Our Weekly Roundup: From Tipping to Startup Airlines

August 16, 2014

Do You Want a Healthcare Nudge?

August 18, 2014Our Sunday Charts

For the most recent data on the EU 28, the real GDP growth rate is .2%, the overall unemployment rate is 11.5% and government debt averages 88%.

Not so good.

As aways, though, the averages can be misleading. So let’s look a bit more closely.

The Charts

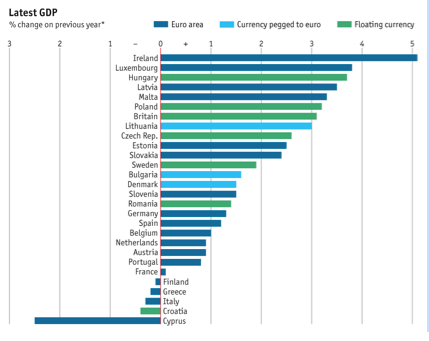

Considering the growth rates of different countries, Greece, Italy and Cyprus have a contracting GDP.

From: Graphic Detail, The Economist

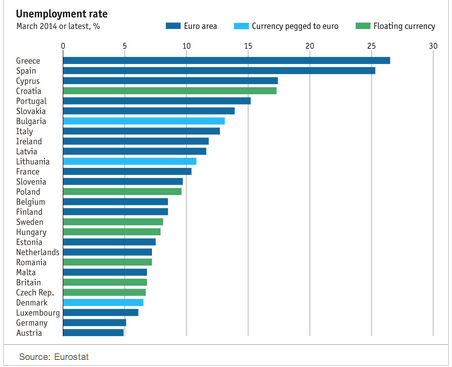

Similarly, for unemployment, Greece, Italy and Cyrus are close to the top of the list.

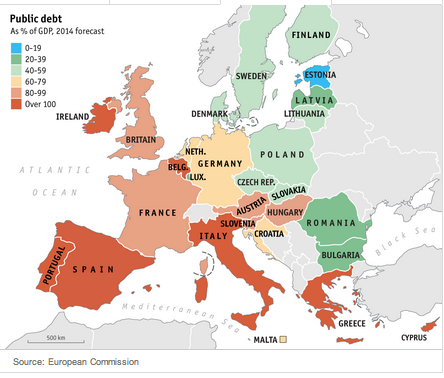

Finally, for the relative size of their public debt, Greece, Italy and Cyprus borrowed a disproportionate amount when we compare their loans to GDP.

Why compare debt to GDP?

Just think of a home mortgage to grasp why we compare debt to GDP. Someone who earns $50,000 a year—sort of comparable to GDP as national income—should not borrow $1 million. However, a household with an annual income of $5 million can afford a $1 million loan.

The Bottom 3 and The Bottom Line

Because of ongoing problems, I selected Greece, Cyprus and Italy as the bottom 3. We should add, though, that Germany’s GDP contracted and France’s stagnated during the past quarter.

Our bottom line: When you have disparate rates of economic growth, unemployment and debt, for the 18 countries in the euro zone, the separation of monetary and fiscal power is problematic. Consequently, Greece, Italy, and Cyprus have less control over their economic difficulties.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)