First, some background…

As a pay-as-you-go program, Social Security is primarily financed by taxes paid by today’s workers. No, our own money is not saved and then returned to us. Instead, (oversimplifying) we can just say it is a money transfer that goes from the young to the old.

We should add that money also comes from several trust funds. The trust funds get more money whenever revenue exceeds spending while money is withdrawn if revenue is inadequate. The extra money? It is invested in U.S. government securities that pay interest. Those securities are sold if a Social Security Trust Fund needs more cash.

The Facts:

1. 2021

Until 2021 Social Security tax revenue plus interest income from treasuries will exceed expenditures. Consequently, the system will have a total surplus.

2. 2034

In 2034, the trust funds will reach zero. The reason? Between 2021 and 2034, the system won’t have enough tax revenue and interest income. To make up the shortfall, it will have to use up the Social Security Trust Funds.

3. 2091

From 2034 until 2091, beneficiaries will receive between 73% and 77% of scheduled benefits. For a whopping 75 years, the system will need 20% more revenue to meet its payment obligations.

4. 94%

94% of all workers pay the Social Security payroll tax.

5. 62 million

There are nearly 62 million beneficiaries who receive an average monthly payment of $1258. Among those beneficiaries, 83% are retired or disabled. The remaining 17% are family members.

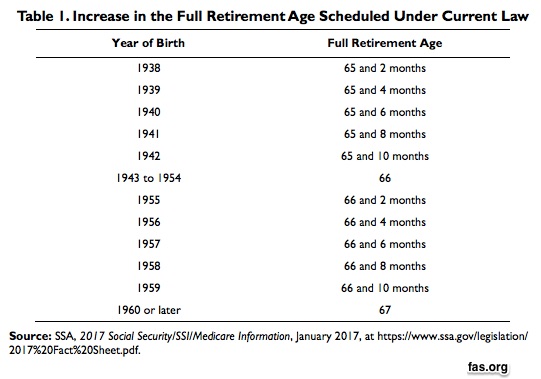

6. FRA

FRA (Full Retirement Age) is going up. People born in 1960 will need to wait until 2027 to get their full benefit. They could start at age 62 but then they will get less.

Our Bottom Line: Congressional Opportunity Cost

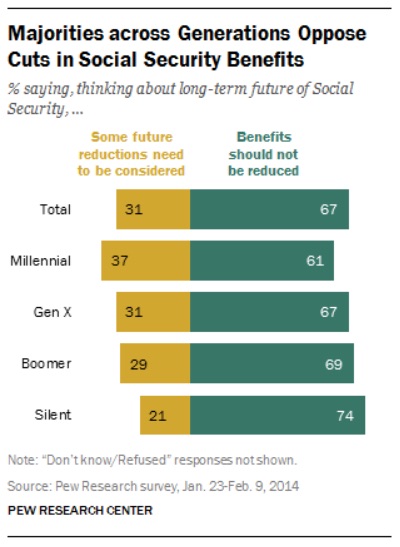

While the Congressional Research Services projects Social Security deficits, the Congress has not focused on them. This survey from Pew tells us why:

As economists, opportunity cost always provides some handy insight. Defined as the next best alternative, the opportunity cost of ignoring the Social Security problem is too high. It would involve raising taxes or lowering benefits.

So why not wait until 2034?

My sources and more: Always the place to get facts, the Congressional Research Service had a Social Security primer. Then Pew’s survey was the ideal complement.

Please note that the beginning of this post was published in a past econlife.