Oil can be sweet or sour, and light, medium or heavy. But the best kind is sweet and light. Sweet oil is low in sulfur; light oil can float on water. Put the two together and you get oil that needs little processing.

And that takes us to WTI (West Texas Intermediate), Brent and the price of oil.

WTI and Brent

Global benchmarks, WTI and Brent are both sweet and light. WTI, though, is U.S. oil while Brent (North Sea) comes from Europe. You can see below that typically, though not always, if you asked about the price of oil, WTI or Brent would have conveyed similar information.

However, after the two prices diverged during the past several years, each got a separate identify. WTI is now associated with the U.S. market and Brent for a world price.

As benchmarks, they matter. Let’s say you have some sour medium oil. A trader could ask, what is the price of Brent and then move down from there to determine the value of the lower quality oil he is evaluating. In one article, an analyst just said, “I’ll give you Brent minus $2.50.

But why are the benchmarks plunging? We need to look at supply and demand.

The Price of Oil

Supply Side:

U.S. oil production far exceeded projections:

U.S. Oil Supply

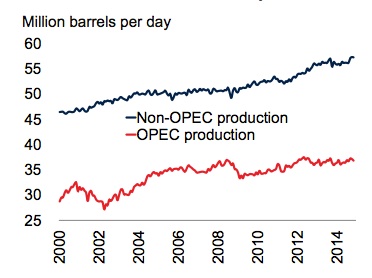

Reflecting U.S. increases in supply and OPEC’s decision not to constrain output, global oil production is up.

OPEC and Non-OPEC Oil Production

Demand Side:

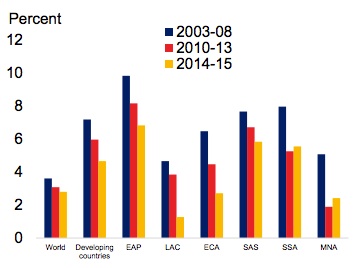

Meanwhile as world GDPs slip…

GDP Growth

World oil demand also drops:

Global Oil Demand

Also, biofuel production is rising.

Global Production of Biofuels

And, global energy use is less oil centered.

Oil Intensity of Energy Consumption and GDP

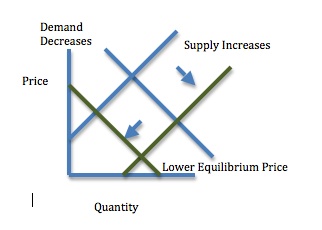

Combine more supply and less demand and you get lower prices.

Our Bottom Line: Supply and Demand

So, to tell the whole story of oil prices, our two words are WTI and Brent. Instead though, we could say, “Supply and demand.”