In Denmark, new parents can get as much as 52 weeks of paid leave, universal day care, and a cash subsidy for each child. Government also provides for two years of unemployment benefits, a university education, and elder care.

Let’s take a look at how they pay for it.

Scandinavian Taxes

Kinds of Taxes

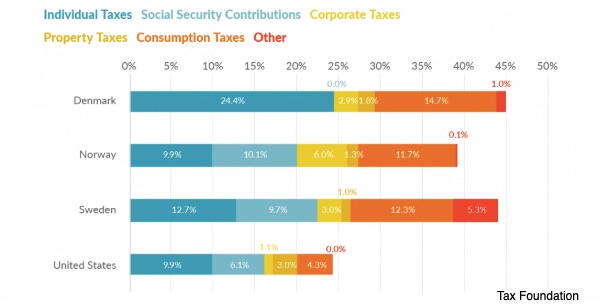

We can start with the kinds of Scandinavian taxes. One big difference between the Scandinavian countries and the U.S. is their consumption tax. You can see that it (in orange) is a much larger proportion of their tax burden than ours.

Across the top, the graph also compares the tax burden to each country’s GDP. For Denmark, the tax to GDP ratio is close to 45 percent. For the U.S., at 24.3 percent, it is much lower:

Consumption Tax

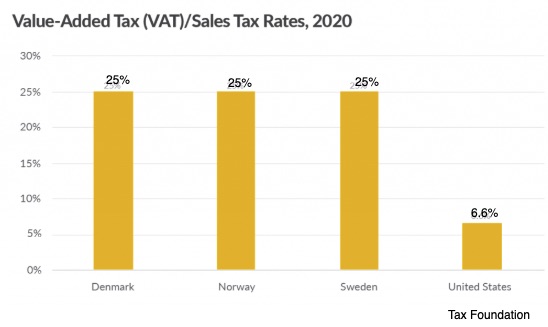

Called the VAT (Value Added Tax), the Scandinavians’ consumption tax is levied during production. A pretzel that is subject to the VAT would probably have been taxed as wheat, as flour, as a pretzel, and then in the supermarket. At 25 percent, a VAT can add up to a hefty amount and yet be somewhat hidden. The U.S. equivalent is a sales tax on certain items that can go to a federal or state government:

Personal Income Tax Rates

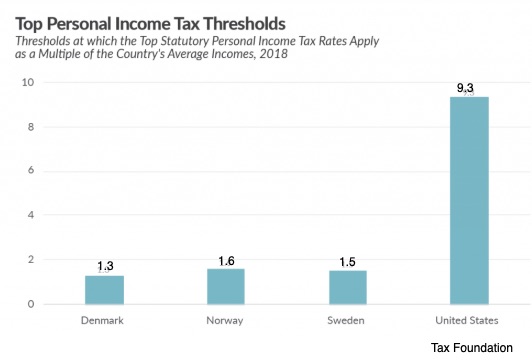

As you might have expected, Sweden’s (57.1%) and Denmark’s (55.9%) top tax rates are higher than U.S. rates. (At 38.4%, Norway has a lower top rate than the U.S.) But there is another less obvious difference. Denmark’s higher tax rate is paid by people who earn more than 1.3 times the average. If that dividing line were in the U.S., people earning $65,000 would pay the highest rate. Similarly, in Norway and Sweden, groups that earn less pay more:

Social Security Taxes

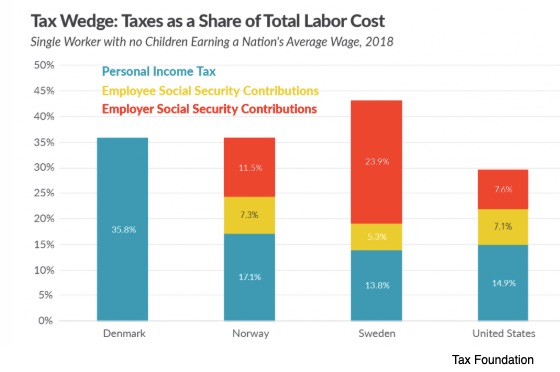

Here, Denmark has no payroll tax that would be comparable to what we pay in the U.S. But the rate in Sweden and Norway is higher than ours:

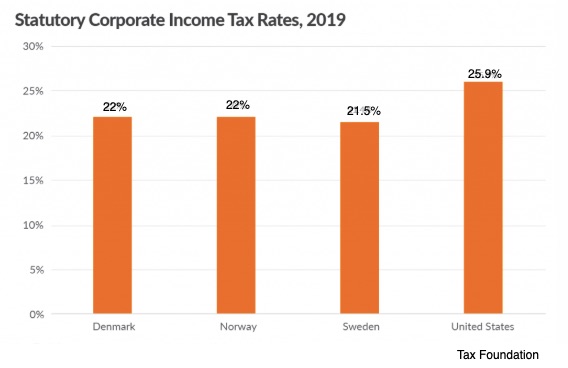

Corporate Taxes

Corporate taxes are higher in the U.S.:

Our Bottom Line: Types of Taxation

Our Bottom Line: Types of Taxation

Whether looking at Scandinavian taxes or the U.S. we wind up with three categories: progressive, proportional, and regressive.

- A progressive tax takes a higher percent from those who earn more. With the highest rates hitting the more affluent, the U.S. personal income tax is progressive.

- Meanwhile a proportional tax takes the same percent from everyone. The U.S. Medicare payroll tax of 2.9% is proportional.

- And finally, a regressive tax takes a higher percent from those who earn less. Our example is a consumption tax. When everyone pays the same amount, then the proportion of one’s income will vary. Assume, for example, that you and someone else each purchase the same bottle of water with a tax of $1. Because the $1 is a higher proportion of a less affluent individual’s income, it is a regressive tax.

So, do we want to be more like Scandinavia? The big tradeoff is the taxes.

My sources and more: You can see that I got all of my tax information from the Tax Foundation. However, there are lots more tradeoffs. For other costs, you might want to look at this comparison of Cuddly and Cutthroat capitalism and at Denmark’s Education caps, On the other hand, for more benefits, this WEF article focuses on work hours. And, for some surprises, this paper looks at mobility.