Whether it’s a family buying a house, a business paying for its holiday inventory, or a city selling bonds to build a new bridge, we borrow money all the time. The question though is if we have the incentive to use someone else’s money. Yesterday the Federal Reserve gave us some answers.

Federal Reserve Decisions

When determining whether borrowing should be cheap or expensive, the Fed is aiming for stable prices, maximum employment, and economic growth. Yesterday, after two days of meetings, they let us know that their goal for price increases remained 2 percent. Yes, we have had some inflation that exceeds the target but it seems transitory. As long as the average is 2 percent, rates that are moderately higher are okay. They also expressed comfort with where employment and economic growth are trending. So because the Fed’s low interest rates are doing what they want, the policy will continue.

But for how long?

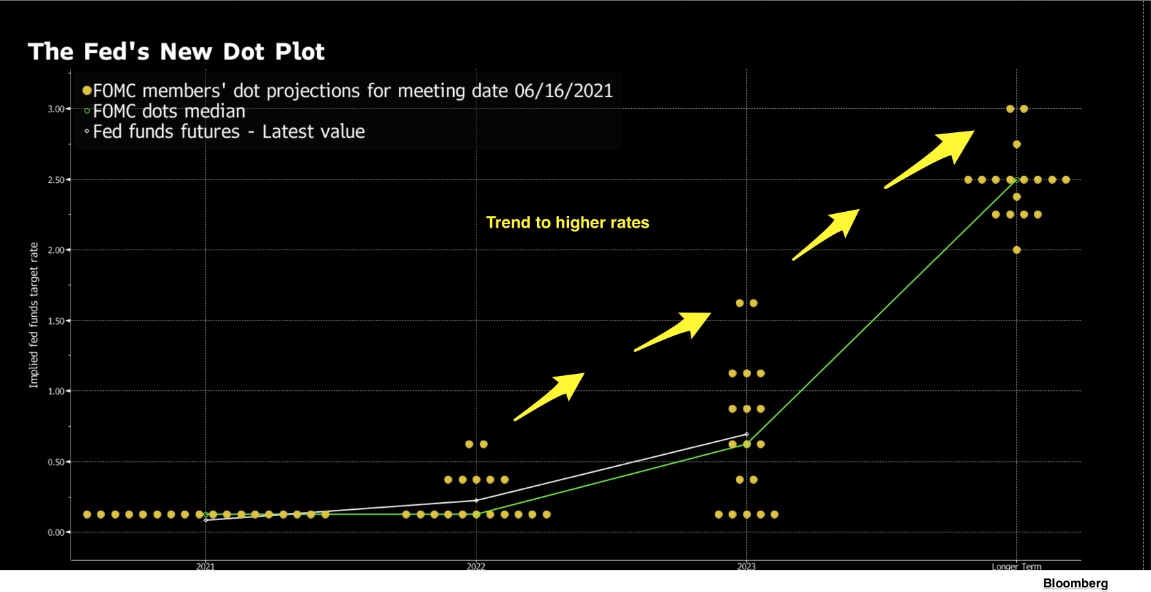

In his press conference, Fed Chair Jay Powell projected (tentatively) two interest rate hikes by 2023. But he emphasized that, “whenever liftoff comes, policy will remain highly accommodative.” The future to which he referred is detailed in a Fed dot plot. A graphic that displays what Fed officials expect, the dot plot is not a forecast.

While 7 Fed officials expect interest rate hikes in 2022, the number goes up to 13 for 2023:

Meanwhile, the March dot plot, had 4 expecting rate hikes in 202 and 7 for 2023. The upward trend reflects higher expectations for each of the Fed’s key metrics:

Our Bottom Line: The Fed Funds Rate

The fed funds rate–a bank-to-bank lending rate– is a Fed target. We say “target” because they cannot actually determine the rate. Instead, by setting the interest rate on banks’ reserves and other rates from the Fed to banks, they try to incentivize financial institutions to lower or raise their lending rates.

With the highest rate on this graph at 2.5 percent, the fed funds rate has been law since 2016:

But not always. You can see a whopping pop to close to 20 percent during the early 1980s:

Rather than numbers and lines, each graph is really a story about whether the Fed is encouraging us to borrow.

My sources and more: A slew of Federal Reserve Policy papers, here and here, told the monetary policy story. Then, the NY Times had more of the summary and a St. Louis Fed report had the perfect description of what the Fed is and does. (Our featured mage is from Reuters.)