Asked by the IRS (Internal Revenue Service) if it is okay to cheat on your taxes, 1,760 of 2,000 survey participants said, “Not at all.”

But the IRS has other problems.

IRS Problems

Just before the deadline for filing this year’s tax returns, the IRS had a technology glitch. With Direct Pay one of the options that refused to function, the IRS gave everyone a penalty-free extension.

So yes, the IRS has been coping with antiquated technology. Still though, responding to 80% of all calls, they said this year’s performance was good. I am not so sure since lots of people weren’t able to access a customer service rep.

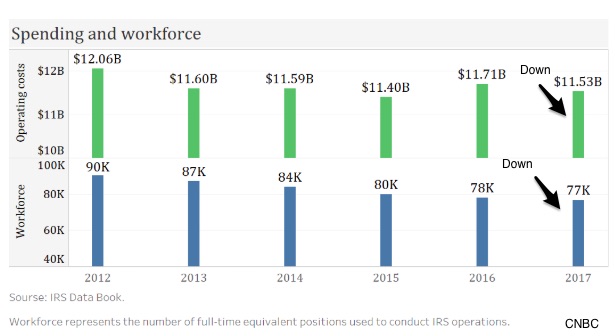

And you can see below that shrinking Congressional appropriations have diminished their staff and spending. The arrows are mine:

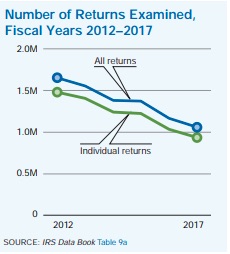

Naturally that means examining fewer returns and sacrificing the revenue they would have received:

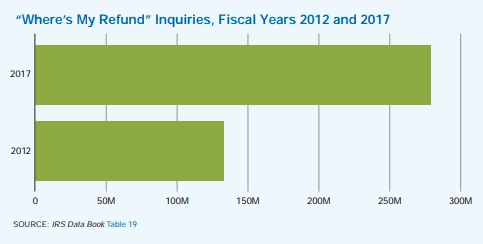

It also means close to 300 million “Where’s my refund” inquiries:

Senate Testimony

The acting head of the IRS recently told the Senate Finance Committee that technology needed to be reprogrammed, forms revised, and customer assistance expanded because of the new tax act. Perhaps more of a concern, he said 59% of the agency’s hardware was outdated as well as one-third of its software.

Our Bottom Line: Tax Basics

Since we are looking at our tax collector, let’s conclude with what it collects (and why we should apologize).

Which taxes?

The individual income tax generates the most revenue:

From whom?

And 87% of the revenue from the individual income tax comes from the earners in the top 20%:

This returns us to where we began. Because the IRS has retained our honesty while coping with outdated equipment, less staff, and more customer service calls, perhaps we should apologize for inadequate funding.

My sources and more: The Washington Post, here and here and CNBC have been the best sources for IRS problems. Then, for more of the human side, Quartz told about technology glitches and the Washington Times had the IRS Acting Commissioner’s Senate testimony .