Sort of like you and I run low on milk and bananas, a bank might not have enough coins and cash. To get a cash delivery, they can contact the Federal Reserve. They also receive currency and coin deposits from households, stores, and restaurants.

But now, the deliveries and the deposits are smaller.

And that is a problem.

Coronavirus Coin Shortages

During Fed Chairman Jay Powell’s recent Senate testimony, a Congressman from Tennessee expressed concern about coin shortages. Chairman Powell said that banks were getting a smaller amount of coins because production had declined. Like all other businesses, the U.S. Mint was responding to coronavirus constraints. In addition, the coin deposits from local merchants had shrunk by close to 50 percent. Consequently, temporarily, banks might not have the coins they need for the “reopening” from our lockdowns.

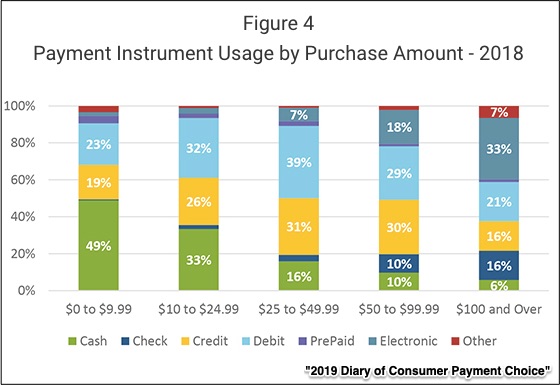

In its annual “Diary of Consumer Payments,” the Federal Reserve illustrates the lingering importance of cash. Even when we think we’ve become cashless, we are still using cash for smaller transactions:

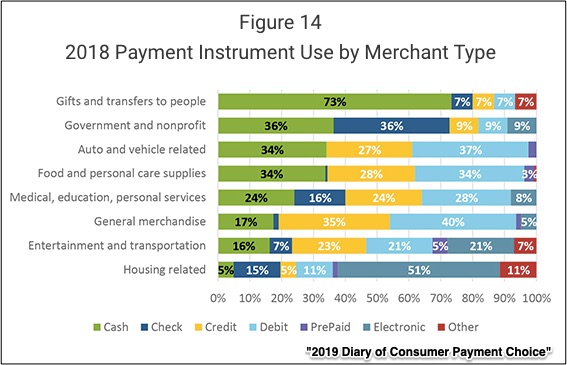

Those smaller transactions include gifts, gasoline, and gum:

Chairman Powell said that the U.S. Mint was trying to ramp up production.

Our Bottom Line: Demand for Money

Hershey tells us that we are buying fewer mints and less gum because of social distancing.

Economists would say that those mints are a part of our transactions demand for money. For smaller transactions, we use cash. For larger transactions, we need the checking accounts that are called demand deposits and the accounts that fund our debit cards.

Then, we also demand money for precautionary reasons. We have medical emergencies, our cars need repairs, and our dishwashers break. For those larger expenses, we use another component of the money supply, our savings accounts, and also demand deposits.

The third category of demand for money is speculative. That speculative category just refers to our investing in money instruments that will pay us more in the future than we paid for them. One example is the Certificates of Deposits that we buy from banks.

Returning to where we began, we can say that banks are receiving fewer coin deliveries from the U.S. Mint and smaller deposits from the vendors that sell Hershey mints.

My sources and more: Thanks to Bloomberg radio for alerting me to the coin shortage. From there I found more detail at WSJ, The Washington Post, and CNBC. Also, the Fed’s “Diary of Consumer Payment Choice” came in handy as did their FedCash Services website. But actually, the best article was about Hershey’s mint demand.

And here in Australia (where I’m from) many shops aren’t accepting notes and coins (it’s card tap payments only) because of the supposed greater risk of transmission through touch. Brings a new literal meaning to the term ‘filthy lucre’.

Here in Australia, some shops also aren’t accepting cash because they’re worried about greater virus transmission risk. So it’s tap payment by card only. Brings literal new meaning to the term ‘filthy lucre’.

Here in Australia, some shops also aren’t accepting cash because they’re worried about greater virus transmission risk. So it’s tap payment by card only. Brings literal new meaning to the term ‘filthy lucre’.

It’s just away to get rid of paper money like the government has wanted for years under the one governing law take a little away at a time let you get use to that then take more until one you are like cows and now you are fenced in for example the coin shortage is not real just stop and think about it!!! Scott

It’s just away to get rid of paper money like the government has wanted for years under the one governing law take a little away at a time let you get use to that then take more until one you are like cows and now you are fenced in for example the coin shortage is not real just stop and think about it!!! Scott