Twitter was regularly buying new ping-pong tables until the end of 2014. By 2016, the headlines said that their growth had stalled.

There might be a connection.

Ping Pong and Startups

In tech, playing ping pong is a normal part of the workday. Or, as one chief tech officer said, “If you don’t have a ping-pong table, you’re not a tech company.” We could add that when you stop buying ping-pong tables, your tech company might be declining.

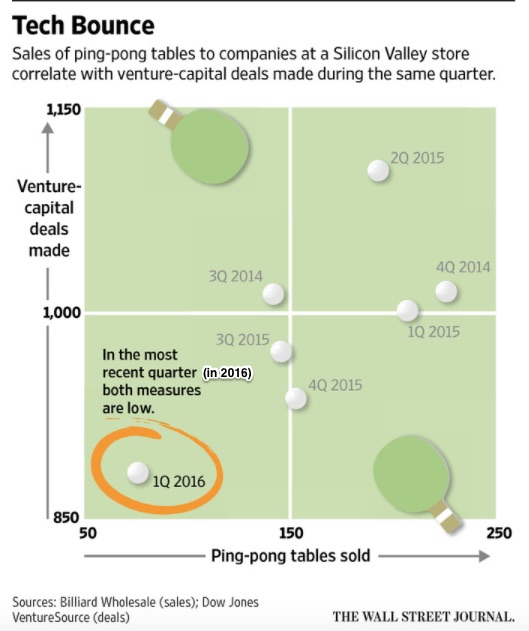

To prove the correlation, one ping-pong table dealer tells us that when his store’s sales declined by 50% during the first quarter of 2016, startup venture capital funding dropped 25%. However, he was quick to point out that the table purchases are not a predictor. Rather they are “coincidental”:

Venture Capital (VC) Activity

If VC and ping pong (perhaps) relate, let’s follow the money.

Who?

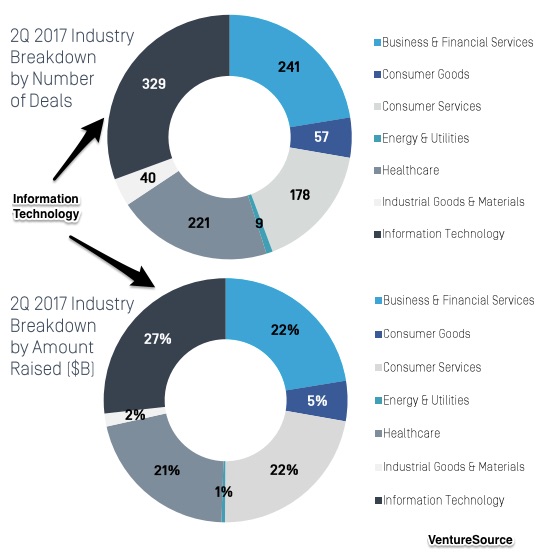

In the following graphic, you can see that information technology got the most money from the most VC deals:

Where?

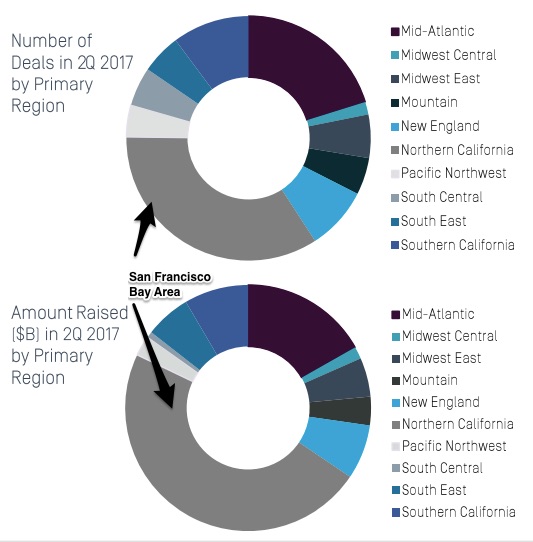

The San Francisco Bay Area was by far the top region for startup money and then the Boston/New York/Washington DC corridor.

However, New York is a distant second behind San Francisco:

Our Bottom Line: Venture Capital

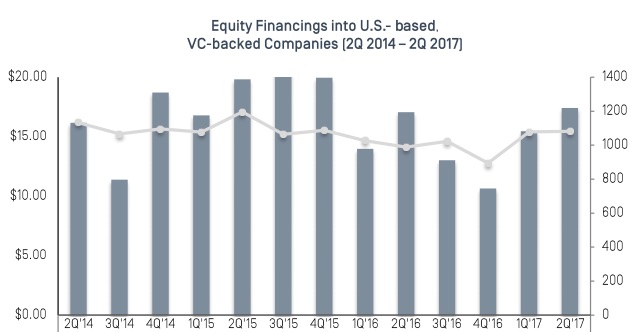

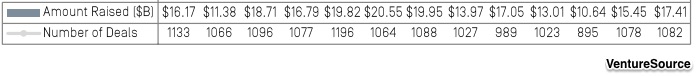

Yes, we can look at the gargantuan dollar and deal totals for venture capital:

But what actually is venture capital?

Here is the perfect VC primer. I’ve summarized the list from BusinessInsider:

- Just like Shark Tank, venture capital is the money received by young companies that helps them to grow. In exchange for the dollars, the investors get ownership shares.

- On the other end, the VC firms get their money from investors like mutual funds and affluent individuals.

- Entrepreneurs go to the VC firms asking for cash. (You might enjoy Startup.com-an award winning documentary about a tech startup.) The initial stage of funding is called “seed capital.” Snapchat first got $485,000 in 2012.

- If the firm survives, the next step is the “growth round,” also known as Series A. Then the funding hits the multiple millions. For those millions, the VC investor gets a slice of the company. BusinessInsider compares it to an 8-slice pizza. Assume the pizza (the startup) is valued at $24 with one slice worth 12.5%. If that firm grows, the VC group retains its 12.5% stake and hope they have the next Google.

- The last stage is the “exit.” If all works out for the VC firm (which is rare), the startup could be acquired or sell its shares to the public through an IPO (Initial Public Offering).

And then, ping-pong table sales skyrocket?

My sources and more: When ping pong and VC connect, that means there is lots more to explore. So, I took the next step with Medium and then the leap in the VC world with VentureSource. But if you want more of the perfect VC overview, do go to the BusinessInsider summary.