It sounds rather simple. Led by the OECD (Organization for Economic Cooperation and Development), 136 countries agreed to a 15 percent corporate tax deal.

But there is so much more.

The Corporate Tax System

History

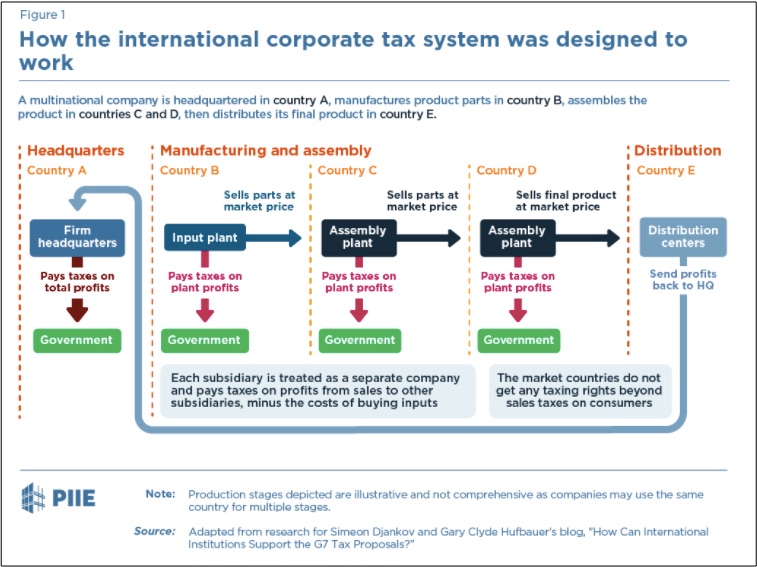

After World War I, the League of Nations created a corporate tax model. The basic idea was for a company to be taxed where its headquarters (HQ) was based and its products were made. At its HQ, the company would pay taxes on total profits. However, it would also owe taxes on profits wherever the stages of production took place:

You can see that countries in the supply chain are supposed to receive their fair share of taxes. The problem though was that the system was easy to manipulate. Companies just needed to shift their costs and revenue, depending on whether it was in a high or low tax jurisdiction.

OECD Proposals

To minimize the potential for manipulation, restore confidence, and generate revenue, the new proposal has Two Pillars.

Pillar One

Very different from the past, sales now count. Countries where sales occur can tax the largest, most profitable companies. Consequently, the new proposals target the digital economy:

Pillar Two

The second pillar dominated the headlines. By establishing a minimum corporate tax rate, they would eliminate the race to the bottom. Firms, for example, could not locate in Ireland to get its low rate. Yes, still a country could offer a lower rate. Then though the HQ country could charge a “top-up” tax. As a result, the proposal preserves the 15 percent minimum:

The Next Step:

The pillars will need legislative approval in 136 jurisdictions. National tax laws will have to be rewritten. Further complicating adoption, countries could figure out new perks that circumvent the 15 percent minimum.

Our Bottom Line: The British Coastline

Corporate taxation is rather like looking at the coast of England. From a distance it appears smooth and curvy. But the closer you look, the more inlets and zigzags you see.

Returning to where we began, we can say that adopting a minimum corporate tax rate sounds uncomplicated. But its details can occupy eight years of negotiations and hundred-page explanations. Still, they just add up to digital taxation and a global 15 percent minimum that is tough to shift.

My sources and more: Always handy for international trade, the Peterson Institute had the corporate tax primer. From there, details of the October agreement were at FT and the OECD.

Thanks, Mrs. Schwartz! This explanation is great. All the best — Carol Cronheim, KPS `82

Thanks! Great to hear from you!