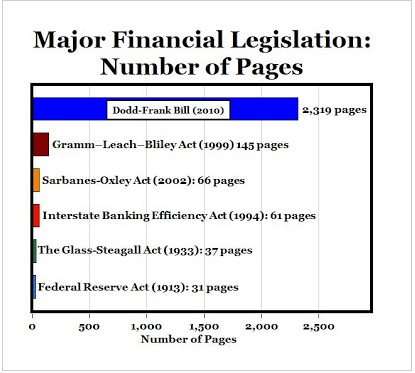

It’s been more than four years since Dodd-Frank was passed. Composed of 2,300 pages, the Act is supposed to prevent a repeat of the 2007-2009 financial crisis by increasing financial stability. The problem, though, is that Dodd-Frank describes 398 rule making requirements. The next step was to make those rules.

So, how are we doing?

Let’s start with two words and four categories that can describe the over all purpose of the legislation:

The Words:

- Risk: Lawmakers wanted to manage the impact of the risks taken by financial institutions.

- Protection: Lawmakers hoped to protect consumers from making unwise financial decisions.

The Categories:

- Government: Its powers are multiplying.

- Banks: Financial firms are experiencing new trading restrictions and capital requirements.

- Consumers: A new bureau to protect consumers has been established.

- Investors: Different investing groups such as hedge funds, people who give investment advice, insurance companies, and those who create securities packages have new constraints.

Dodd-Frank Rule-Making Progress

Next, we can go to (law firm) Davis Polk’s monthly Dodd-Frank progress report. Looking at rule making in selected areas, you could say that banking regulators have made the most headway:

Dodd-Frank Economic Impact

Switching our perspective to Dodd-Frank’s success, we can refer to a Brooking Institution analysis that conveys a mixed review. Their “wins” primarily involve banks and consumers.

A Mayor Michael Bloomberg Opinion

And finally, the last word from Mayor Bloomberg. Summarizing his opinion of Dodd-Frank with one word–dysfunctional–former Mayor Michael Bloomberg added, “What happens is every little group in Congress has to add something to that bill in return for their votes, and a lot of those things are just mutually exclusive. Years later now we don’t have the regulations that are required and complying with it is just really impossible.”

Our Bottom Line: Unintended Consequences

Compared to other financial regulation, Dodd-Frank is long. When you have a 2300 page law that, a year ago, had almost 14,000 pages of rules and they were below the halfway mark, I become concerned with unintended consequences. Faced with higher costs when they comply with legislation, they have already begun to charge us more.