It’s the seventh extension.

On May 1, a new four month federal (and some private) student loan pause kicked in. That means no loans, no interest payments, no defaults. In addition, a fresh start is a possibility for certain people who are in default.

To see if permanent cancellation makes sense, we can take a look at some of the issues.

The Student Loan Debate

Federal spending

Loan forgiveness initiatives are expensive. At the low end, eliminating $10,000 in loans would cost us $373 billion. Then, moving to the high end, we would spend $1.6 trillion erasing all debt. And, in the “middle,” the price tag is close to $1 trillion for the $50,000 alternative.

To see how expensive, we can do some comparing. In the 2020 budget, Social Security spending was $1.1 trillion, Medicare was at $769 billion and defense, $714 billion.

Compared to other income support programs, the expense would be staggering:

We also can ask about the impact of injecting a new household spending incentive. Without the weight of student loan debt, 41 million borrowers will have more money to spend or save. With more dollars chasing goods and services, forgiveness could fuel the inflation that the Fed is trying to reverse.

Minorities

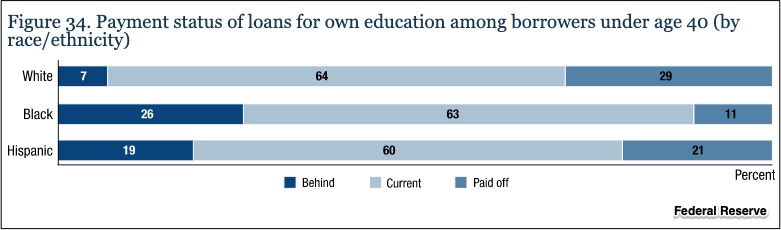

On the plus side, erasing student loan debt would help fight the battle against income inequality. As a massive redistribution initiative, it would eliminate a burden that is heaviest for women, households of color, and younger individuals. If the pause is lifted, a 15.5 percent delinquency rate will especially hit younger borrowers, people with lower credit scores, and those with less income. It will affect more women than men, more people who did not complete college, and more non-white individuals.

We should note that Brookings believes any student loan forgiveness should be income driven. According to their calculations, higher income households would disproportionately benefit. They point out that student loan borrowers “are more likely to be white and better educated.”

This graphic sums up some of the racial and ethnic disparities:

Our Bottom Line: Opportunity Cost

As economists we should always look at the opportunity cost of a decision. Defined as the best sacrificed alternative, the opportunity cost of a decision comes with a list of benefits as does what was chosen. We could fill in the following table:

But I did not fill it in because it is so very complicated. As we have said in the past, issues like these take us to the British coastline. From afar it looks like an unbroken curving line. When we look closely, though, it becomes infinite.

My sources and more: As always, the NY Fed’s Liberty Street Economics has a treasure trove of facts on student loans while Brookings has the fiscal perspective. However, if you want a summary (and the source of our featured image), the NY Times is a possibility.