When we last looked at China’s Belt and Road Initiative during February 2019, all seemed to be what they planned.

Now it appears quite different.

China’s Belt and Road Initiative

Let’s start with some history.

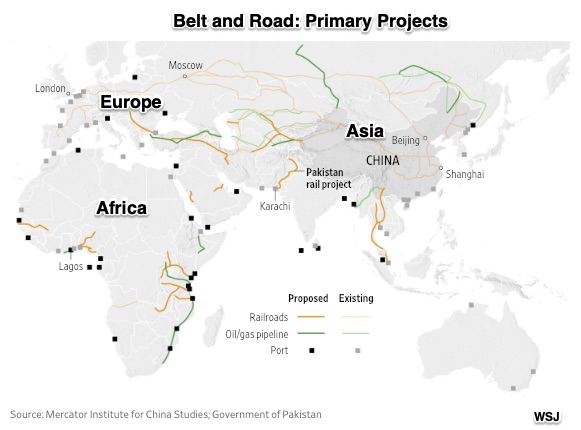

Referring to the land and the sea, Belt and Road touches three continents and 70 or so countries. In return for trillions earmarked for highways, ports, and pipelines. China gets the money back through payments to the Chinese companies that will help to build it all. Also, by upgrading infrastructure, it can reduce trade costs and use new pipelines to boost its oil and gas supply. Completing the picture, China gets more demand for its goods and services in countries that become increasingly affluent.

This is the Belt and Road path:

By 2018, these Belt and Road projects were entirely or partially completed. The labels give us a good idea of what is being done and where:

More precisely, with Pakistan, we can see what we are really talking about. Completed during December, 2019, through Belt and Road, a new $2 billion+ overhead railway runs through Lahore. Called the Orange Line, it was mostly built by Chinese SOEs (state-owned enterprises) that received the money that Pakistan borrowed from China. Now Pakistan cannot pay back their loan.

This is a computer image of the Orange Line:

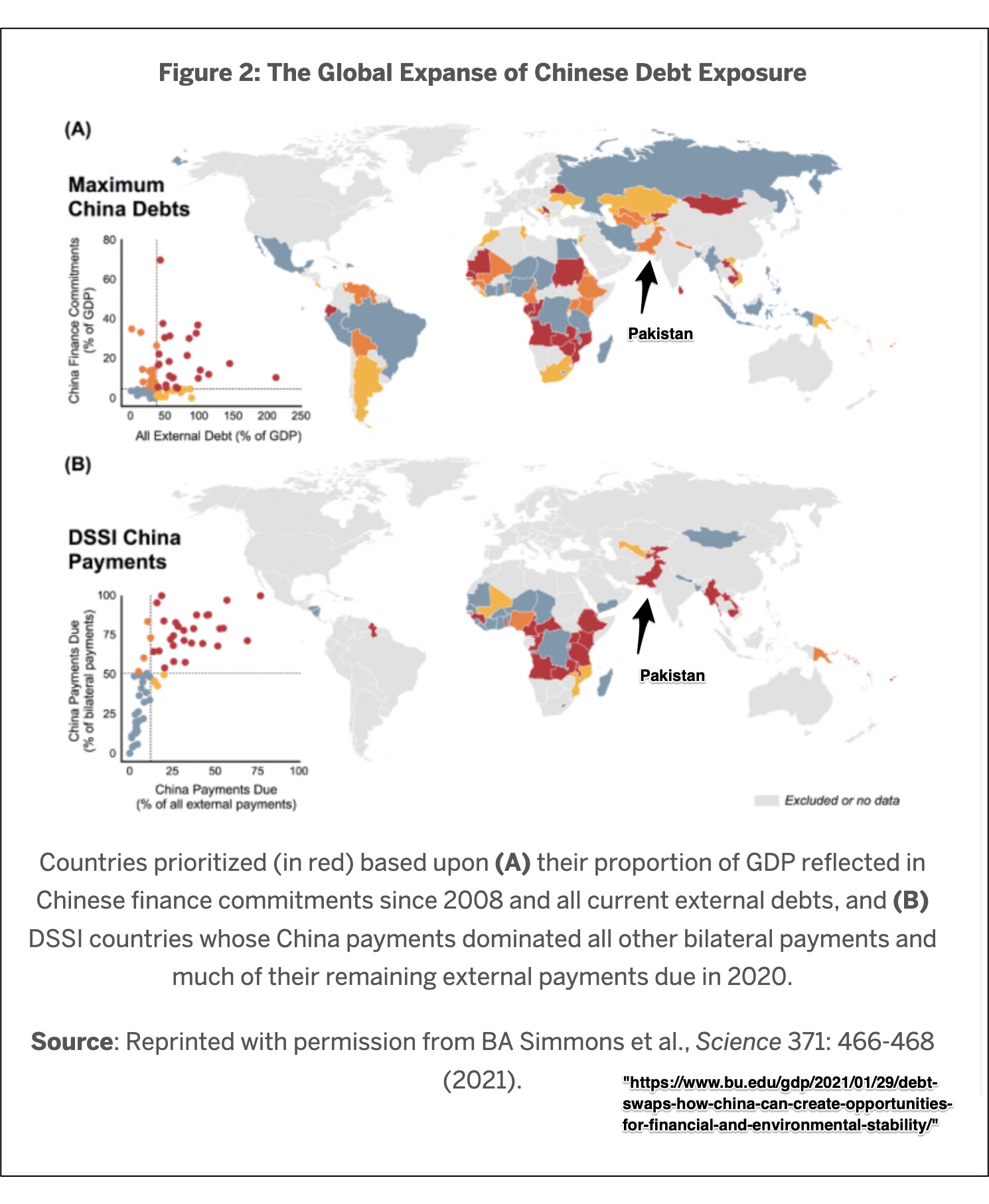

China’s Debt Exposure

One academic paper said we could call China’s debt exposure and rescues, its “Bailouts on Belt and Road.” As our example, my arrow points to Pakstan:

Next, we can ask how. With Pakistan listed as an example of the fourth lending instrument, we have four listed below. (The swaps could be currency exchanges):

Next, we can ask how. With Pakistan listed as an example of the fourth lending instrument, we have four listed below. (The swaps could be currency exchanges):

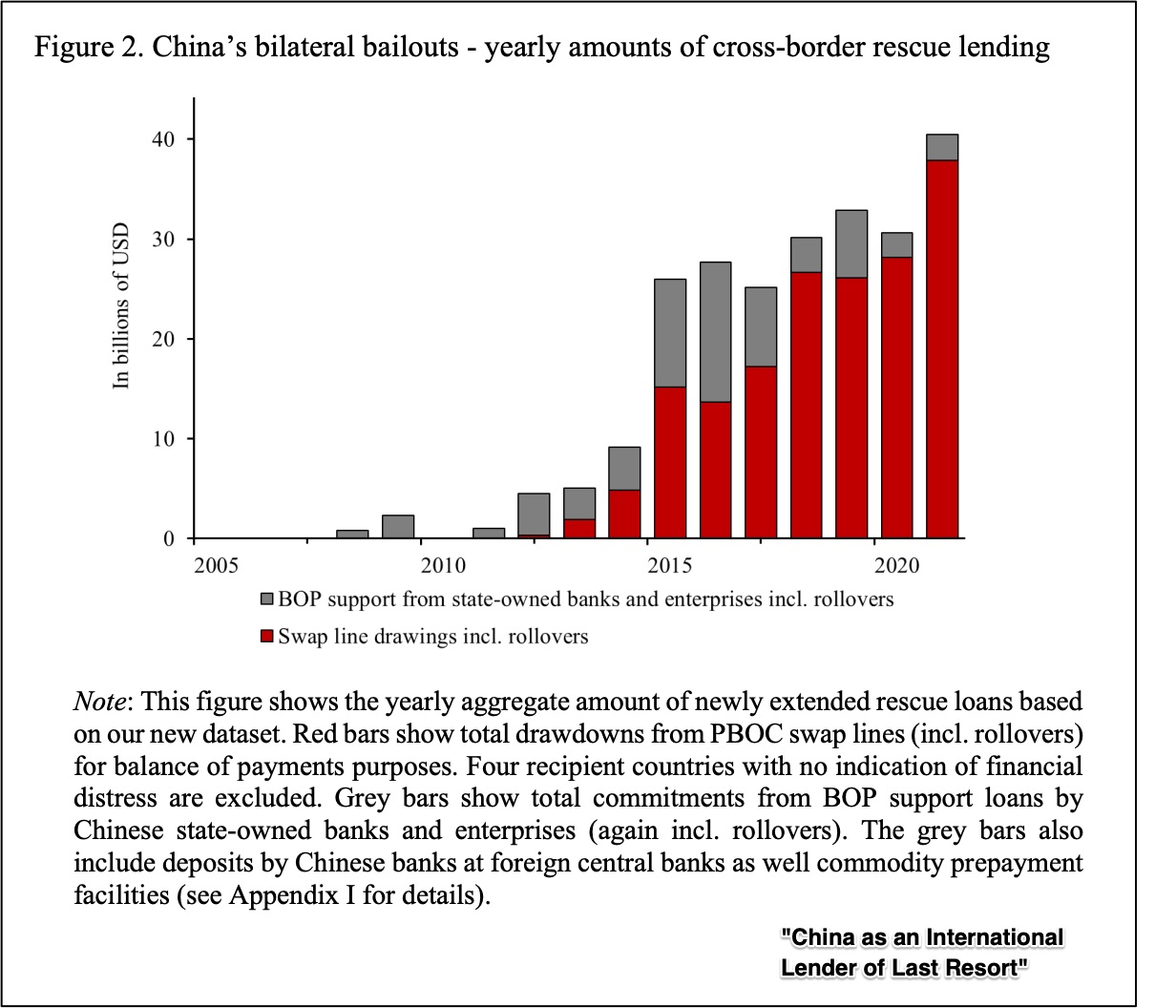

And finally, we can see that it all adds up to China’s debt exposure ascending massively:

To conclude, we can ask why China’s debt exposure matters.

Our Bottom Line: Finance Architecture

We could say that we are looking at the world’s finance architecture. Dominated by the United States and the IMF, borrowing and bailouts were shaped by governments, businesses, and individuals from Western nations.

Now though, we have some changes.

Through its Belt and Road Initiative, China has entered the world’s financial structure. Not yet as central as the U.S. and the IMF, still China has become a major player. Understanding their exposure, we can imagine a loop. Rather than the global investing community, China provided the funding that paid Chinese companies to build its Belt and Road Projects. Entering uncharted debt territory we can ask what ultimately happens when debtors have inadequate resources to pay what they owe.

Indeed, in a world with with rising interest rates, slowing growth, and increasingly recurrent black swan events, the world’s financial architecture is in the blueprint stage. The one sure thing is that China will add to it.

My sources and more: This NY Times article has the update on the Belt and Road Initiative. More specifically, we also accessed the details on Pakistan’s Orange Line project. But, most crucially, the academic analyses are here and here. (Pleae note that several of today’s sentences were in a previous econlife post.)