Asked to define a recession, you can give the mechanical answer. It is 2 or more adjacent quarters of a real GDP decline. So, if Q1 GDP grows by 3%, Q2 by 2% and then Q3 by 1%, is that a recession? (I always use that as a tricky quiz question.) No, it is not a recession because GDP has still grown. The rate has just decelerated.

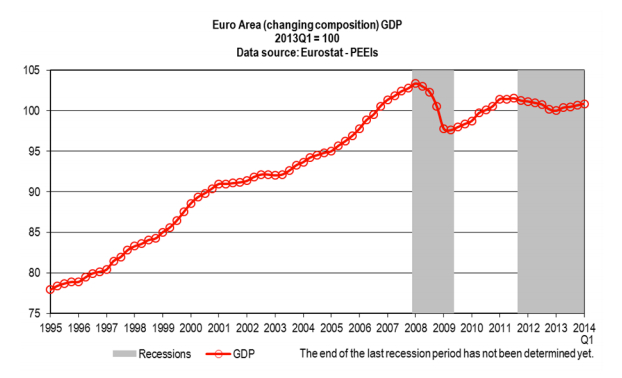

After reading “The Upshot” NY Times column about a possible “prolonged pause” in a euro area recession, I started thinking about the impact of business cycle dates. For the euro area, the austerity debate could resurface with some saying spend more and others calling for less sovereign debt.

In the US, the National Bureau of Economic Research (NBER) is the official source of business cycle dating while for the EU, it is the Center for Economic Policy Research (CEPR). Both say that when they determine the start and end of a recession, yes, GDP dips are important. But also they care about the depth and duration of the GDP drop, unemployment data and, less crucially, a range of other indicators. For several quarters during the 1980-1982 recession, GDP even grew.

And therein lies the problem.

The further we depart from the mechanical definition, the tougher it becomes to decide. After all, what is a significant real GDP decline? When does unemployment take us across that recessionary line? And what if several of the euro area countries are in recession while others are not?

It appears that at the moment we are in the midst of a euro area statistical dilemma. In their June 16th report, the CEPR said they are just not sure where the euro area is in the business cycle. It could be in the midst of a prolonged recessionary pause or the recovery could have begun.

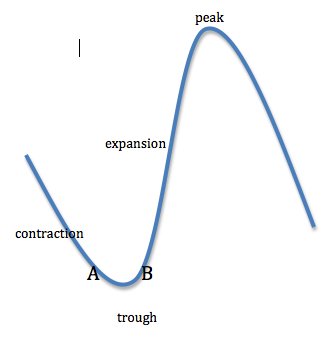

Below, I have noted the 2 possibilities within the 4 phases of the business cycle. If they are at Point A, the trough is yet to come. However, being at Point B means the worst is behind them.

Our bottom line? Business cycle dates have political implications that shape fiscal and monetary decisions. For that reason, it matters whether the CEPR says the euro area recession has ended.

According to the NBER, the US recession dates were December 2007-June 2009. Please let us know in a comment if, anecdotally, you disagree.

The Reason That Recession Dates Matter

Elaine Schwartz

Elaine Schwartz has spent her career sharing the interesting side of economics. At the Kent Place School in Summit New Jersey, she was honored with an Endowed Chair in Economics. Just published, her newest book, Degree in a Book: Economics (Arcturus 2023), gives readers a lighthearted look at what definitely is not “the dismal science.” She has also written and updated Econ 101 ½ (Avon Books/Harper Collins 1995) and Economics: Our American Economy (Addison Wesley 1994). In addition, Elaine has articles in the Encyclopedia of New Jersey (Rutgers University Press) and was a featured teacher in the Annenberg/CPB video project “The Economics Classroom.” Beyond the classroom, she has presented Econ 101 ½ talks and led workshops for the Foundation for Teaching Economics, the National Council on Economic Education and for the Concord Coalition. Online for more than a decade. econlife has had one million+ visits.