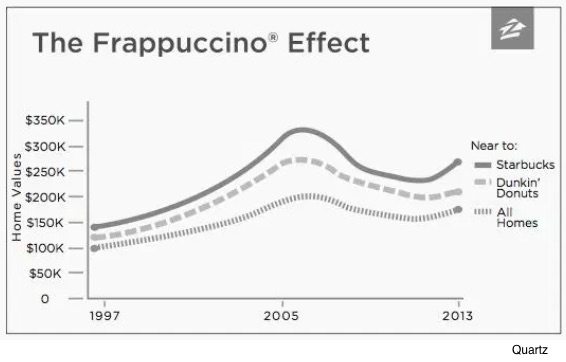

A 2015 study from Zillow tells us that home prices increase after Starbucks arrives in a neighborhood. Yes, they say that “properties near Starbucks tend to start out more expensive.” However, they claim that the Starbucks connection stands out.

While homes near a Starbucks sell, on average, for $137,000, those that are distant from it average $102,000. They also found that over 17 years, the Starbucks correlation was reflected by a 96% appreciation. Homes not near went up by 65%.

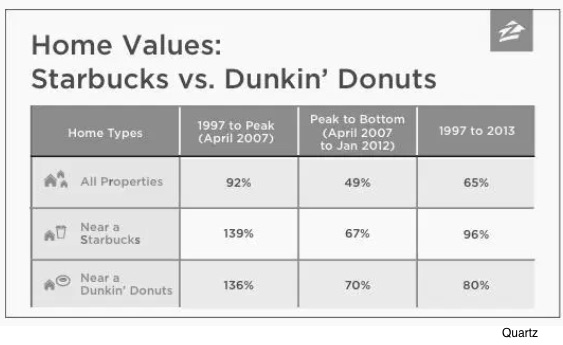

The clincher though is the Dunkin’ Donuts comparison. You can see that your wealth went up by less when a Dunkin’ Donuts was nearby:

Here’s the data:

Asked which came first, the Zillow people concluded that Starbucks fueled the housing price increases. At Starbucks, they just said, sure…we understand real estate. It’s art and science and we get both.

Some Harvard professors do not entirely agree.

Harvard

In a recent paper, three economists from Harvard used Yelp to compare real time local business activity and gentrification. The Starbucks part of their study focused on the number of cafes. They wanted to see if housing prices rose when there were more Starbucks. Sidestepping causality, they were looking for a leading indicator.

And they found one.

With each new Starbucks, the home prices in a zip code rose by .5%. However, they suggest that Starbuck selects zip codes with an “upswing.” Also, Starbucks is one of many new establishments in the neighborhood. As the authors point out, we simply have communities where more people like expensive coffee. They also want more restaurants, bars, cafes, and grocery stores.

Our Bottom Line: Consumption Expenditures

Whether looking at Starbucks or the other businesses that accompany higher housing prices, we can hypothesize that GDP spending rises. As a dollar measure of what we produce, the totals are mostly what we, businesses, and governments spend. So, a new Starbucks can mean more consumer spending. Meanwhile, the new Starbucks and new housing are in the businesses category because they are defined as investments.

I guess we could conclude that the Starbucks effect is a GDP effect.

My sources and more: In two slightly different ways, Starbucks is linked to rising home prices. Quartz had an excerpt of a Zillow study in 2015. Much more auspiciously sourced, this NBER paper from Harvard Business School is dated August 2018.