The Unintended Consequences of Daylight Saving Time

November 3, 2014

Some Warren Buffett Investing Wisdom

November 5, 2014Sometimes countries take longer than we might expect to pay back a debt.

Like the United States…

Perpetual Bonds

Faced with a federal debt from the Revolutionary War that the country could not afford, in 1790, Secretary of the Treasury Alexander Hamilton had to figure out how to avoid defaulting. His solution was to delay some interest and principal payments by funding most of the debt. The funding involved immediately covering our obligations to the French, Dutch and Spanish who had loaned us money. Meanwhile though, domestic bondholders had a menu of choices Including new bonds that were redeemable at the government’s discretion, annuities and even western lands valued at 20 cents an acre. With no maturity date, some of those bonds were not retired until 1835, the only year the U.S. government has had no debt.

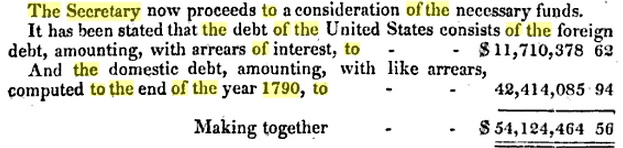

As you can see below, the amount owed was daunting. It is amazing that Hamilton not only funded the federal debt but created a credit worthy United States.

From: Hamilton’s Report on the Public Credit

It took the United States 45 years to completely retire its Revolutionary War debt. Creating perpetual bonds, the British government has taken much longer.

Just now, the British government said it will repay some—not all—of its National (First World) War Bonds sold in 1917 and refinanced by selling new securities (like Hamilton’s) that became “perpetual bonds” because they had no redemption date. Set at 3.5 percent, the interest has been paid since their inception.

But the story gets better.

Those bonds, though, were really perpetual. Some of them refinanced debt that dates back to the South Sea Bubble fiasco in 1720. Rather than describing a complicated financial tale, we can just say that the British government took over some of the obligations of the South Sea Company and has been paying interest on perpetual bonds ever since.

Our Bottom Line: The Value of Good Credit

Perpetual debt does not matter if the financial world knows you have good credit.

In 2011, the United States’s S&P Triple A credit rating on long-term sovereign credit was reduced to AA+. As for Great Britain’s perpetual bonds, having sustained interest payments for centuries surely supports their “top notch” S&P Triple-A credit rating.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)