When the unexpected occurs and changes our view of stock market risk, we call it a black swan or fat tail because it is far from the mean of a bell curve.

Our Weekly Roundup: From Bank Regulation to Water Taxation

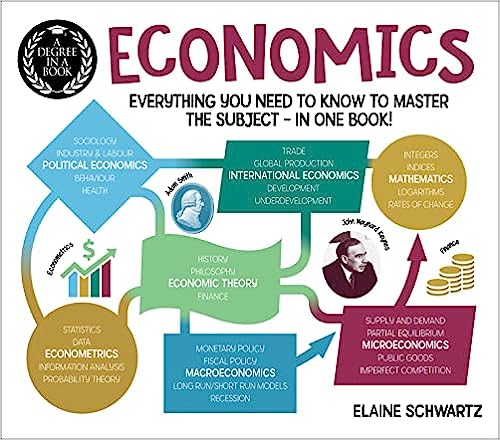

This week’s everyday economics stories included minimum wage, price floors, cost-benefit analysis, behavioral economics, financial regulation and public goods.

econlife®

Connecting economics with everyday life.

Located at the intersection of current events, history, and economics, econlife® slices away all of the layers that make economics boring and complex. We like economics and we would like for you to like it too.

Translate

Most Recent

Connecting

economics with

everyday life.

Signup for your daily slice of

econlife®.