According to Warren Buffett, “You don’t find out who’s been swimming naked until the tide goes out.” Now 30 years after Mr. Buffett’s comment, the receding tide revealed major problems at a slew of banks.

Many of us know the big picture.

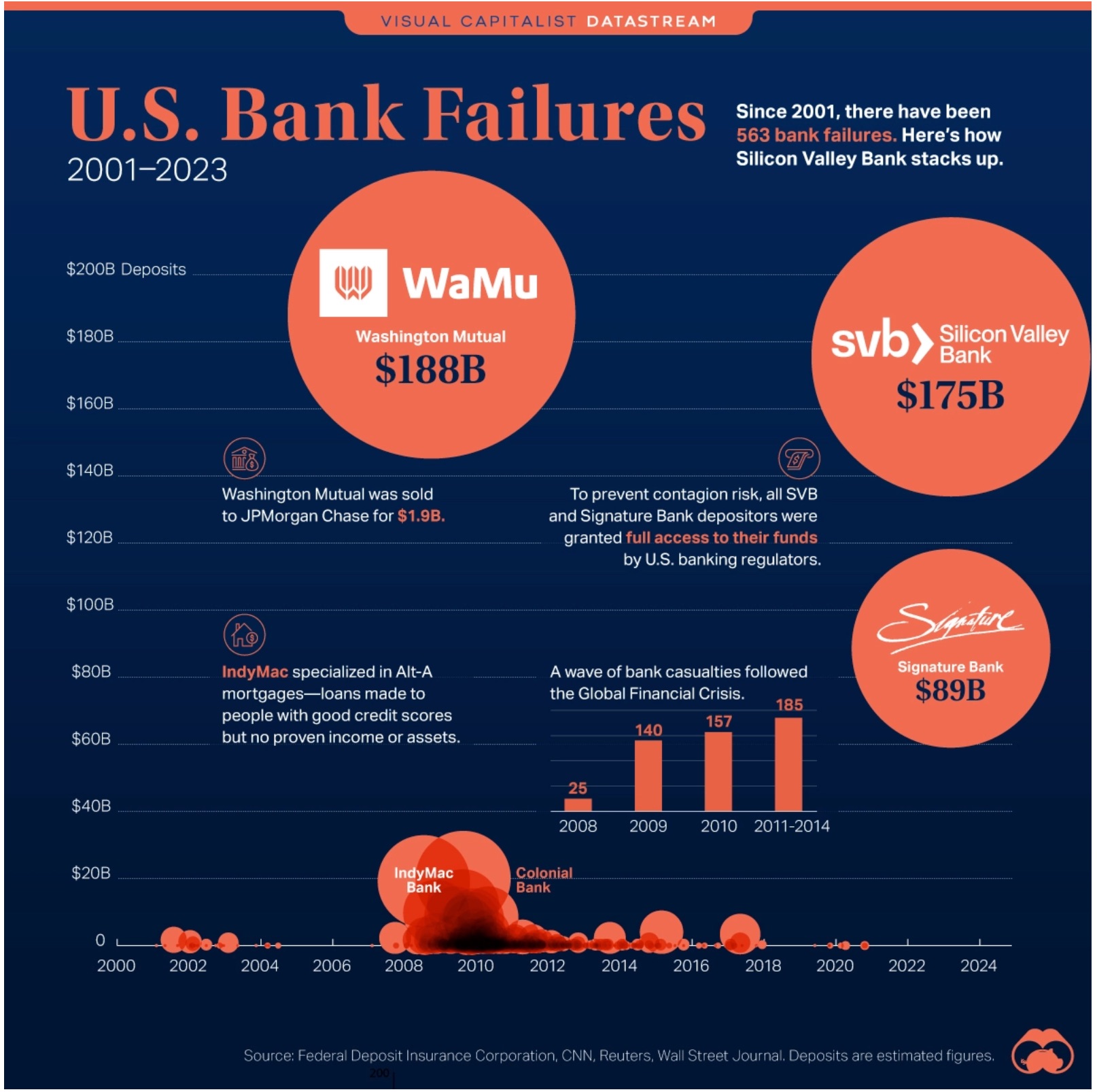

After a classic bank run, regulators took over Silicon Valley Bank. Next, Signature Bank had a similar fate while First Republic received life support. And then, beyond regional territory, Credit Suisse, a big 30 bank, needed a take over.

But let’s look at some of the smaller facts.

Bank Failure Facts

Swiftly sliding into the #2 bank failure slot behind WaMu (Washington Mutual), SVB’s collapse was also notable for its speed. Whereas WaMu’s $16 billion bank run lasted 10 days, at SVB, it took one day for $42 billion to depart. Furthermore, at SVB, there were relatively fewer depositors with larger accounts. (Bloomberg called WaMu the Walmart of financial institutions while SVB focused on startups.)

According to financial journalist Felix Salmon, startup executives had neither the time nor the inclination to relocate the millions to where they could earn more money. One said during a podcast interview that because the service at SVB was supreme, he did not try to earn more elsewhere.

Also, you might be wondering how the FDIC could legally ignore the $250,000 deposit insurance cap. It turnes our that the legislation lets them make an exception. However, to remove or change the cap for everyone, they need a revised law. Still, even with SVB an FDIC “exception,” they closed the bank and moved deposits to SVB Bridge bank.

And finally, we end with 9 zeros. As of this past weekend, the Fed lent a colossal $153,000,000,000 to banks from its emergency window.

Our Bottom Line: Too Big To Fail

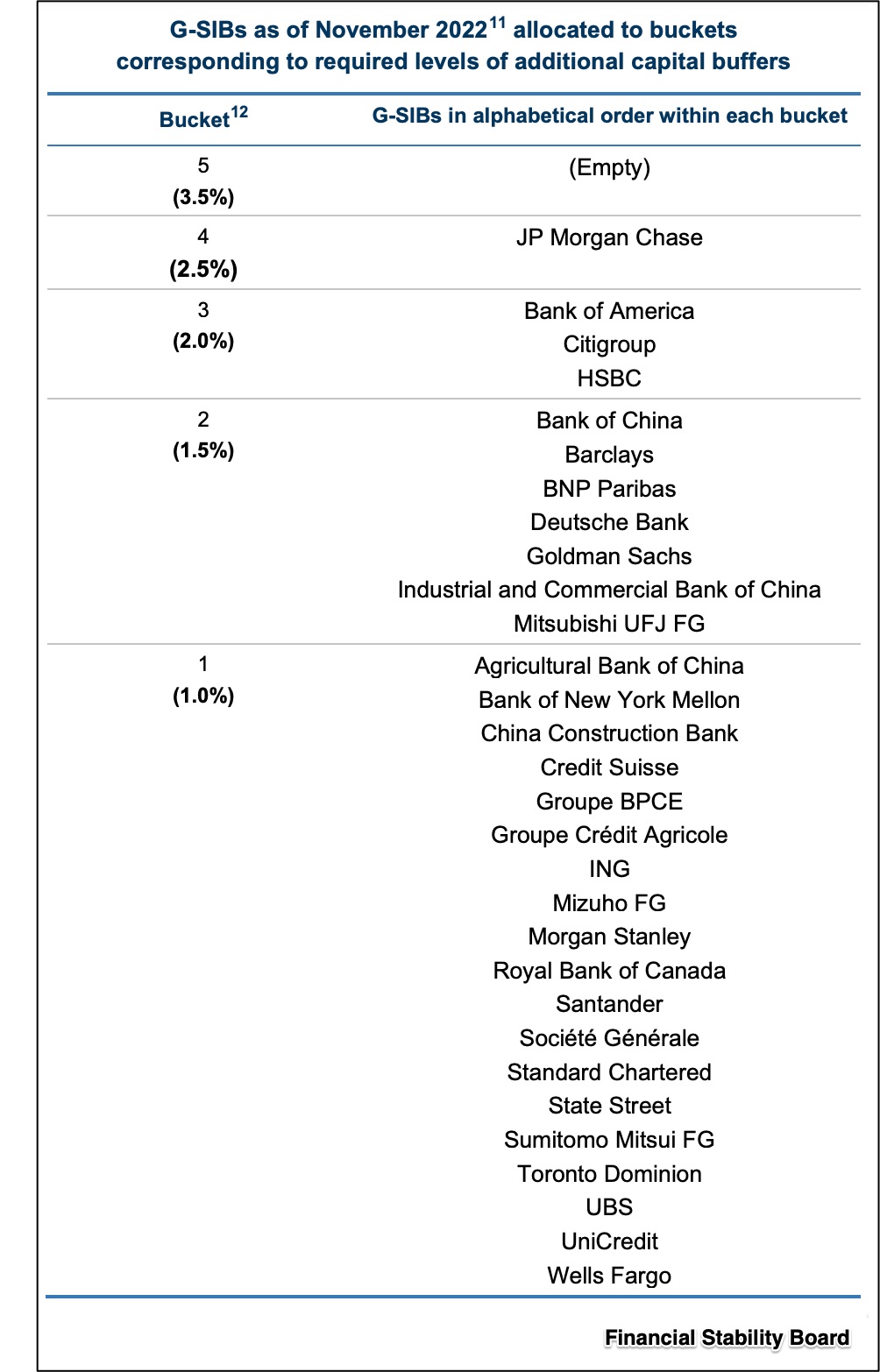

Different from the regional banks that failed, Credit Suisse was in an elite category. It was listed among the 30 financial institutions on the G-SIBs (Global Systemically Important Banks) list. Knowing that firms on a Too Big To Fail list had the incentive to engage in risky behavior, using buckets, regulators added to the capital requirements that were supposed to counteract their temptations.

The banks that have G-SIB status are based in the U.S., Europe, and Asia:

With UBS acquiring Credit Suisse, we are down to 29.

My sources and more: Warren Buffett actually was referring to reinsurance when he said his swimming quote during 1994. Then, wondering who had “to swim” conservatively, I looked up the Too Big To Fail List at the Financial Stability Board. But fundamentally, my inspiration for today’s post came from the smaller but enticing facts I learned from the Saturday Slate Money podcast. And finally, I should add but did not focus on Barney Frank’s current plight as a (former?) member of the board of the failed Signature Bank and the sponsor of Dodd-Frank legislation that increased bank oversight. The New Yorker Magazine describes the specific situation and larger dilemmas that regulators have when deciding whether to serve on bank baords.