The Paradox That Automation Creates

July 6, 2015

The Impact of Japan’s Aging Population

July 8, 2015Most of us dislike property taxes. In New Jersey, we have a law that limits annual property tax hikes to two percent. And yet still, according to WalletHub, New Jersey has the highest property taxes in the country. Consequently, New Jersey politicians always seem to be promising they will lower them.

Where are we going? To why NJ politicians are wrong about property taxes.

You can see below, that as Number 51, New Jersey is the highest property tax state in the U.S. Other light colored states, including Illinois, New Hampshire, Wisconsin and Texas are high property taxers.

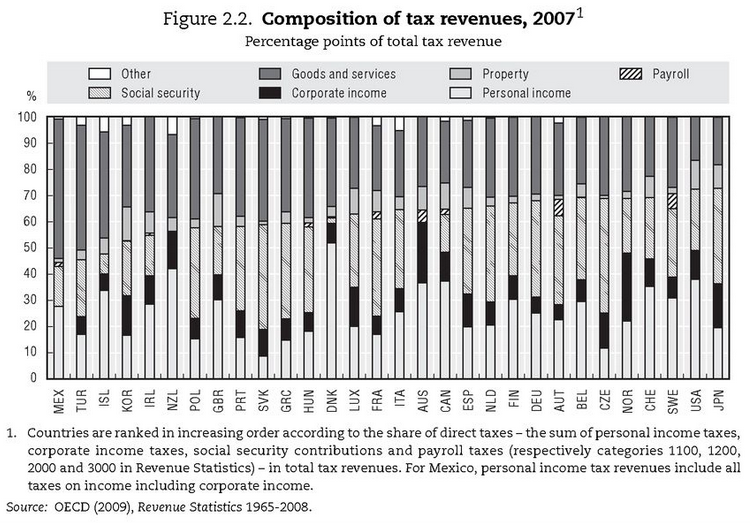

The World’s Property Taxes

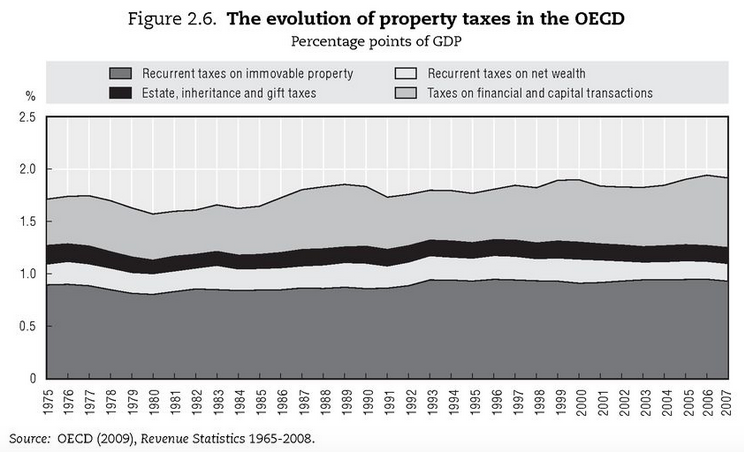

Among developed nations, the property tax has been a remarkably consistent source of revenue.

Below, country by country, you can see the relative property tax burden. As an OECD average, property taxes total close to 6 percent of tax revenue.

Our Bottom Line: Property Tax Plusses

Taxes influence how hard we work, how much we save, and where we spend. The incentives that accompany individual and corporate income taxes can affect how much we want to work and where businesses locate their facilities. Sales taxes can constrain purchases and might send buyers online, away from local stores.

By contrast, the property tax has the “least drag” on GDP and is tough to avoid. Several steps away from production, its incentives relate instead to where we live and the services our towns provide.

So, it might be wise for New Jersey to embrace its property taxes.

And finally, all we said about property taxes might not be as accurate for Greece. In 2010, the NY Times told us that out of the 16,974 pools that satellite photos revealed in one affluent Athens suburb, only 324 homeowners declared them for their property taxes.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)