Where Mackerel Is Money

November 29, 2023

How Cost Can Change Climate Policy

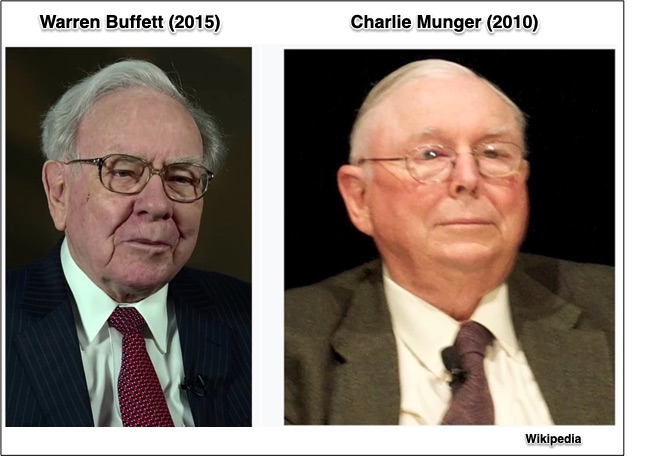

December 1, 2023Talking about Berkshire Hathaway, we usually focus on legendary investor Warren Buffett. Publicly, his partner Charlie Munger (January 1, 1924-November 28, 2023), gave him the spotlight. Privately though, the two (reputedly) were equals.

Through recent WSJ articles, we can learn about and from Charlie Munger. Finally though, we can wind up with some behavioral economics wisdom.

Charlie Munger: Stock Picking

Charlie Munger met Warren Buffett at a dinner party in 1959 in Omaha. Initially friends, they started to work together at Buffett’s Berkshire Hathaway in 1978. Since then, the S&P 500 was up 16,427%. Much more, at 400,000%, $100 invested in Berkshire Hathaway 45 years ago would have ballooned to a whopping $396,282 today:

Explaining what he learned from Munger, Warren Buffett said, “Forget what you know about buying fair businesses at wonderful prices; instead buy wonderful businesses at fair prices. Munger added that during the 40 years between the 1930s and 1970s, it made sense to be sure that assets per share value far exceeded stock market per share value. Then, you wait for the price to rise and you sell. Selecting low-hanging fruit or “loaded laggards,” those “cheap” stocks underpinned a successful investing philosophy.

Today, though, Charlie Munger said it’s different because those underpriced companies had to be high quality. Agreeing in 2015, Buffett said, “Charlie had been urging this course for some years, but I was a slow learner.”

Both also agree that stock picking is not for most of us. While at Berkshire’s shareholder meetings and beyond, Warren Buffett said his heirs should invest in index funds, we rarely heard Charlie Munger expressing the same advice. And yet, echoing Buffett, Munger also reminds us that, like we don’t design our own egg beaters or electric motors, we lack the expertise to select stocks.

Charlie Munger: Quotes

Perhaps though these quotes sum up his message:

In 2000, about iuvesting in speculative internet stocks:

- “if you mix raisins with turds, they’re still turds.”

Setting executive pay:

- “Well, I would rather throw a viper down my shirtfront than hire a compensation consultant.”

On cryptocurrencies:

- “a gambling contract with a nearly 100% edge for the house.”

Emphasizing assiduity:

- he said it means “sit down on your ass until you do it.”

With equanimity as a complement:

- he also advised acceptance of 50% losses every couple of decades.

And finally, having little to do with investing, he was asked for what he was most grateful:

“My second wife’s first husband…I had the ungrudging love of this magnificent woman for 60 years simply by being a somewhat less awful husband than he was.”

Our Bottom Line: Behavioral Economics

Many behavioral economic ideas explain our investing tendencies. Ranging from confirmation bias to reference points, they can all determine what we buy and when. However, probability neglect is the one concept that stands out.

The behavioral economics idea of probability neglect explains why we ignore reality. Somewhat irrationally, we pay no attention to the 1 in 292,201,338 chance of winning because it makes us feel so much better. In addition, our personal response to an event matters. When a terrorist event becomes more vivid, for example, we imagine more of a probability that it will happen.

Similarly, Seeing the S&P or Dow skid downward, typical investors respond emotionally and sell. They ignore the probability—a statistical reality—that markets in the long run have provided consistent returns.

The average S&P 500 return for 2012 to 2021 was 14.8%. However, the trajectory was not consistently up:

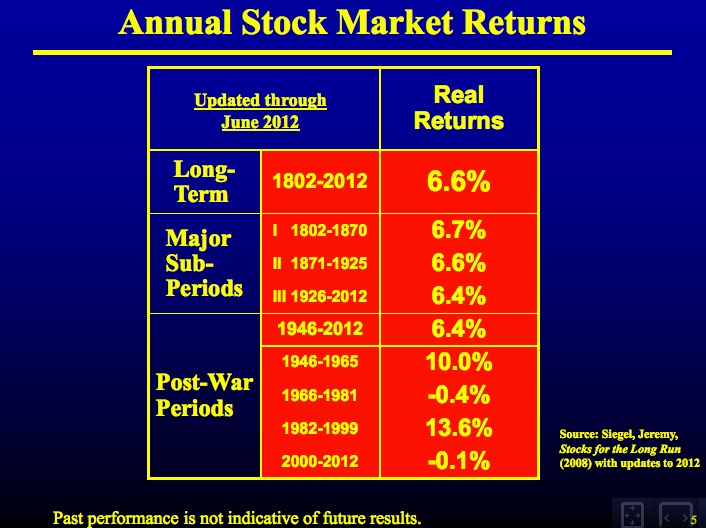

Looking further back, through Wharton Professor Jeremy Siegal’s calculations, we see similar trends:

Charlie Munger’s wisdom is all about avoiding probability neglect.

My sources and more: Our facts came from a plethora of articles before and after Mr. Munger’s death. They included Yahoo Finance for his early history and two WSJ articles, here and here, and FT. Meanwhile, Business Insider had Berkshire’s price history. Then, for even more on Munger, you could read Poor Charlie’s Almanack, and, for stock market performance, Motley Fool.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)