Talking about U.S. business tax reform, a PWC/World Bank Report shows us that there is so much more to consider than the 35% top rate.

The Best Business Tax Places

The Report did a country-to-country comparison by creating a standardized medium-sized company. They then asked the rate, compliance time, types of taxes, number of filings. At the end, they came up with a rank for the 190 countries in their study.

In their ranking, Qatar and the UAE shared the top spot for tax systems that were least burdensome and most efficient.

Top 10 (2015)

- Qatar and United Arab Emirates

- Hong Kong SAR, China

- Bahrain

- Ireland

- Kuwait

- Denmark

- Singapore

- Macedonia FYR

- United Kingdom

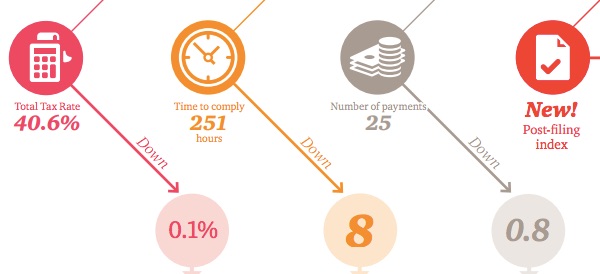

With an 11.3% tax rate and 41 compliance hours a year, Qatar is far below the averages shown below. Among 190 nations, the average total business tax rate was 40.6%, with compliance time 251 hours, and the number of payments, 25. All were slightly down during 2015 and all sound pretty burdensome:

We should note that these averages hide key facts. So yes, Tajikistan did pull the average total tax rate down with a massive 16.6% decrease. However, the new rate was a whopping 65.2%. The reason? Their road tax halved from 2% to 1%. It is also crucial to know that 162 countries had a Value Added Tax (VAT) with revenue generated at each production stage.

Our Bottom Line: U.S. Rank

The U.S. is #36. (Since the U.K., at #10, was next on the table, I included its numbers.)

Thinking of tax reform, we can keep in mind the criteria for a rank of 36. Compared to the U.K. our rate is high but so too are the number of hours devoted to tax compliance.

My sources and more: The PWC/World Bank Report has an immense amount of handy business tax facts and a summary here. But for even more on the U.S., I found it useful to look the Tax Foundation’s map of state business taxes. Finally, BusinessInsider had the Trump proposals.