What We Can Learn From Firewood

July 28, 2025

Why We Could Need 70,000 Bugs and 150 Million Pounds of Beet Juice

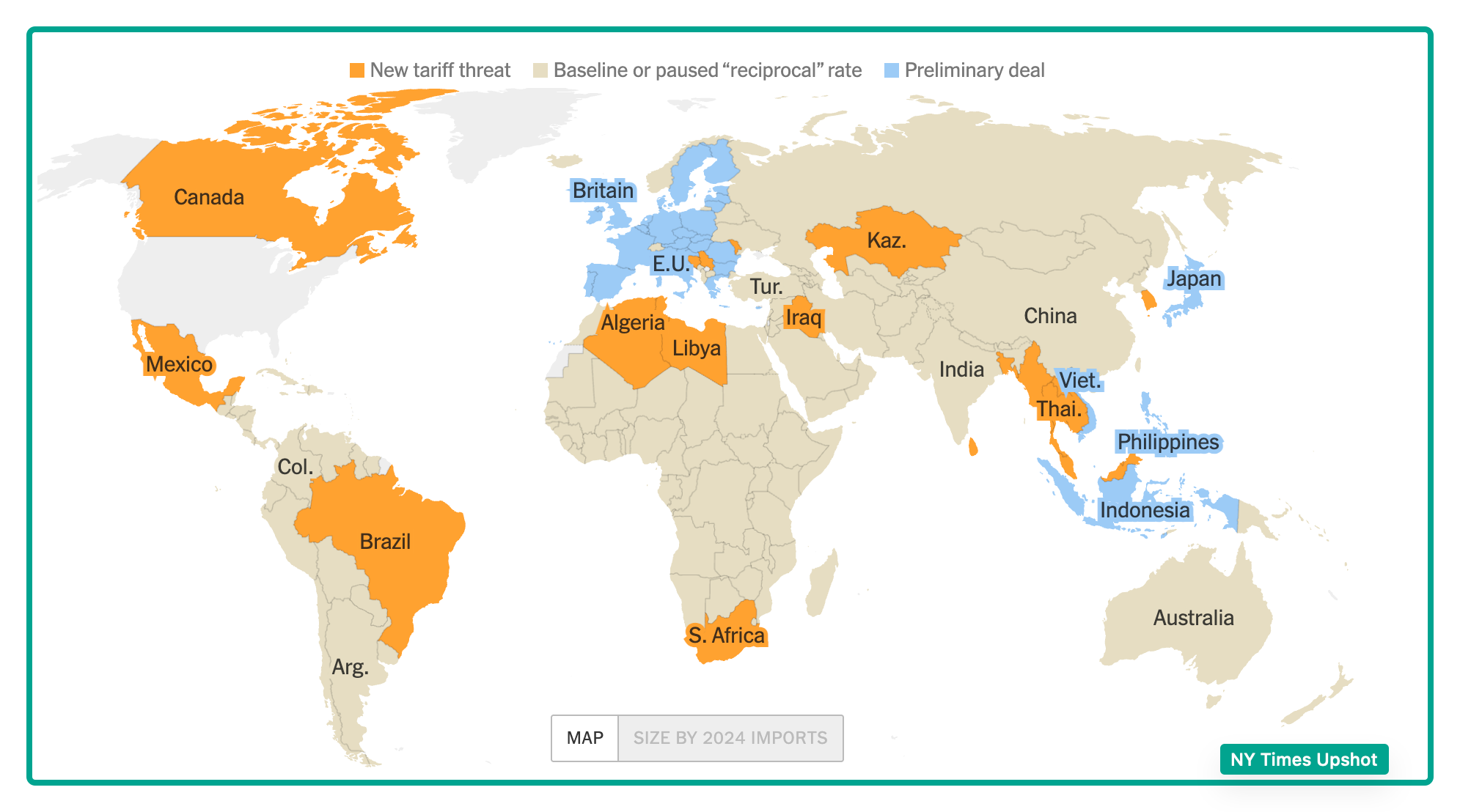

July 30, 2025Perhaps changing tomorrow, today’s tariff map takes us to threats, baseline rates, and preliminary deals:

Still, certain facts remain constant.

Let’s take a look.

Unchanging Tariff Facts

1. As the tariff legislation that first shook the world, Smoot-Hawley remains a benchmark.

During 1930, President Herbert Hoover signed the Smoot-Hawley Act. In addition to raising average tariffs by an estimated 20% (and then more because of unit taxes and deflation), most economists believe that Smoot-Hawley was a signal that had a calamitous impact on world trade. Generating a cycle of reciprocal tariffs, the act also isolated the U.S. when it stimulated closer trading relationships among other nations.

2. Tariffs create tradeoffs between their revenue and the negative externalities they create.

We can be sure that while tariffs add dollars to federal coffers, they subtract government revenue through reduced growth and the elevated prices that can be called a household tax.

3. Tariffs can target countries, industries, and products.

Tariffs need not target countries. With commodities also a possibility, President Trump implemented the tariffs on steel (50%), aluminum (50%), and autos and auto parts (25%).

4. Average effective tariff rates differ, based on their variables.

Faced with countless variables, think tanks like the Yale Budget Lab and the Tax Foundation disagree about how much the average effective tariffs rate has gone up. Using data as of July 28th, Yale says 18.2% while the Tax Foundation is at 11.6%. They do agree though that the rate will be the highest since 1934:

5. Households are the losers.

Yale and the Tax Foundation agree that tariffs elevate the price level. Again, not knowing the Federal Reserve’s response and household substitutions, think tank predictions vary. But the estimates are close to a $2400 household “tax” this year.

6. Clothing tariffs tend to favor men.

Called pink tariffs, during 2022, tariff rates on women’s clothing averaged 16.7% while for men, they were 13.6%. For a men’s anorak, the tax was 8.5% while a comparable woman’s coat had a 14% tax.

Through the following 2017 data, we can see that pink tariffs are not new:

Our Bottom Line: Anchors

Anchors influence our opinions. Assume, for example, that we are told a jar has 500 jellybeans, and then are asked to guess the number of candy bars in another container. Based on Nobel laureate Daniel Kahneman’s experiments (described in Thinking Fast and Slow), people who are told the first jar has 200 beans instead of 500 answer the second question with a lower number. The reason? The first jar became an anchor that biased the second answer.

With tariffs, we’ve been barraged with slew of high numbers that could become our anchors. They ignore the real one percent rates that used to prevail:

Rather than getting used to the gob smackingly high tariff numbers that President Trump names, we should let the Bruegel numbers be our anchors.

My sources and more: Thanks to the NY Times for returning me to our tariff focus. Then, for specific data Yale’s Budget Lab and the Tax Foundation are possibilities. Also, CNN and the 19th News had an update on the tariff tilt toward men. And finally, Bruegel had the analysis as did Daniel Kahneman in Thinking Fast and Slow.

Please note that several of today’s sentences were in a past econlife post and, after publication, I changed one word..

![econlifelogotrademarkedwebsitelogo[1]](/wp-content/uploads/2024/05/econlifelogotrademarkedwebsitelogo1.png#100878)