Our Wednesday environment focus

Here is my “To Do” list for reducing carbon emissions:

- Buy a Prius.

- Install solar panels.

- Take the train to NYC.

- Lower my thermostat to 60 degrees during the winter.

- Raise my AC thermostat to 78 during the summer.

- Turn off the lights when I leave a room.

- Eliminate meat from my diet.

Having not felt a sufficiently powerful “nudge” that would make me reduce my carbon footprint substantially, I wondered what would get me started. Many economists propose a carbon tax.

Economists like a carbon tax because of its simplicity, efficacy and revenue. A concise piece of legislation, perhaps only a page long, could mandate a carbon tax. Its only objective would be to tax fossil fuels based on the amount of carbon they emit. The tax could work because higher prices provide the nudge that makes us demand a lower quantity. But then, as an MIT economist suggests, we could be “repaid” if the tax revenue were returned to us through lower payroll taxes or income taxes.

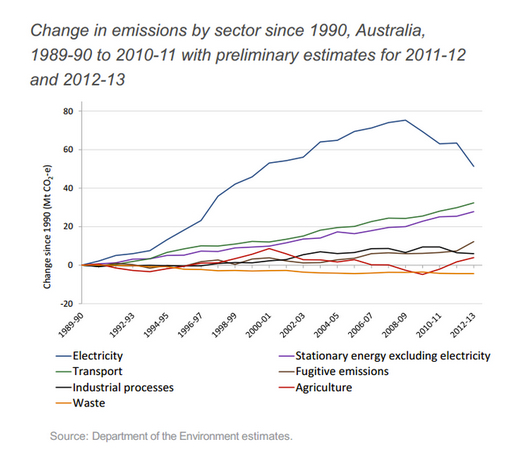

Two years ago, Australia actually did implement a carbon tax of $23 a ton but then, just this month, a new government voted to abolish it. Reading about its repeal, I saw our abstract discussion of a seemingly good idea become a heated economic debate about businesses, consumers, exports and inflation. The following graph implies that the tax reduced emissions but the trend had already begun.

Instead of macroeconomic issues, for Planet Money, the carbon tax was all about you and me. Below, they estimated what an annually escalating carbon tax would cost a typical consumer during its first year:

- gasoline $125

- electricity: $60

- heating: $100

- airplane flights: $75

- food: $50.00

Sadly, they mentioned but decided to ignore the rather high costs that some industries would experience. With its huge carbon footprint, cement fabrication, for example, could see a 25% price hike.

Our bottom line? A carbon tax is a Pigovian tax. Named after British economist Arthur Pigou (1877-1959), Pigovian taxes accomplish some good because they encourage socially responsible behavior while generating revenue that can be used productively. The carbon tax evokes some social responsibility from us by creating the incentive to consume less. Correspondingly, it raises revenue that could actually be returned to us through tax reductions.

For each item on your carbon “To Do” list, how would a carbon tax impact your consumption? Please let us know in a comment.