Our Weekly Economic News Roundup: From Breakfast Inflation to Cronut Economics

April 29, 2023

Why India Needs Its Census

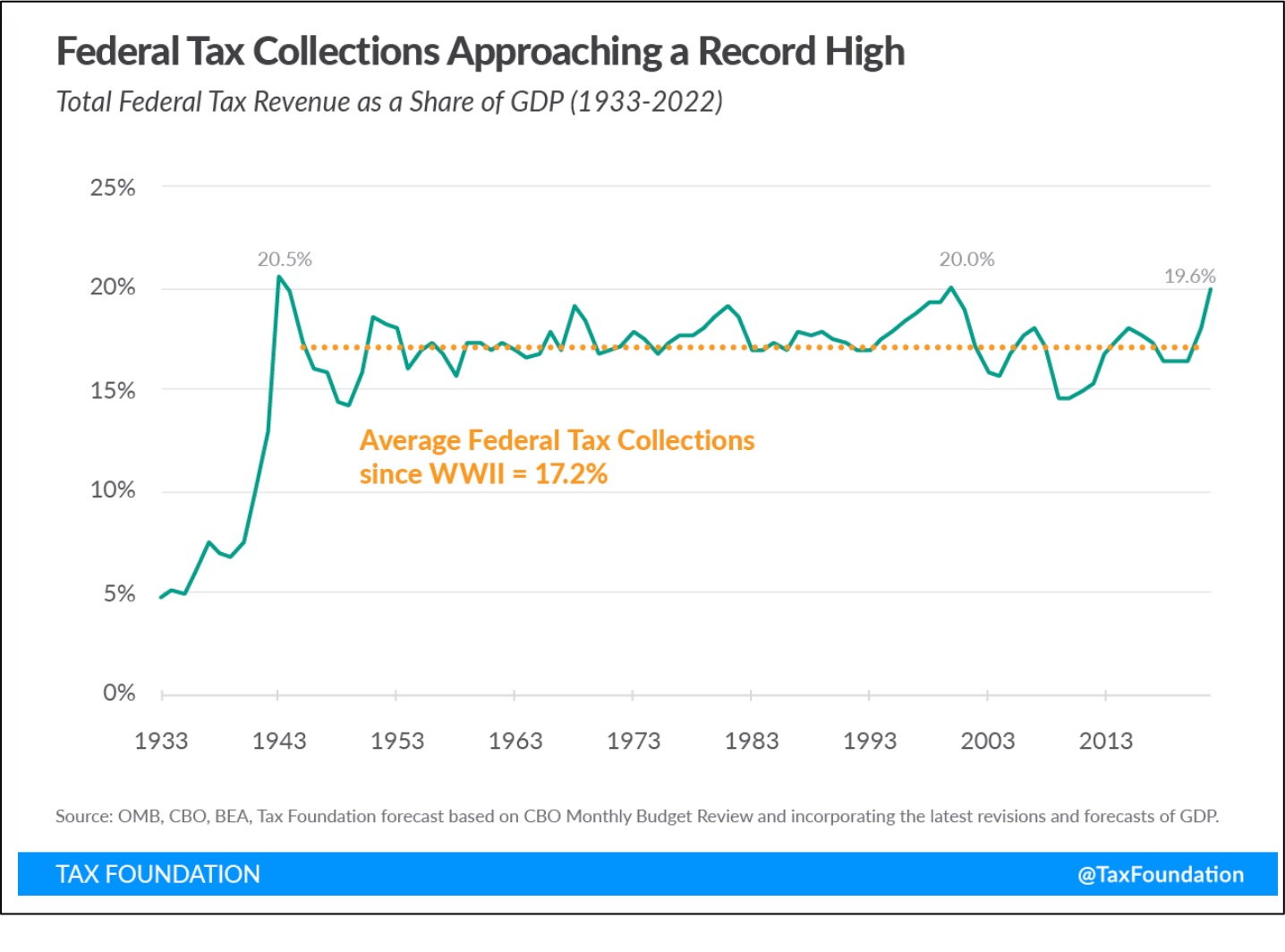

May 1, 2023Last October policy makers were trying to figure out why tax receipts had soared:

Now they are worried about how a possible decline in tax revenue will affect the X-date.

Fiscal Policy

Taxes

Economists hypothesize that soaring stock and housing markets boosted capital gains tax revenue collected during 2022. In addition, with payroll and corporate taxes up, and pandemic spending down, the federal deficit was smaller. Now though, Axios tells us that 2023 tax receipts have been “on the low side,” possibily because markets had an “awful year” during 2022.

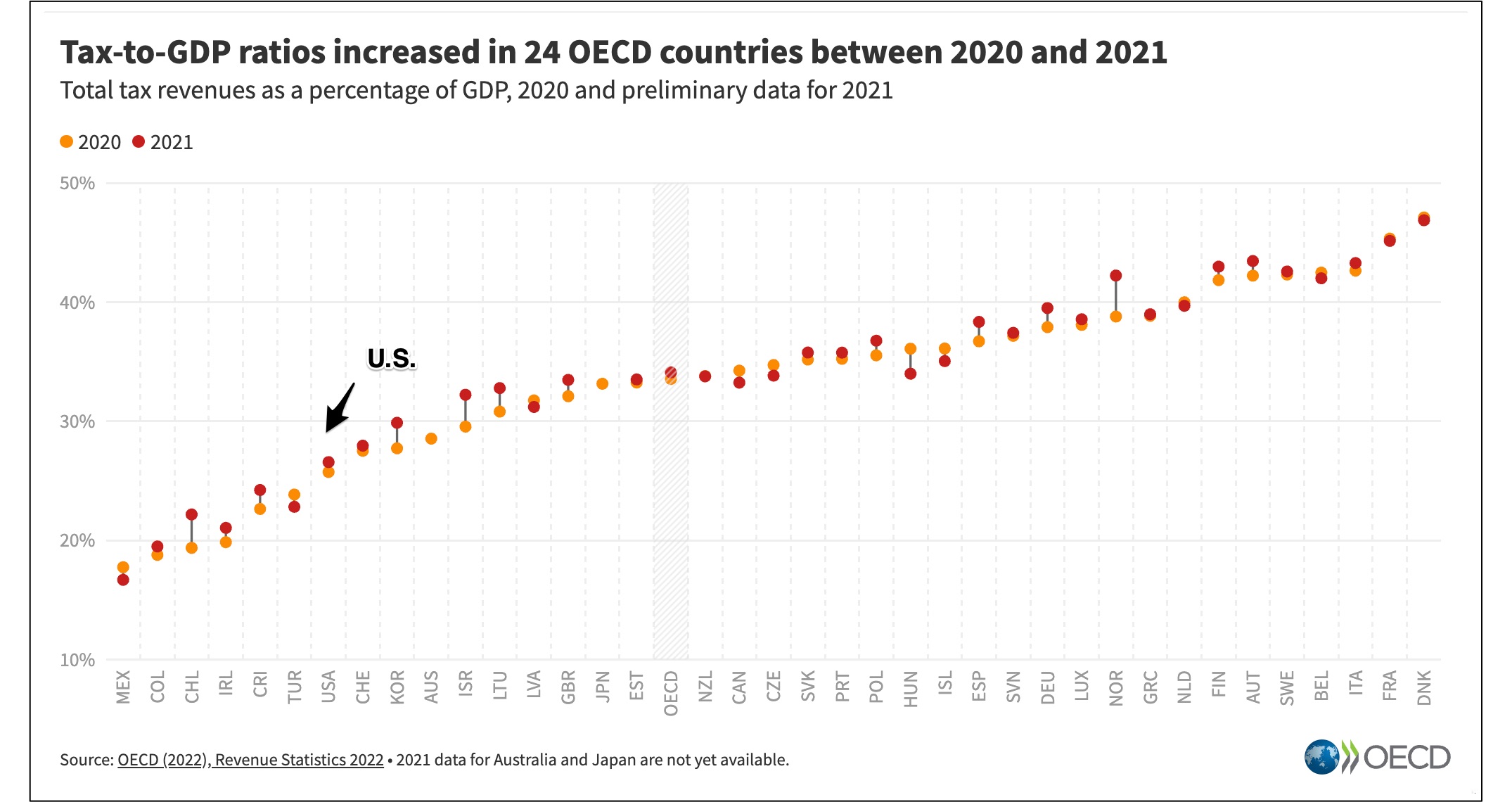

This is how U.S. taxes compared to other OECD (Organization for Economic Co-operation and Development) countries:

Spending and Borrowing

Sent to 66 million (or so) people, and adding up to approximately $1.2 trillion, Social Security deposits are made on the second, third, and fourth Wednesday of each month. Your date depends on your birthday. Also, the government pays for Medicare, submarines, and highway maintenance. It owes the President and National Park rangers their paychecks. And still there is much more.

Whenever the U.S. borrows, someone, somewhere buys a Treasury security such as a bond. The U.S. gets the money. The lender gets the bond–an IOU– and the promise that it will be repaid with interest (for most types of securities).

So who has close to $31.4 trillion in government securities?

Actually, we do. The bonds are held by the public and in government accounts. The U.S. government lends to itself when the Social Security trust fund or Medicare swap their extra cash for bonds. In addition, individuals, businesses, state governments, local governments, pension funds–the list is long–buy U.S. Treasury securities.

A large portion of the U.S. debt is held by foreign governments with Japan first and China close behind. After that, the UK, Belgium, and Luxembourg are next, with Peru last in a 38 country list of the top U.S. foreign debt holders.

Our Bottom Line: The X-Date

It all takes us back to why raising the debt ceiling is so crucial. To cover our existing spending obligations, we have to borrow. So yes, we can debate what those obligations should be in the future but we do need to cover what we said we would spend. Or as stated in a Brookings paper, “Raising the debt limit is not about new spending; it is about paying for previous choices policymakers legislated.”

On the X-date, Treasury will not be able to meet its obligations. Somewhere between early June and early Fall, the precise X-date will depend on the tax revenue that the government just received.

My sources and more: One handy destination for tax information is the (slightly right of center but factually accurate) Tax Foundation. But if you go to just one other source, the ideal explanation of fiscal policy came from the Treasury. Then, for more, do take a look at the current foreign holders of the debt.

Please note that parts of today’s spending and borrowing descriptions are an updated version of a previous econlife post.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)