How To Make Kids Smarter

July 30, 2019

Why a Safety Net Should Catch Kids

August 1, 2019Our nation’s tart cherry bowl is located four hours northwest of Detroit. Growing two thirds of the nation’s tart cherries, Michigan’s tart cherry farmers are engaged in a price war.

WSJ says Turkey is their adversary. But the battle is much bigger.

Tart Cherry Prices

During the past four years, Turkey has geometrically increased its tart cherry exports to the U.S. Climbing annually from 200,000 pounds in 2015, the 2018 total is 1.5 million pounds. This year, by the end of February, the number entering the U.S. had surpassed one half million.

The big problem is price. Because of the Turkish government’s support, the price per pound for Turkish tart cherries has been 89 cents. Far more, U.S. cherry processors have been receiving $4.60 (while the farmers, at $.30/pound or so, get much less). So the processors asked the U.S. International Trade Commission to rule that they’ve been harmed and deserve a 628.9% tariff.

Some History

But the industry has always had price problems. Tart cherries are particularly vulnerable to the weather. The industry is plagued by a big crop one year and a small one during the next. Dried cherries face competition from other commodities. They have no support from a big processor.

Responding, the industry has sought to control the market. They’ve gotten a small tariff on Turkish tart cherry juice and federal marketing orders that permit them to manipulate volume through marketing strategies. The federal government just said it would do a repeat $15 million tart cherry purchase for federal assistance programs. Based on the Agricultural Marketing Agreement Act of 1937, tart cherry farmers can sidestep antitrust regulation. They can accumulate a cherry reserve that is released when there is less supply and withheld when there is more.

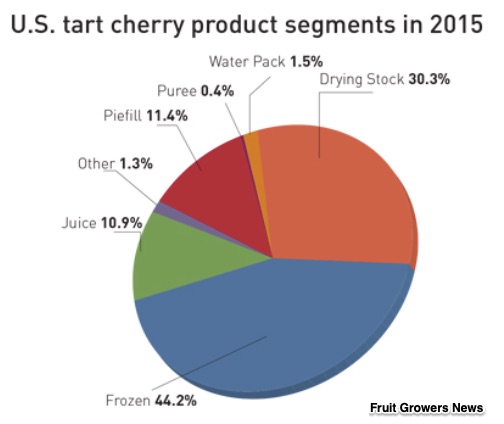

You can see where the tart cherry crop goes:

Our Bottom Line: Tart Cherry Markets

The big question is the role of government.

Tart cherry processors and growers have more to cope with than Turkey. We can ask if we want to perpetuate an industry that cannot survive the vagaries of the market. If the answer is yes, then a 600% tariff, a cherry reserve, and U.S. government subsidies are okay.

Your opinion?

My sources and more: WSJ alerted me to the possibility of a tart cherry tariff. From there, the Detroit News gave more insight about tart cherry prices. But the fascinating part was this Fruit Growers News report and the USDA’s market controls.

This post was edited after publication. I thank tart cherry grower Kathy Morrison for correcting my incorrect pricing facts.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)

4 Comments

I am a Michigan tart cherry grower and never in the history of our 150 year old farm have we gotten the $4.60 a pound that your article states. We are feeling very lucky when we get 30 cents per pound because usually it is 25 cents or less per pound. I have no idea where your tart cherry price figures came from but they are way, way off the mark.

Kathy, thanks so much for letting me know. I got my price information from the Wall Street Journal. I wonder if I misunderstood their information. This is an excerpt from the article that I linked in my post:

“Turkish imports of tart dried cherries have nearly doubled annually over the last three years to 1.5 million pounds in 2018, selling at 89 cents a pound. U.S. processors sell the same product for about $4.60 a pound, according to data from USDA.”

Just as the price a cotton farmer gets per pound is far, far less than what is made on a finished product, like a cotton blanket, the price a fruit grower gets versus a fruit processor, is far different. The prices you used are likely the price for a finished, processed product (dried tart cherries). It in no way represents what the tart cherry grower makes per pound which is in the 10-30 cent range. Big difference between the grower and the processor.

I thank you for the accurate prices. I corrected the post.