A Marijuana Branding Problem

January 15, 2017

Some Sweet (Drink) News From Government

January 17, 2017In Kenya, the absence of a banking network meant people saved less. Transporting money to far off family members who needed cash, they wasted time and worried about robberies on buses.

Where are we going? To the benefits of mobile banking.

Kenya’s M-PESA

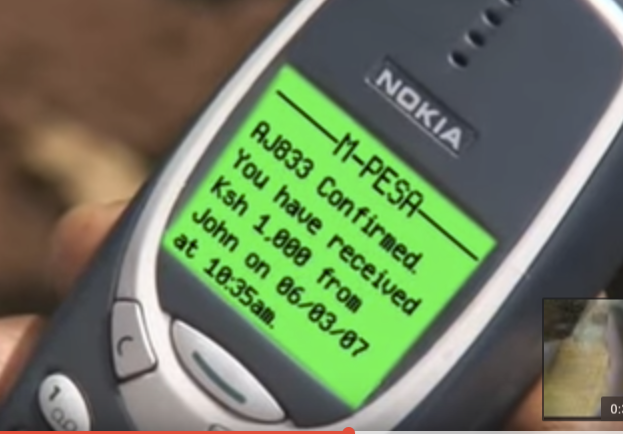

In 2007, M-PESA came to Kenya. A banking system that was cell phone based, M-PESA just means mobile banking. (The M is for mobile and PESA means money in Swahili.) After subscribers give a deposit to a local agent, the cash becomes spendable and sendable.

One gentleman tells of spending his weekly part time pay on sweets until he had M-PESA. Saving $215, he moved to Nairobi and got a better paying job in construction. Because M-PESA made it easy for him to send money to his wife in their village, she soon bought two goats which turned into five. His next goal is cows and a milk business… And maybe college one day.

Below, an M-PESA ad explains how it works.

The M-PESA Impact

In a country with a limited banking and ATM network, M-PESA is the model that makes sense. Used by someone in almost all of Kenya’s households, it has changed financial behavior. Researchers specifically point out though that women have been empowered by M-PESA money that they alone can control.

Our Bottom Line: Financial Infrastructure

Like a heart pumping blood that carries nutrients, a banking network sends money around an economy. In the U.S., we started with the National Bank that Alexander Hamilton proposed during the 1790s. By the end of the 19th century, we had a commercial and investment banking system that moved money throughout the country.

With M-PESA, Kenya has taken a shortcut.

My sources and more: The Wall Street Journal and NPR had some insight about Kenya’s M-PESA that took me to Science Magazine and an MIT study. But for a good basic explanation of how the system works, this Economist article was ideal.

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)