Why Italy Is Selling Some Palazzos

August 11, 2019

The Downside of Vegan Leather

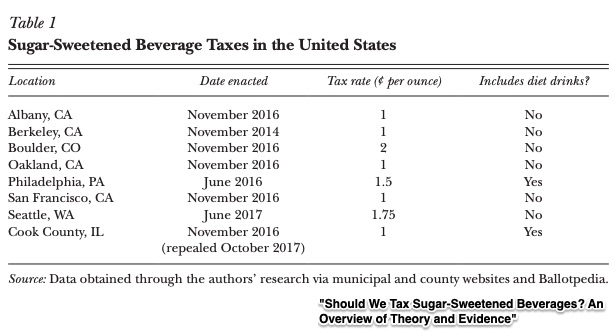

August 13, 2019Ranging from chocolate milk to soda, sugary drinks are currently taxed in seven U.S. cities. Sometimes diet drinks are included.

These are the cities:

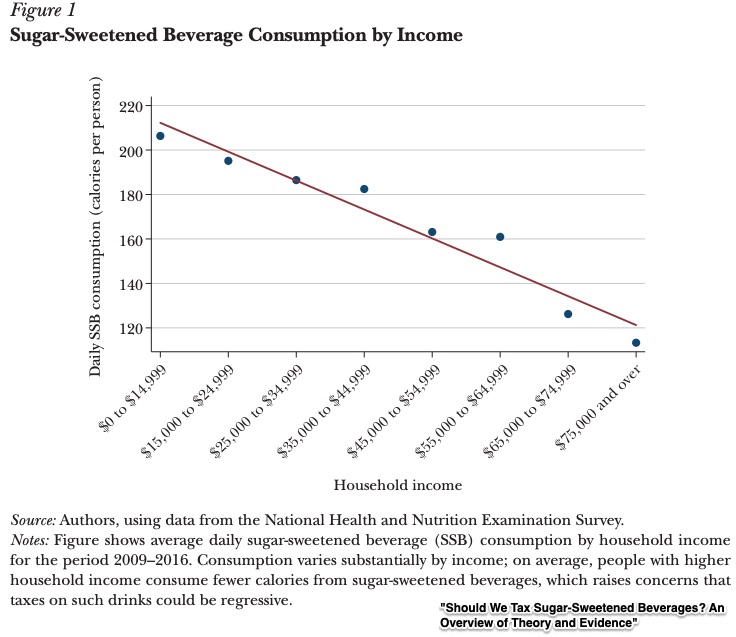

Supporters say sugary drink taxes generate municipal revenue and encourage healthy eating habits. Meanwhile, opponents are concerned with a paternalistic government policy that disproportionately affects low income households.

These are the lower income households that are most affected by the tax:

From here it gets more complicated.

A typical sugary drink tax starts with distributors who then pass all or a part of it to retailers. Some stores include the tax in the labeled price while others charge it at the register. At this point, the impact on the consumer varies. It depends on household income and whether a nearby community has also levied the tax. It is also possible that individuals will substitute non-taxed sugary items for the ones they stopped buying. We can even ask if stores have to close because of diminished sales.

So yes, Berkeley and Boulder and Philadelphia report different results based on different metrics. After all, Berkeley had a penny per ounce tax while Boulder’s was two cents an ounce and Philadelphia was in the middle with 1.5 cents.

With so many variables, how can we decide if the tax is a good one?

Our Bottom Line: Internalities and Externalities

In the newest issue of the Journal of Economic Perspectives, several economists suggest we can start by considering internalities and externalities. Simple stated they just mean looking at how sugary drink consumption affects individuals (alone) and everyone (together).

Individuals

Called an internality because people bear the cost of their own consumption decisions, here we have “time-inconsistency” issues. Many of us prefer the short term pleasure of a sugary drink rather than the long term benefit that restraint provides. Taxes could nudge people toward the long-term benefit.

Everyone

Defined as the impact on uninvolved third parties, the negative externalities related to excessive sugary drink consumption affect everyone’s healthcare costs by increasing the incidence of weight gain, type 2 diabetes, and cardiovascular disease. But also we can generate positive externalities by spending tax revenue on programs that assist populations most affected by sugary drink consumption.

Where does all of this leave us? I always like to return to Benoit Mandelbrot. As the mathematician who told us that the length of the British coast is infinite, he said that when you see it from a distance, it appears to be an unbroken measurable line. However, the closer you look, the longer it gets. There are small inlets that have tinier indents. They go on forever, getting smaller and smaller.

A sugary drink tax is similar. The closer we look, the more we see.

My sources and more: The Journal of Economic Perspectives has the most up-to-date analysis of sugary drink taxes. From there, the perfect complement was this paper’s look at the Boulder tax.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)