Sometimes we are guilty of probability neglect.

Coined by Harvard law professor Cass Sunstein, probability neglect just means our concern that a catastrophe will occur can be way out of proportion when we consider its likelihood.

Where are we going? To the excessive cost that probability neglect can generate.

Warren Buffett’s Investment Advice

Looking back at 2013 in his Letter to the Shareholders of Berkshire Hathaway, Warren Buffett gave some “when I die” investing advice. Referring to his wife, but really to all of us, he said the trustee overseeing her money should, “Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors—whether pension funds, institutions or individuals—who employ high-fee managers.”

Mr. Buffett’s wisdom is all about avoiding probability neglect. Seeing the S&P or Dow skid downward, typical investors respond emotionally and sell. They ignore the probability—a statistical reality—that markets in the long run have provided consistent returns. By compelling the Trustee to remain in the index fund, he is precluding the possibility of probability neglect when the market plunges.

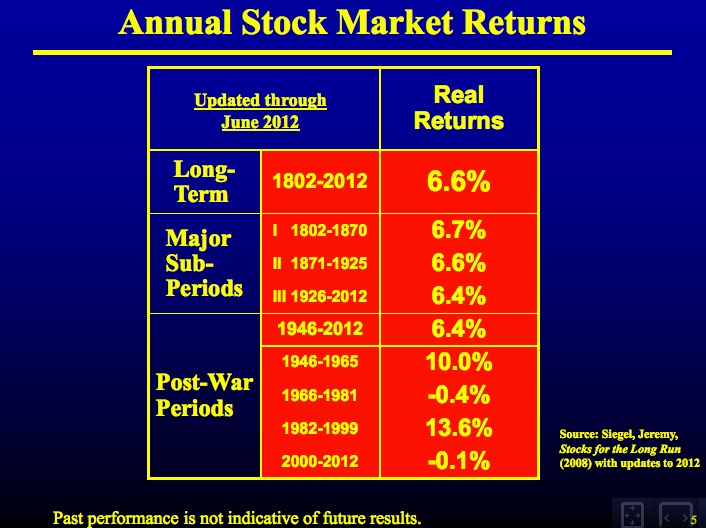

Wharton Professor Jeremy Siegal has done research on long-term stock market returns:

Our Bottom Line: The Prevalence of Probability Neglect

Evident in our investing behavior, in the resources we allocate to homeland security, and in our Ebola response, probability neglect surfaces whenever our emotions prevent a logical cognitive response. The result? Our cost/benefit analysis is skewed.