Bitcoin and AI

Bitcoin

Five years ago, Plattsburgh, NY said, “No more.” As one of the country’s cheapest places to buy electricity, it attracted a Bitcoin mining industry that required massive computing capability (that would identify the algorithms that got them the Bitcoin). After Bitcoin miners spiked electricity demand, Plattsburgh had to buy extra high-priced power. When local residents began to complain about soaring electricity bills and annoying noise, the city proclaimed an 18-month moratorium that prohibited new miners.

Then though, seven months before its end date, the moratorium was lifted. Guaranteeing no residential rate rises from spot market purchases, the reason was Rider A. But because Rider A shifted costs to the miners, the city’s biggest mining operation moved most of its computing activity to another New York state city. Others stayed.

Globally, Bitcoin miners are attracted to pockets of cheap electricity:

AI

Somewhat similarly, according to a new paper, AI is unusually “thirsty.” Estimating that AI facilities could require somewhere between 4.2 billion and 6.6 billion cubic liters of water (equal to half of the UK’s annual demand), we can add to our list of the earth’s water worries,

As always though, the details are increasingly complex. We start simply with the water that cools the equipment. From there, local weather conditions, the water infrastructure, water efficiency, the fuel energy mix are relevant. Like a carbon footprint, we are talking about a water footprint. From there, the impact takes us to withdrawal and consumption and whether the water cycles or disappears.

Below, you can see where water enters the AI picture:

Our Bottom Line: Pigovian Taxes

As a result, governments rather than corporations could be wise to identify where and how Bitcoin and AI use resources. Then, to shape usage, Like Rider A, they could use Pigovian taxes.

Whereas electricity’s low price creates the incentive for Bitcoin miners to use a disproportionally huge amount, a tax shifts the incentives. We could also say we have a win-win situation. Whether it winds up with less consumption or more tax revenue, the municipality benefits. An economist would call the remedy a Pigovian tax.

Expressed in the new research about thirsty AI, water usage is hidden. Achieving a proper balance, especially between the expansion of AI and its resource depletion, will be tough but necessary.

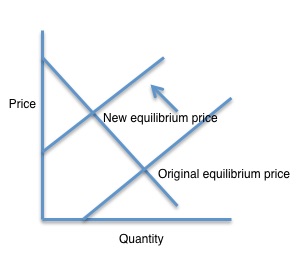

Below, I’ve drawn the traditional response of supply to a tax:

My sources and more: At econlife, we had the original Bitcoin story and then, i found this 2022 update and this excellent one also. Then, happily, a new paper provides a comparison with AI. Finally, we should add that my graphic (with 2021 data) has me a bit perplexed but it still is useful. While China banned Bitcoin mining during 2021, according to CNBC, it still thrives.

Please note that several of today’s sentences were in a previous econlife post. Also, post publication, I improved clarity and accuracy with some editing.