We had thought that 2034 was a crisis year for Social Security.

No more.

Because of the pandemic, it could be sooner.

The Social Security Shortfall

I’ve never seen a Social Security Trustees Report with a warning about its accuracy. This year though, they tell us that their numbers do not reflect the impact of the COVID-19 pandemic.

The 2020 Report

The Report was released on April 22, 2020.

As expected, during 2034, the Old Age and Survivors Trust fund–a cushion that has had extra money–will run out. After that, whenever expenditures exceed revenue, the system has nothing to make up the difference. At that time recipients will get 76 percent of what they expected.

Traditional reasons for the shortfall have included an avalanche of baby boomers and longer lives. Now we can add the COVID-19 pandemic.

The Pandemic

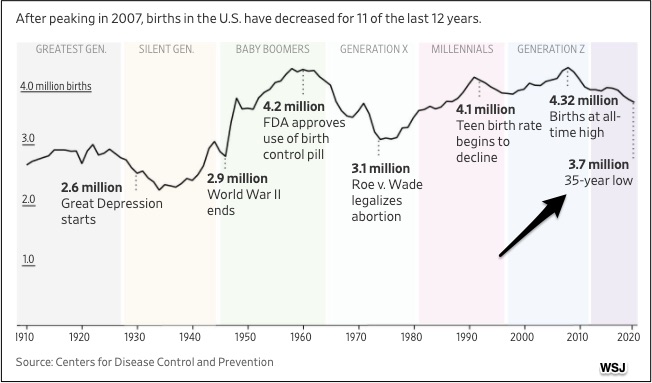

Somewhat similar to the Great Depression, the pandemic could cause a lower fertility rate. Babies are a concern because Social Security depends on pay-as-you-go through which a current worker’s payroll tax goes to today’s Social Security recipients. Fewer babies eventually mean fewer workers will fund the system.

Following a 2007 high, the number of births in the U.S. recently touched a 35-year low. Because of the pandemic, it could slide further:

To all of this we can add the cost of the pandemic. With record unemployment, we have fewer payroll tax dollars that make a bigger Social Security shortfall.

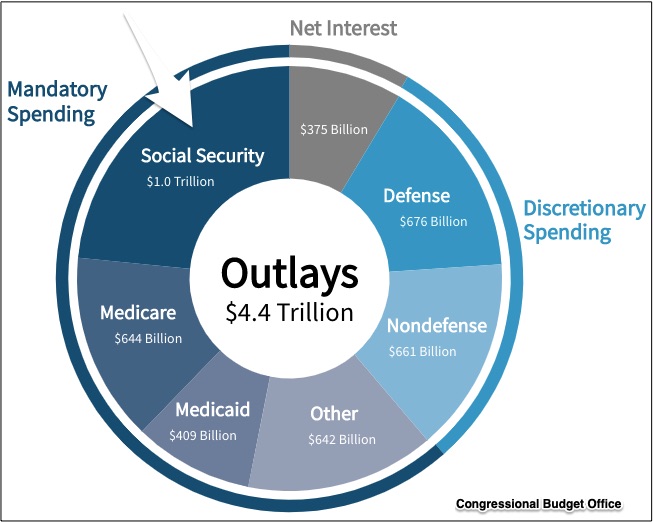

Our Bottom Line: The Federal Budget

In the federal budget, Social Security was the largest spending category. At $1 trillion, it was tough to top but coronavirus stimulus spending is more:

So, when Social Security “sneezes” the whole federal budget gets a “cold” and a 2034 illness date could be too late.

My sources and more: Together, for more facts than you might need, this 2020 Trustees Report for Social Security, this WSJ article on the plummeting birth rate, and the CBO budget summary tell the whole story.