Reading that Argentina’s debt problems just got worse, I thought of Alexander Hamilton.

In his 1790 Report on Public Credit, Alexander Hamilton explained why it was crucial for the United States to honor its Revolutionary War debt. Governments, he said, needed to be able to borrow money for emergencies and everyday needs. Consequently, just like you and me, they have to pay back loans fully and promptly in order to borrow again at reasonable rates.

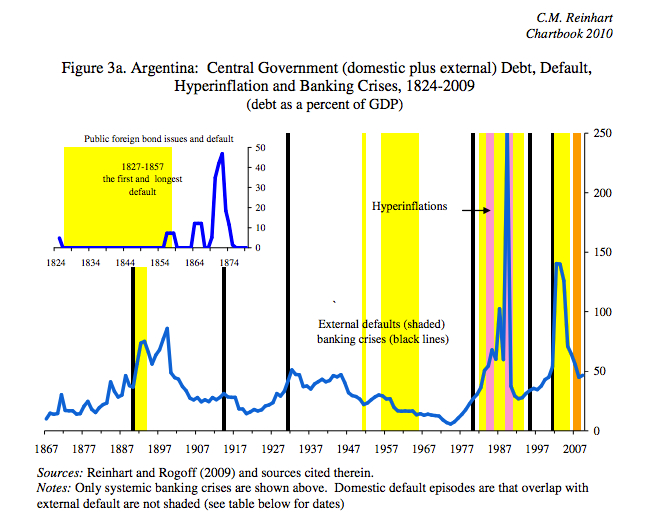

Argentina has ignored Hamilton’s wisdom:

(The yellow shading represents the number of years their debt was in default or restructured.)

Argentina’s most recent debt saga began with what scholars Rogoff and Reinhart called the lending boom of the 1990s. Enjoying an influx of dollars, Argentina borrowed and grew and prospered…for a while. But when recession hit at the end of the decade, the good times quickly unraveled.

In 2001, after Argentina defaulted on $95 billion of sovereign debt, she offered bondholders a swap. Anyone willing to take a 70% “haircut” could receive new securities that paid them 30 cents on the dollar. 93% of those who held the defaulted debt said yes while 7% were the “holdouts.” Meanwhile, some investors bought the original bonds for bargain prices.

This is where the story gets interesting. When Argentina refused to honor the holdouts’ (a group of hedge funds) bond payments, they went after Argentina’s assets. In Ghana, they were able to have an Argentine naval ship impounded for them (really!) and Argentina’s President Kirchner flew commercial to see the Pope so her private jet would not be threatened by the group.

The holdouts also went to court and won.

In its decision, a NY court said Argentina had violated the following contractual obligations that it had promised its bondholders:

- Even in default, she would pay interest and principal in full.

- NY courts would have jurisdiction over any dispute.

- The bonds would be transferable “and payable to the transferee.”

- Bonds would have the same status as other external debt.

Then last June, the Supreme Court upheld the lower court’s decision by refusing to hear the case.

And now, refusing to observe her contractual obligations to bondholders by missing a July 30th interest payment deadline, Argentina has again defaulted.

Our bottom line: As Hamilton explained more than two centuries ago, for dependable relationships between lenders and borrowers, governments need to guarantee and observe the sanctity of contracts.